Companies mentioned:

· Alico, Inc. (ALCO) - $50 Million Stock Repurchase Program & Amends Credit Agreement with MetLife Investment Management

· Asia Pacific Wire & Cable (APWC) - Reports 2024 Financial Results and Files Annual Report

· Chicago Rivet & Machine Co. (CVR) - Announces 2025 Annual Shareholders Meeting

· Flexible Solutions International (FSI) - Reports 2024 Financial Results and Provides Business Update

· Jewett-Cameron Trading (JCTC) - To Present at Investor Conferences in April 2025

· NACCO Industries Inc. (NC) - Announces Annual Meeting and Key Proposals for 2025

· Key Tronic (KTCC) – Mentioned on X

· Jewett Cameron Trading (JCTC) – Mentioned on X

· Village Super Market Inc. (VLGEA) - Proposed Sale of Securities by Insiders

· Future Fuel (FF) – Insider Purchases & Expands Board of Directors, Appoints Pamela R. Butcher as New Director

· Tree Island Steel (TSL) – Buybacks

· Tandy Leather Factory (TLF) – Mentioned on X

· Kimball Electronics (KE) - Releases 2024 Sustainability Report Highlighting Significant Progress in Emissions Reduction and ESG Goals

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alico, Inc. (ALCO) - Announces $50 Million Stock Repurchase Program & Amends Credit Agreement with MetLife Investment Management

Alico, Inc. (Nasdaq: ALCO) announced on April 2, 2025, that its Board of Directors has approved a stock repurchase program allowing the company to buy back up to $50 million worth of its common stock. The program, which will expire on April 1, 2028, permits repurchases through the open market, privately negotiated transactions, or other methods, depending on market conditions and corporate needs. Transactions conducted in the open market will comply with Rule 10b-18, and the company may also utilize Rule 10b5-1 plans to facilitate repurchases. The program does not obligate Alico to acquire a specific amount of shares and can be modified, extended, or terminated at the company's discretion.

On March 31, 2025, Alico, Inc. (Nasdaq: ALCO) executed a Seventh Amendment to its amended and restated credit agreement originally dated December 1, 2014, involving subsidiaries Alico Land Development, Inc., Alico Fruit Company, LLC, and MetLife Investment Management, LLC, representing Metropolitan Life Insurance Company and New England Life Insurance Company. The amendment introduces adjustments to Alico’s reporting requirements, Affirmative Covenants, and Restrictive Covenants, including changes related to RLOC Note disbursement requests, planned paydowns, catastrophic insurance coverage, LT Covenant, and minimum liquidity requirements.

Asia Pacific Wire & Cable (APWC) - Reports 2024 Financial Results and Files Annual Report

P/TB 0.18 │ URL

Asia Pacific Wire & Cable Corporation Limited (NASDAQ: APWC) reported its full-year 2024 financial results, posting revenues of $472.7 million, an 11.0% increase from $425.8 million in 2023, driven by revenue growth across all segments. Operating profit surged to $10 million, up 546.5% from $1.5 million in 2023, mainly due to improved profitability in the public utility sector in Thailand. Net income declined by 9.9% to $3.5 million, with EPS dropping to $0.17 from $0.19. Revenue growth was supported by higher sales in power cables and fabrication services, rising copper prices, new customer acquisitions, and increased production of rectangular wire and wires for drone motors. Despite positive revenue growth, operating profit margins declined in the North Asia and ROW segments due to increased R&D expenses related to EV product lines and competitive market pressures from China. The company is also actively pursuing expansion into renewable energy and EV-related solutions, targeting the Americas and South Asia.

Chicago Rivet & Machine Co. (CVR) - Announces 2025 Annual Shareholders Meeting

P/TB 0.50 │ URL

Chicago Rivet & Machine Co. (NYSE American: CVR) has scheduled its Annual Meeting of Shareholders for May 13, 2025, at the Sheraton Lisle Hotel in Lisle, Illinois. Shareholders will vote on the following key matters:

Election of Seven Directors: The board has nominated seven directors, including Gregory D. Rizzo (CEO), Kent H. Cooney, Kurt Moders, James W. Morrissey, Dr. Walter W. Morrissey, Karen G. Ong, and John L. Showel.

Approval of Executive Compensation (Say-on-Pay): An advisory vote on executive compensation practices.

Frequency of Future Say-on-Pay Votes: Shareholders will determine whether advisory votes on executive compensation should occur every one, two, or three years. The board recommends a three-year interval.

