Companies mentioned:

· Alpha Pro Tech (APT) – Insider Selling

· Alico (ALCO) – On Tawast´s Substack

· Avalon Holdings Corp (AWX) - Stable Revenues Amid Regulatory and Membership Headwinds & Executive Pay in Focus Ahead of 2025 Shareholder Meeting

· Bridgford Foods (BRID) – “A Hold Until the Business Stabilizes”

· Friedman Industries (FRD) - Appoints New Director to Board

· Hurco Companies (HURC) - Expands Equity Plan and Confirms Board at Annual Meeting

· Seneca Foods (SENEA) – “With Easy Money Already Made, Time to Move on”

· Unifi (UFI) - Among Fast Company’s Most Innovative Companies 2025 for Circular Textile Solutions

· FutureFuel (FF) - Delays 10-K Filing, Expects Sharp Decline in FY2024 Revenue and Earnings

“Graham’s Geiger counter”

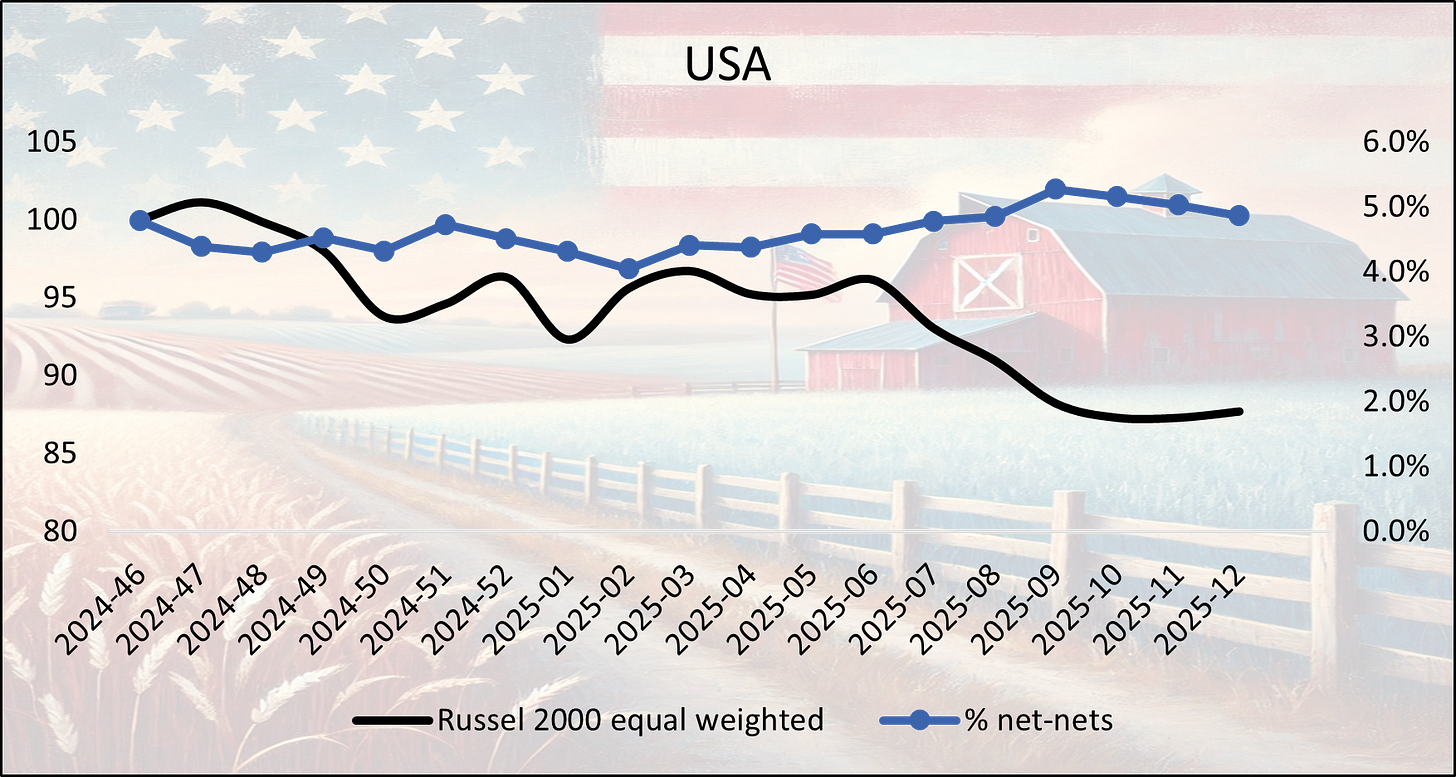

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alpha Pro Tech (APT) – Insider Selling

P/TB 0.88 │ URL

John P. Ritota, a director at Alpha Pro Tech, Ltd., filed a Form 144 indicating his intent to sell 9,413 common shares—worth approximately $48,456—on the NYSE. These shares stem from vested restricted stock received as compensation for services between 2021 and 2022. The filing notes no sales in the past three months and includes a standard declaration that Ritota holds no undisclosed material negative information.

