The Deep Value Week #3 – 2024/42

The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Another fairly calm week in our deep value world. It's nice to note that some new well-researched analyses of the companies we follow have been published.

Companies mentioned:

· Flexible Solutions International (FSI)

· Jewett-Cameron Trading (JCTC)

· Village Super Market (VLGEA)

· Universal Stainless & Alloy (USAP)

ALICO - LIMITED IMPACT ON CITRUS GROVES AFTER HURRICANE MILTON. Alico Inc. (ALCO) (P/TB 0.75x) is an agricultural company primarily growing citrus fruits across large tracts of land in Florida, supplying fruit to leading juice producers. The company’s citrus groves, covering around 48,000 hectares, were exposed to hurricane or tropical storm winds, particularly in Polk and Hardee County, where fruit was observed to have fallen from the trees. However, initial assessments suggest that most trees remain intact, indicating that the impact is limited to this season’s production rather than long-term output. No significant flooding was noted, and offices and equipment have not been seriously damaged. Alico has insurance against catastrophic events but does not expect the damage from Milton to be sufficient for major claims.

Recently, two well-written analyses about the company were published: (1) Alico: A Post-Hurricane Buying Opportunity May Be Presenting Itself and (2) Alico – a land giant hiding in plain sight.

AXT – NEW MAJOR SHAREHOLDER. AXT Inc. (AXTI) (P/TB 0.59x) manufactures semiconductor substrates, primarily gallium arsenide (GaAs), indium phosphide (InP), and germanium (Ge) for high-tech applications such as fiber optics, wireless communication, and LED lighting. Last week, Cleveland Capital Management disclosed a 5.3% stake of the outstanding shares. As far as we can see, no one has reduced their stake, so it will be interesting to see who the seller was.

Earlier this year, J Capital Research released a report highlighting potential irregularities in the company's operations in China. The report pointed to possible discrepancies in the reporting of their financial results, suggesting signs of exaggerated revenue growth and questionable business practices. AXT Inc. has denied the allegations, emphasizing that their financial reporting complies with all regulatory requirements.

CCM describes itself as a fundamental, deep-value, event-driven, constructive activist hedge fund. It applies a private equity approach to public market investing by purchasing securities that trade at deep discounts to intrinsic fundamental or private market value.

According to ChatGPT, they have an AUM of $118m (this hasn’t been verified, so it should be taken with a grain of salt). The position in AXT has a market value of $6.2m. However, it is positive that they have been active since 1996—managing to navigate the deep value world for nearly 30 years definitely indicates they are doing something right.

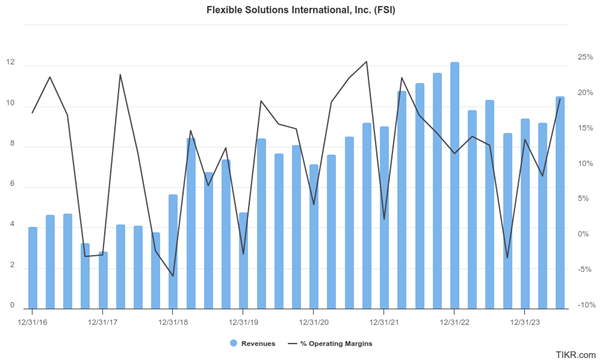

FLEXIBLE SOLUTIONS INTERNATIONAL – SALES FIGURES FOR Q3 24. Flexible Solutions International (FSI) (P/TB 1.43x) reported a revenue growth of 6.5%, increasing from $8.7m (Q3 2023) to $9.3m (Q3 2024). Quarters with revenues above $9m have historically resulted in strong operating margins. Full financial results will be released after the market closes on November 14.

JEWETT-CAMERON TRADING – OREGON COMMUNITY FOUNDATION UPDATES ITS 13D. The Oregon Community Foundation (OCF) has updated its Schedule 13D regarding shares in Jewett-Cameron Trading (JCTC) (P/TB 0.61x). OCF now owns a total of 1,008,534 shares (after a gift this summer of 40,000 shares), representing 28.8% of the company's outstanding shares, based on a total of 3,504,802 shares. These shares have been received as charitable gifts, and OCF has sole voting and disposal rights over them. This filing relates to the July gift, and it’s a bit unusual that the update is coming only now. Perhaps the regulations are more lenient for foundations, giving them more time to report?

KEY TRONIC – FY23/24 AND RESTATEMENTS. For FY23/24, Key Tronic Corporation (KTCC) (P/TB 0.49x) reported a net loss of $2.8m compared to a net profit of $5.2m in the previous year. Net sales decreased 6.3% to $566.9m ($605.3m). This drop was mainly due to reduced demand for programs based in Mexico and production stoppages caused by a cyberattack during the fourth quarter of 2024. Operating margin fell from 2.7% to 1.2%, while gross margin decreased from 7.8% to 7.0%. HotRockCapital posted the following thread on X.

KTCC has also filed a corrected 8-K report, where they adjusted previously reported financial results for the quarter ending June 29, 2024.

A bright note is that the majority of the loss was due to a one-off in the last quarter. But on the other hand, the long-term profitability of this business does not impress.

VILLAGE SUPER MARKET – INSIDER SALE AND NEW SA ANALYSIS. Kevin Begley, CFO of Village Super Market Inc (VLGEA) (P/TB 1.05x), sold 5,133 shares in two transactions: (1) on October 16, 2024, 133 shares were sold at $30.99 per share, and (2) on October 18, 2024, an additional 5,000 shares were sold at $30.55 per share. After these sales, Begley retains 61,261 shares in the company. Additionally, Daniel Jones recently published an analysis of the company on Seeking Alpha titled "Village Super Market: Still on Sale."

UNIVERSAL STAINLESS & ALLOY PRODUCTS – A BID! A former (unfortunately) portfolio company received a bid this week. Universal Stainless & Alloy Products Inc. (USAP) has recently agreed to be acquired by the Luxembourg-based steel company Aperam (APAM) for $45 per share. This price represents a premium of approximately 19% over Universal's three-month volume-weighted average share price as of October 16, 2024. The deal is valued at 10.6x the company's adjusted EBITDA (TTM) and P/TB 1.73x. A few years back we invested in the company aorund 0.50x TB but still managed to lose money on the position.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.