The Deep Value Week – 2025/16

Major Property Sell, New Reports, Buyback and Insider Transaction

Companies mentioned:

· Flexible Solutions (FSI) - Reports 20% Decline in Q1 2025 Revenue

· Jewett-Cameron (JCTC) - Reports 10% revenue growth in Q2 2025, but posts net loss amid margin pressure

· Reko International (REKO) – Further Buybacks

· Unifi (UFI) - To sell North Carolina facility for $53.2 million to Enovum Data Centers

· Village Super Market (VLGEA) - Director Robert Sumas reduces stake through continued share sales

· Key Tronic (KTCC) – Mentioned on X

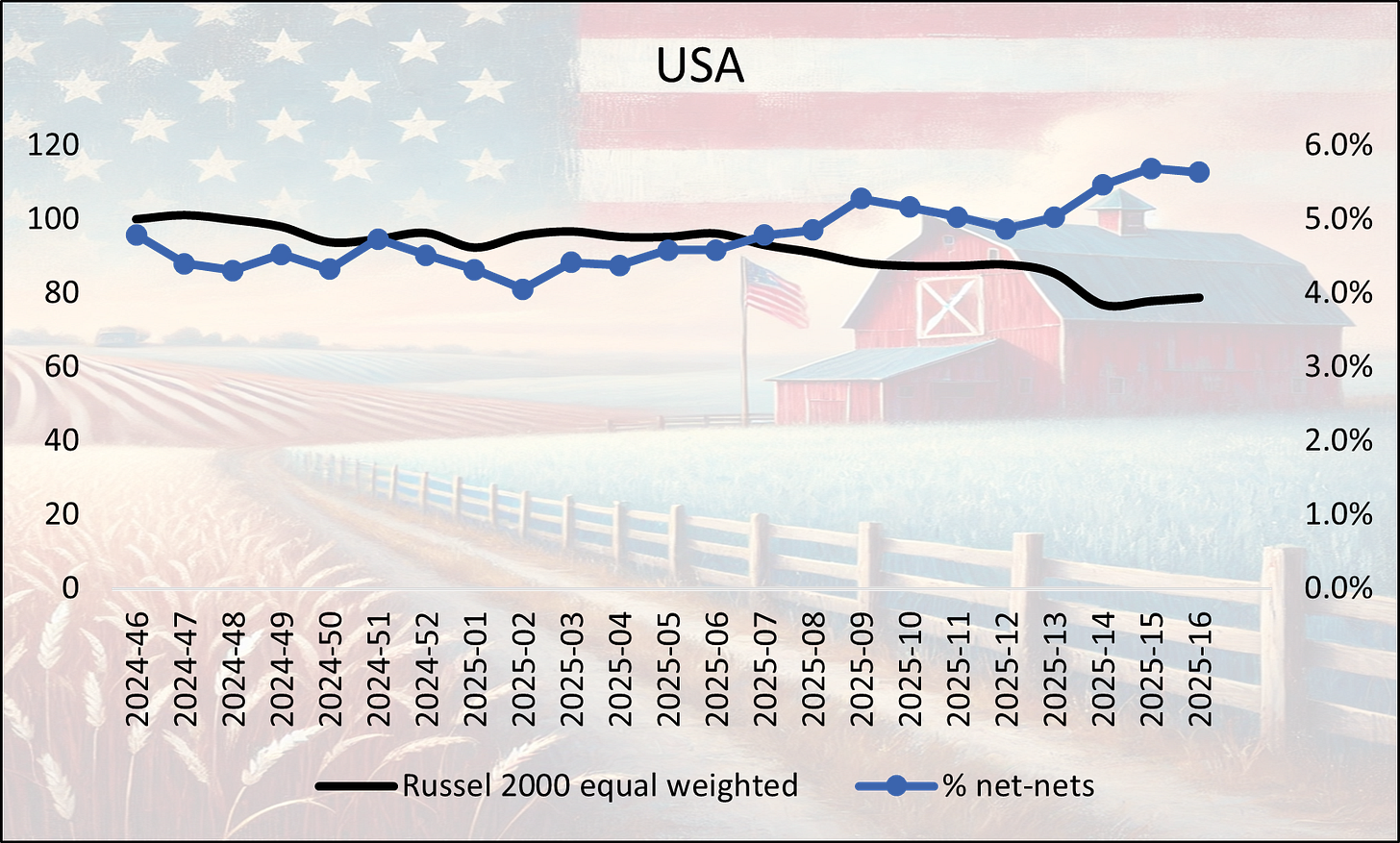

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Flexible Solutions (FSI) - Reports 20% Decline in Q1 2025 Revenue

