Companies mentioned:

· Alico (ALCO) – “Alico´s Big Plan Is A Game-Changer”

· Bridgford Foods (BRID) – Insider Transactions Reported by Richard Eugene Bridgford and Allan Jr. Bridgford

· Chicago Rivet & Machine Co (CVR) - Reports $5.6m Loss in 2024 Amid Revenue Declines and Liquidity Concerns

· Friedman Industries (FRD) - To Transfer Listing to Nasdaq on April 8, 2025, and Adds New Director

· FutureFuel Corp. (FF) - Reports 59% Net Income Decline in 2024; Initiates Biodiesel Plant Restart

· Hurco Companies Inc. (HURC) - Polar Asset Management Partners Reduces Stake by Selling 12,000 Shares

· Jerash Holdings (JRSH) - Appoints New Auditor CBIZ Following Marcum's Resignation

· Orbit Garant Drilling (OGD) – Insider Purchase

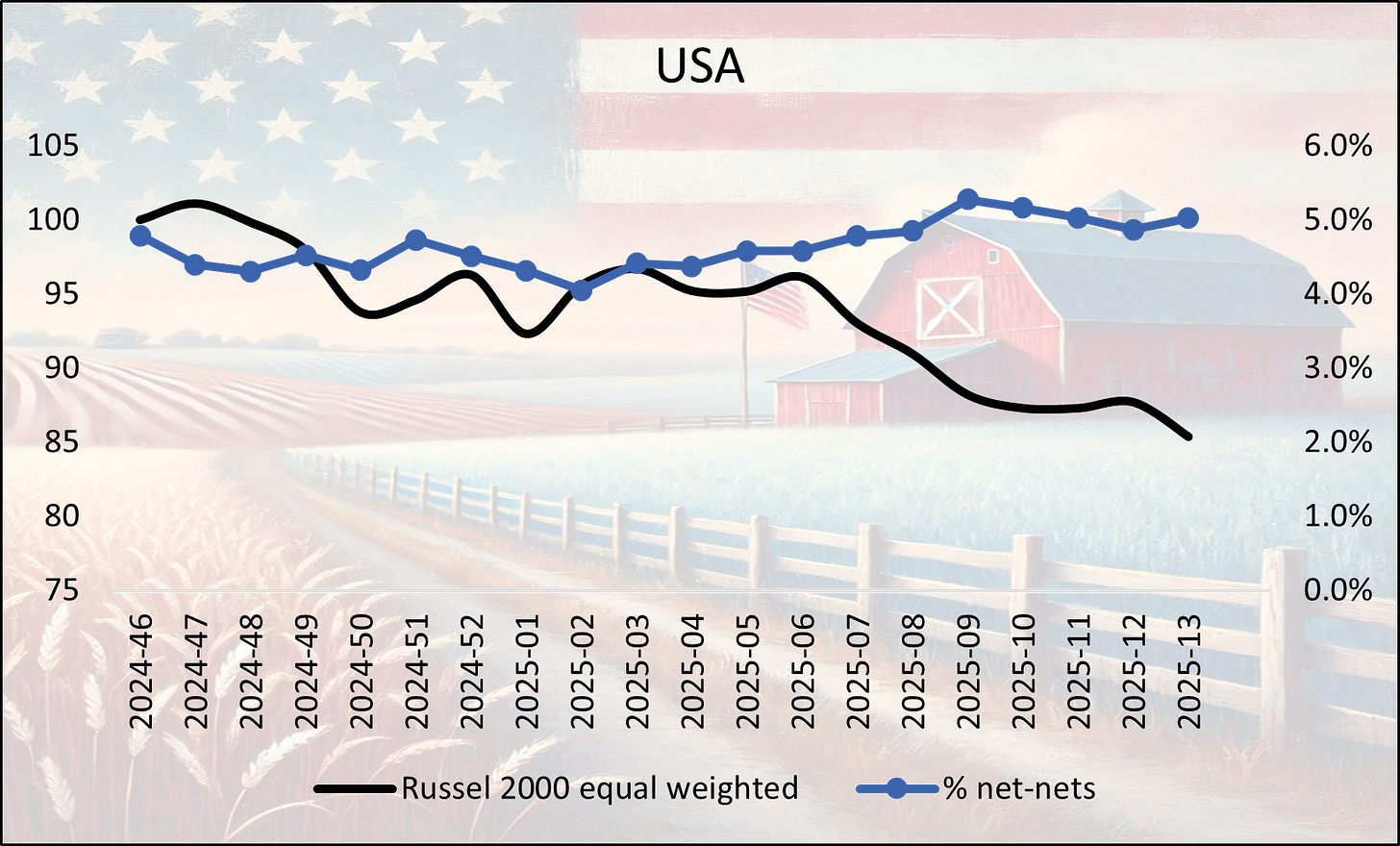

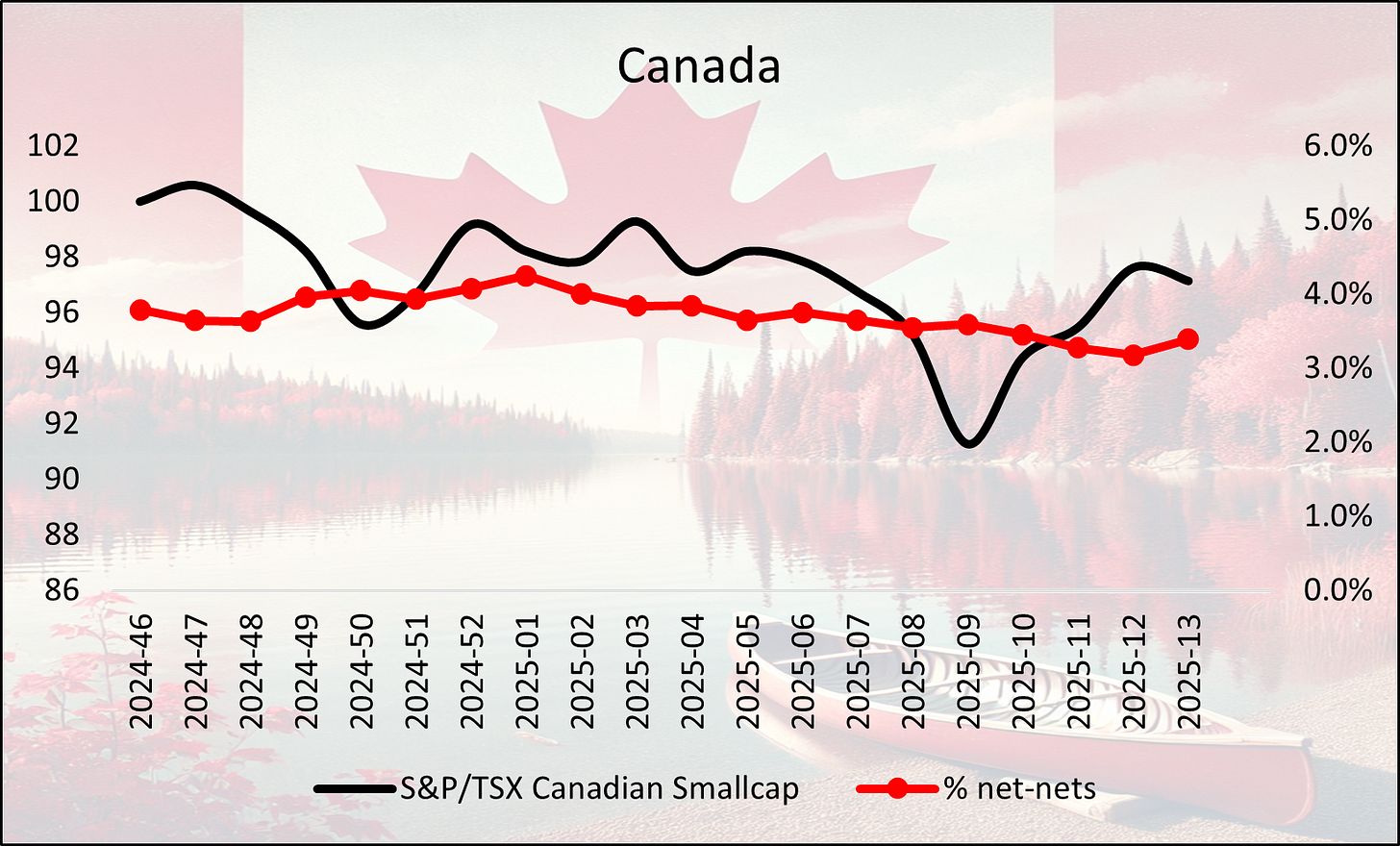

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alico (ALCO) – “Alico´s Big Plan Is A Game-Changer”

P/TB 0.94 │ URL

New Seeking Alpha analysis.

Bridgford Foods (BRID) – Insider Transactions Reported by Richard Eugene Bridgford and Allan Jr. Bridgford

On March 28, 2025, Bridgford Foods Corp (BRID) reported insider transactions through Form 4 filings. Richard Eugene Bridgford, Vice President of Industrial Relations & Safety, acquired 100 shares of common stock at $8.36 per share, increasing his direct ownership to 2,800 shares. Additionally, Allan Jr. Bridgford, a consultant to the company, purchased 600 shares at $8.33 per share, raising his direct ownership to 44,600 shares. These transactions were filed under Section 16(a) of the Securities Exchange Act of 1934.