Ratification of Crowe LLP as Independent Auditor for 2025: Approval of the company’s independent auditor selection for the fiscal year 2025.

The board unanimously recommends voting in favor of all director nominees, executive compensation, a three-year frequency for say-on-pay votes, and the ratification of Crowe LLP. Shareholders of record as of March 17, 2025, are entitled to vote.

Flexible Solutions International (FSI) - Reports 2024 Financial Results and Provides Business Update

P/TB 1.58 │ URL

Flexible Solutions International, Inc. (NYSE-AMERICAN: FSI), a producer of biodegradable polymers, water conservation technologies, and specialty chemicals, reported its 2024 financial results on March 31, 2025. Revenue remained stable at $38.2 million compared to $38.3 million in 2023, while net income increased to $3.04 million ($0.24 per share), up from $2.78 million ($0.22 per share) in 2023. Operating cash flow rose significantly to $7.08 million ($0.57 per share) from $4.60 million ($0.37 per share) in the prior year.

Key highlights include:

The NanoChem division, which represents approximately 70% of revenue, continued to grow through sales of thermal poly-aspartic acid (TPA) and nitrogen conservation products.

The company secured a significant food grade contract, with projected revenue beginning in Q4 2025 and potentially reaching $30 million annually by 2026, following a $4 million investment in specialized equipment and clean room facilities.

FSI initiated the development of a manufacturing facility in Panama to reduce tariff impacts and improve international logistics, expected to begin production in Q3 2025.

The company divested its Florida LLC investment for $6 million over five years, although the structure resulted in a temporary accounting loss of $385,000 for 2024, which will be converted to gains upon payment receipt.

Continued efforts to recover over $1 million in unpaid tariff rebates through a newly hired consulting firm.

Long-term debt repayments remain on track, with significant debt obligations scheduled to be cleared by late 2025.

The company also announced plans to explore opportunities in the drug compounding market, including potential production of GLP-1 drugs, although execution is contingent on securing sales and partnerships. Management expects revenue growth to resume in the second half of 2025.

Jewett-Cameron Trading (JCTC) - To Present at Investor Conferences in April 2025

P/TB 0.61 │ URL

Jewett-Cameron Trading Company Ltd. (NASDAQ: JCTC) will participate in the Lytham Partners 2025 Industrials & Basic Materials Investor Summit on April 1, 2025, via a virtual fireside chat, and the Planet MicroCap Showcase: VEGAS 2025 on April 23, 2025, with an in-person presentation and one-on-one meetings in Las Vegas. These efforts are part of the company's broader strategy to enhance investor awareness, which includes updating its NASDAQ trading symbol from “JCTCF” to “JCTC” and expanding shareholder communications.

NACCO Industries Inc. (NC) - Announces Annual Meeting and Key Proposals for 2025

P/TB 0.59 │ URL

NACCO Industries Inc. (NYSE: NC) has filed its Proxy Statement for the annual meeting scheduled for May 14, 2025, in Knoxville, Tennessee. Shareholders will vote on the election of thirteen directors for one-year terms, approval of the revised non-employee director stock compensation plan, an advisory vote on executive compensation, and the ratification of Ernst & Young LLP as the independent auditor for 2025. The board recommends approval of all proposals. As of March 21, 2025, NACCO had 5.87 million Class A shares and 1.57 million Class B shares outstanding. The company's segments include Coal Mining, North American Mining, and Minerals Management, with a strong emphasis on sustainability, safety, and community investment. Ernst & Young’s audit fees totaled $2.4 million for both 2023 and 2024. Executive compensation remains largely performance-based, with 74% of the CEO's total compensation tied to performance. Korn Ferry serves as the compensation consultant, and 94% of shareholders approved the executive compensation plan at the 2024 annual meeting.

Key Tronic (KTCC) – Mentioned on X

P/TB 0.22

Jerome and SmallCapKing shared their thoughts on X.