P/TB 1.43 │ URL

Flexible Solutions International Inc., which specializes in biodegradable polymers and water/energy conservation technologies, reported a 20% year-over-year revenue decline in Q1 2025. Sales fell to $7.4m from $9.2m in Q1 2024. The drop was attributed to two major customers reducing inventory and lower sales from the ENP division, likely due to early purchases made in Q4 2024. CEO Dan O’Brien stated these were temporary factors and maintained a positive outlook for full-year 2025 growth.

Jewett-Cameron (JCTC) - Reports 10% revenue growth in Q2 2025, but posts net loss amid margin pressure

P/TB 0.56 │ URL

Jewett-Cameron reported a 10% increase in revenue to $9.1 million in Q2 2025, driven by strong growth in metal fence products, especially Lifetime Steel Post® and Adjust-A-Gate®, supported by a 65% increase in in-store display units at Home Depot and Lowe’s. Despite this top-line growth and lower operating expenses, the company posted a net loss of $(0.6) million, slightly wider than $(0.5) million in Q2 2024, due to margin pressure from higher logistics costs and an unfavorable product mix. Gross margin fell year-over-year to 20.1% (from 25.1%) but improved sequentially from Q1. Sales of compostable MyEcoWorld® products and Greenwood wood products rose, while wood fencing and pet product sales declined. Inventory was reduced by 15% year-over-year, and the company held $0.4 million in cash at quarter-end with no long-term debt, though it has started drawing on its $6 million credit facility. Jewett-Cameron also listed a surplus property in Hillsboro for sale at $9 million to further support liquidity. Strategic initiatives, including diversified sourcing to reduce China exposure and new product launches, are aimed at improving performance in the seasonally strong second half of the fiscal year.

Reko International (REKO) – Further Buybacks

P/TB 0.40 │ URL

Reko bought back another 1k shares for cancellation last week.

Unifi (UFI) - To sell North Carolina facility for $53.2 million to Enovum Data Centers

P/TB 0.41 │ URL

Unifi, Inc. has entered into a definitive agreement to sell its industrial property in Madison, North Carolina—including the facility, underlying land, and selected equipment—for $53.2 million to Canadian-based Enovum Data Centers. The transaction, signed on April 10, 2025 and disclosed in an 8-K filing on April 16, is expected to close by May 15, 2025. Proceeds will be used to repay existing term and revolving loans under Unifi’s credit agreement with Wells Fargo. The property had a net book value of $9.0 million as of December 29, 2024. The agreement includes standard representations, warranties, and an energy study condition to confirm sufficient power capacity for data center operations. A $2.25 million earnest deposit was made, with $1.2 million non-refundable. Unifi amended its credit agreement to facilitate the transaction and to allow partial loan repayment from sale proceeds.

This increases BV/share by 19% from $12.95 to $15.37 (although this is before any taxes – so in reality it will likely be a bit lower).

Village Super Market (VLGEA) - Director Robert Sumas reduces stake through continued share sales

P/TB 1.15 │ URL

Between April 8 and April 16, 2025, Robert Sumas, director and member of the 10% owner group at Village Super Market Inc, sold a total of 9,000 Class A common shares in multiple tranches at average prices ranging from $35.28 to $36.62 per share. The largest single-day sale was on April 14 with 2,700 shares disposed at an average of $35.59. Following these transactions, Sumas' directly held shares declined from 93,988 to 84,931. An additional 504 shares are held indirectly through the Robert Sumas Family LLC.

Key Tronic (KTCC) – Mentioned on X

P/TB 0.22 │ URL

SmallCapKing wrote about the company.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.