Chicago Rivet & Machine Co (CVR) - Reports $5.6m Loss in 2024 Amid Revenue Declines and Liquidity Concerns

P/TB 0.55 │ URL

Chicago Rivet & Machine Co. faced significant financial challenges in 2024, marked by revenue declines and recurring operating losses. The company's total net sales decreased by 14% from $31.5m in 2023 to $27.0m in 2024, driven by reduced automotive fastener segment sales and high input costs. Despite efforts to improve pricing and operational efficiency, the company reported a net loss of $5.6m, compared to a $4.4m loss in 2023. This loss included a $1.1m warranty-related charge and a $1.6m deferred tax valuation allowance. Cash flow from operations remained negative, while liquidity concerns persisted, highlighted by a working capital decrease of $3.6m.

The company also highlighted substantial business risks, including reliance on a few major customers, supply chain disruptions, and escalating costs of raw materials and labor. Measures to improve financial health included closing the Albia, Iowa manufacturing facility and consolidating operations, along with entering a $3.0m credit agreement. Management acknowledged substantial doubt regarding the company's ability to continue as a going concern, while outlining strategic plans to enhance liquidity, increase revenue, and improve operational efficiency.

Friedman Industries (FRD) - To Transfer Listing to Nasdaq on April 8, 2025, and Adds New Director

Friedman Industries announced it will transfer its common stock listing from the NYSE American to the Nasdaq Global Select Market, effective April 8, 2025, under the symbol “FRD.” The move aims to enhance visibility, improve trading liquidity, and attract broader investor interest. Additionally, the Board of Directors appointed Michael Hanson as a new director on March 19, 2025. Hanson, who previously served as Vice President of Sales and Marketing for North Star BlueScope Steel, brings extensive industry experience to the company.

FutureFuel Corp. (FF) - Reports 59% Net Income Decline in 2024; Initiates Biodiesel Plant Restart

FutureFuel Corp. reported a significant drop in financial performance for 2024, with net income falling by 59% to $15.5m, compared to $37.4m in 2023. Revenues decreased 34% to $243.3m, primarily due to lower sales volumes and prices in the biofuel segment. Adjusted EBITDA declined by 50% to $17.6m. The company noted operational disruptions at its Batesville facility, including downtime for biodiesel production equipment and lower yields.

Additionally, FutureFuel announced it has initiated the restart of its biodiesel plant at its Batesville facility following a temporary shutdown for maintenance and turnaround activities from late December 2024 to March 2025. The restart aims to enhance reliability and efficiency, while FutureFuel continues to advocate for regulatory clarity related to the Inflation Reduction Act, Section 45Z, which replaced the expired blenders tax credit as of January 1, 2025.

Hurco Companies Inc. (HURC) - Polar Asset Management Partners Reduces Stake by Selling 12,000 Shares

Polar Asset Management Partners Inc. reported selling a total of 12,000 shares of Hurco Companies Inc. (HURC) over four consecutive days, from March 24 to March 27, 2025. The shares were sold at prices ranging from $15.50 to $15.78, resulting in a total remaining stake of 763,582 shares. Polar Asset Management Partners Inc., which serves as an investment advisor to multiple funds, retains indirect ownership of these shares.

Jerash Holdings (JRSH) - Appoints New Auditor CBIZ Following Marcum's Resignation

P/TB 0.67 │ URL

Jerash Holdings (US), Inc. announced that Marcum LLP resigned as its independent registered public accounting firm on March 24, 2025, following the acquisition of Marcum’s attest business by CBIZ CPAs P.C. Marcum’s previous audit reports for fiscal years ending March 31, 2024, and 2023 were unqualified. Jerash Holdings engaged CBIZ as its new auditor on March 25, 2025, with approval from the Audit Committee.

No disagreements or reportable events were noted between Jerash Holdings and Marcum, except for previously disclosed material weaknesses in internal controls over financial reporting. These weaknesses related to errors in income tax reporting, account reconciliations, and ineffective IT controls over financial reporting systems.

Orbit Garant Drilling (OGD) – Insider Purchase

P/TB 0.71 │ URL

On March 19, 2025, André Pagé, Director of Orbit Garant Drilling Inc., acquired a total of 100,000 common shares in two separate transactions. Through indirect ownership via Francine Langan, Pagé purchased 76,500 shares for a total of $81,090 ($1.06 per share). Additionally, Pagé acquired 23,500 shares directly for $24,910 ($1.06 per share). Following these transactions, Pagé's total holdings stand at 96,500 shares.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.

Any chance to be able to read - Alico (ALCO) – “Alico´s Big Plan Is A Game-Changer”