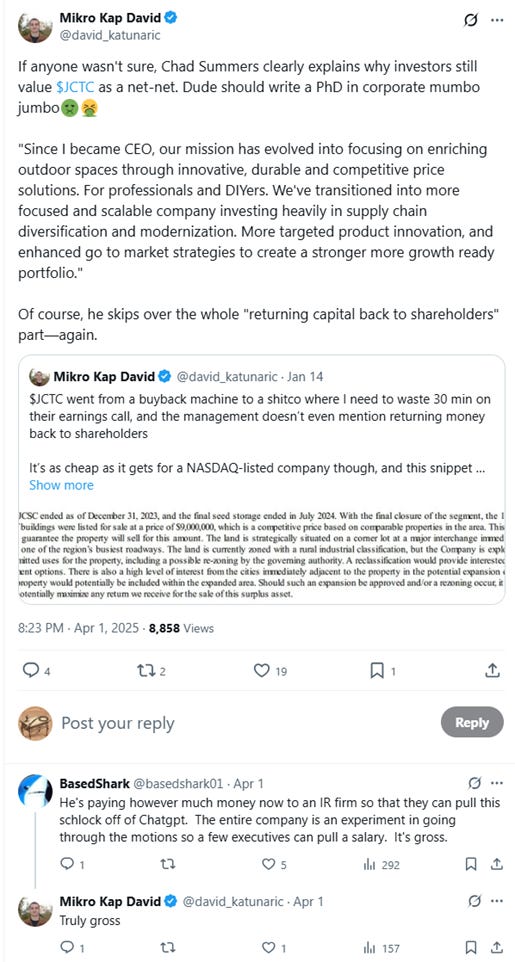

Jewett Cameron Trading (JCTC) – Mentioned on X

P/TB 0.61 │ URL

Mikro Kap David shared his thoughts on X.

Village Super Market Inc. (VLGEA) - Proposed Sale of Securities by Insiders

P/TB 1.20 │ URL

Village Super Market Inc. (NASDAQ: VLGEA) filed multiple Form 144s in early April 2025, indicating proposed sales of securities by officers and directors. On April 1, 2025, CFO & Treasurer John L. Van Orden filed to sell 3,000 shares of Class A common stock at an estimated market value of $113,970 through Charles Schwab & Co. On April 3, 2025, Kevin Begley, another officer, filed to sell 13,433 shares worth approximately $488,424. Additionally, on April 4, 2025, Director Robert Sumas filed to sell 10,000 shares valued at $361,000. All transactions are set to occur on Nasdaq, and no adverse information concerning the company's operations was reported by the sellers.

Future Fuel (FF) – Insider Purchases & Expands Board of Directors, Appoints Pamela R. Butcher as New Director

P/TB 0.82 │ URL

D. C. Bedell bought 10k shares at $4.00 and R. P. Rowe bought 15k shares at $3.95. This was Bedell´s 10th buy transaction since late 2012 and his average 1y return on those transactions has been 39%. He has on average also paid around 1.17x TB.

FutureFuel Corp. (NYSE: FF) announced on April 3, 2025, that it has expanded its Board of Directors to nine members and appointed Pamela R. Butcher as a Class C director. Ms. Butcher, who has extensive business management and marketing experience in the chemical industry, currently serves on the boards of J.M. Huber Corporation and Pilot Chemical Corp. She previously held senior leadership roles at The Dow Chemical Company and served as CEO, President, and COO of Pilot. Ms. Butcher will receive compensation according to the company’s standard director compensation arrangements and has been granted an option to purchase 10,000 shares of FutureFuel’s common stock under the 2017 Omnibus Incentive Plan, set to expire in April 2030.

Tree Island Steel (TSL) – Buybacks

P/TB 0.55 │ URL

Tree Island Steel Ltd. conducted a series of share redemptions, retractions, cancellations, and repurchases between March 14, 2025, and March 31, 2025, with the final balance of shares being reduced to zero on March 31, 2025. The transactions were made at prices ranging from $2.47 to $2.63 per share. The largest transaction occurred on March 25, 2025, where 1,300 shares were repurchased at $2.47 each, totaling $3,211. A total of 15.6k shares were bought back.

Tandy Leather Factory (TLF) – Mentioned on X

P/TB 0.43 │ URL

Joakim shared his thoughts on X.

Kimball Electronics (KE) - Releases 2024 Sustainability Report Highlighting Significant Progress in Emissions Reduction and ESG Goals

P/TB 0.62 │ URL

Kimball Electronics, Inc. released its 2024 Guiding Principles Report on March 31, 2025, highlighting its progress in sustainability, including a 42% reduction in Scope 1 and 2 GHG emissions since 2019, with a net-zero target by 2050. The company aims for 100% renewable electricity usage by 2030 and over 90% waste diversion from landfill. Governance improvements include tying executive compensation to sustainability achievements. The report adheres to the EU’s CSRD and ESRS standards, is externally assured, and emphasizes inclusivity, responsible sourcing, and strong community investment.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.