Alico (ALCO) – On Tawast´s Substack

P/TB 0.93 │ URL

Tawast wrote a piece on the company.

Avalon Holdings Corp (AWX) - Stable Revenues Amid Regulatory and Membership Headwinds & Executive Pay in Focus Ahead of 2025 Shareholder Meeting

P/TB 0.30 │ URL / URL

Avalon Holdings Corporation reported stable performance for FY2024, with its two main segments—waste management services and golf/resort operations—contributing 55% and 45% of total net revenues, respectively. Waste management revenues remained consistent with 2023 levels, driven by industrial brokerage and landfill management. Golf and related operations faced continued pressure from seasonal weather and member retention challenges. Memberships are renewed annually and remain the largest revenue source for this segment. The company also continued to operate The Grand Resort and expanded wellness offerings with Avalon Med Spa and Avalon Dermatology, now included in consolidated financials due to majority ownership.

Avalon Holdings Corporation’s 2025 proxy statement outlines its governance structure ahead of the annual shareholder meeting scheduled for May 7, 2025. The company will elect six directors, including four Class B directors—voted by holders with 10x voting power—and two Class A directors. Ronald E. Klingle, the controlling shareholder with 66.8% voting power, remains Chairman and CEO. Compensation for executives was largely discretionary, with Mr. Klingle receiving a total of $268,500 in 2024 and Kenneth McMahon of American Waste Management Services earning $534,527, driven by a bonus tied to pre-tax income. No equity-based compensation was awarded in 2024, and all previously issued stock options have expired.

Bridgford Foods (BRID) – “A Hold Until the Business Stabilizes”

P/TB 0.68 │ URL

A new analysis was published on Seeking Alpha.

Friedman Industries (FRD - Appoints New Director to Board

P/TB 0.89 │ URL

Friedman Industries, Inc. announced the appointment of Michael Hanson as a new board member effective March 19, 2025, following a board decision to expand the number of directors. Mr. Hanson, who retired in 2022 as VP of Sales and Marketing at North Star BlueScope Steel, brings decades of experience in flat rolled steel markets serving the automotive, construction, and agricultural sectors. He currently chairs the board of Adopt America Network. Hanson will receive a pro rata portion of board compensation but has not been assigned to any board committees at this time.

Hurco Companies (HURC) - Expands Equity Plan and Confirms Board at Annual Meeting

P/TB 0.55 │ URL

At its Annual Meeting on March 13, 2025, Hurco Companies, Inc. received shareholder approval to amend its 2016 Equity Incentive Plan by adding 850,000 shares to the plan’s reserve. All eight director nominees were re-elected, and shareholders approved, on an advisory basis, the executive compensation plan. Additionally, Deloitte & Touche LLP was ratified as the company’s auditor for FY ending October 31, 2025. The approved plan amendment was previously authorized by the board in January and outlined in the proxy statement filed on January 29, 2025.

Seneca Foods (SENEA) – “With Easy Money Already Made, Time to Move on”

P/TB 0.99 │ URL

New analysis on Seeking alpha.

Unifi (UFI) - Named Among Fast Company’s Most Innovative Companies 2025 for Circular Textile Solutions

P/TB 0.38 │ URL

UNIFI, Inc., the maker of REPREVE® recycled fibers, has been named one of Fast Company’s Most Innovative Companies of 2025 in the Fashion and Apparel category. The recognition highlights UNIFI’s efforts in advancing sustainability through innovations in bottle-to-textile and textile-to-textile recycling, such as its Textile Takeback™ program and ThermaLoop™ insulation. The company has already recycled textile waste equivalent to 950 million T-shirts and aims to reach 1.5 billion by FY2030, while also targeting 50 billion diverted plastic bottles and a 30% reduction in GHG emissions intensity. UNIFI’s focus on traceability, circularity, and accountability sets a benchmark for sustainable practices across the global textile industry.

FutureFuel (FF) - Delays 10-K Filing, Expects Sharp Decline in FY2024 Revenue and Earnings

P/TB 0.85 │ URL

FutureFuel Corp. has filed a Form NT 10-K, notifying the SEC that its annual report for the year ending December 31, 2024, will be submitted late due to the need for additional time to complete documentation of internal processes. The company expects to file by April 1, 2025. Preliminary results indicate a significant year-over-year decline in performance: FY2024 revenue is expected at $243.3 million (vs. $368.3 million in FY2023), and net income is projected at $15.5 million or $0.35 per diluted share (vs. $37.4 million or $0.85 per share in FY2023). Q4 revenue is estimated at $61.5 million (down from $92.0 million) with net income of $2.8 million (vs. $23.4 million). These figures are unaudited and subject to change. The company warns of risks related to the year-end close, audit adjustments, and other operational uncertainties.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.