Companies mentioned:

· Alpha Pro Tech (APT) - Reports Lower Q4 Sales But Maintains Strong Balance Sheet; Expects Growth in 2025

· Alico (ALCO) - Declares Q2 FY2025 Dividend, Files Development Application for 3,000-Acre Community in Strategic Land Shift & X Discussion

· Flexible Solutions International (FSI) – New Analysis & Youtube Presentation

· Fonar (FONR) – New Analysis

· Key Tronic (KTCC) & Sigmatron International (SGMA) – Mentioned on X

· Orbit Garant Drilling (OGD) - Significant Insider Selling by 10% Owner Pierre Alexandre

· SigmaTron (SGMA) - Reports Q3 Profit Driven by One-Time Gain Amid Ongoing Revenue Decline

· FutureFuel Corp. (FF) - Delays Release Of 2024 Financial Results Pending Audit Completion

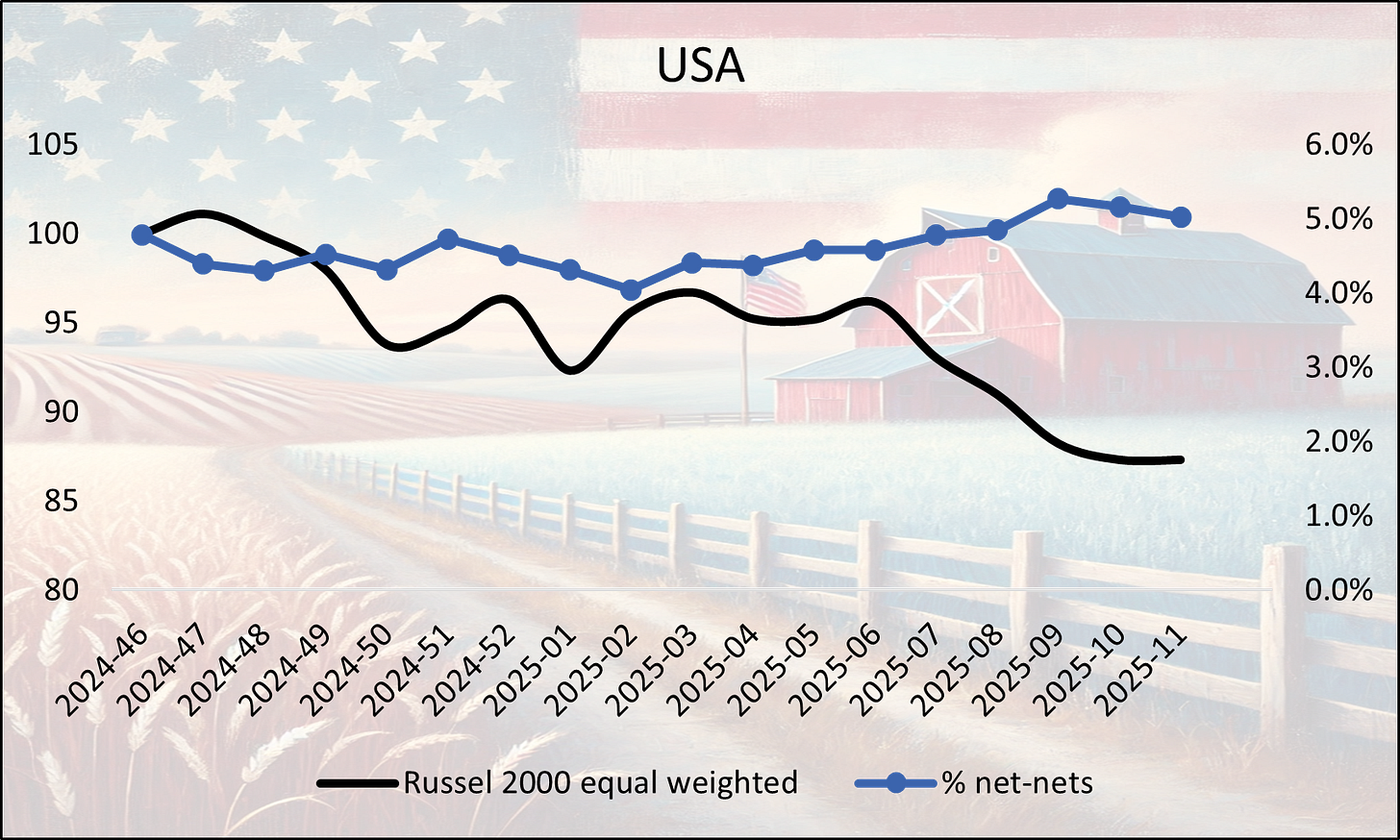

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alpha Pro Tech (APT) - Reports Lower Q4 Sales But Maintains Strong Balance Sheet; Expects Growth in 2025

P/TB 0.89 │ URL

In Q4 2024, Alpha Pro Tech reported net sales of $13.8m, down 9.5% YoY, with net income falling 20.2% to $847k. The Building Supply segment dropped 8.1% due to lower housewrap (-16.9%) and woven material sales (-17.6%), slightly offset by a 5% uptick in synthetic roof underlayment. Disposable Protective Apparel declined 11.9% in the quarter. For the full year, net sales decreased 5.5% to $57.8m, and net income dipped 6.2% to $3.9m. Gross margin, however, improved to 39.6% (vs. 37.3% in 2023). The company ended the year with no debt, $18.6m in cash, and a solid 16:1 current ratio.

Looking ahead, management expects growth in both Building Supply and Disposable Protective Apparel for 2025. Housing starts are projected to rise, and new hires plus distributor agreements are seen as growth enablers. However, risks remain, particularly around housing market volatility, offshore pricing pressure, and freight rate fluctuations. Despite near-term challenges, Alpha Pro Tech maintains a strong balance sheet and is investing in sales infrastructure and product development to drive long-term expansion.

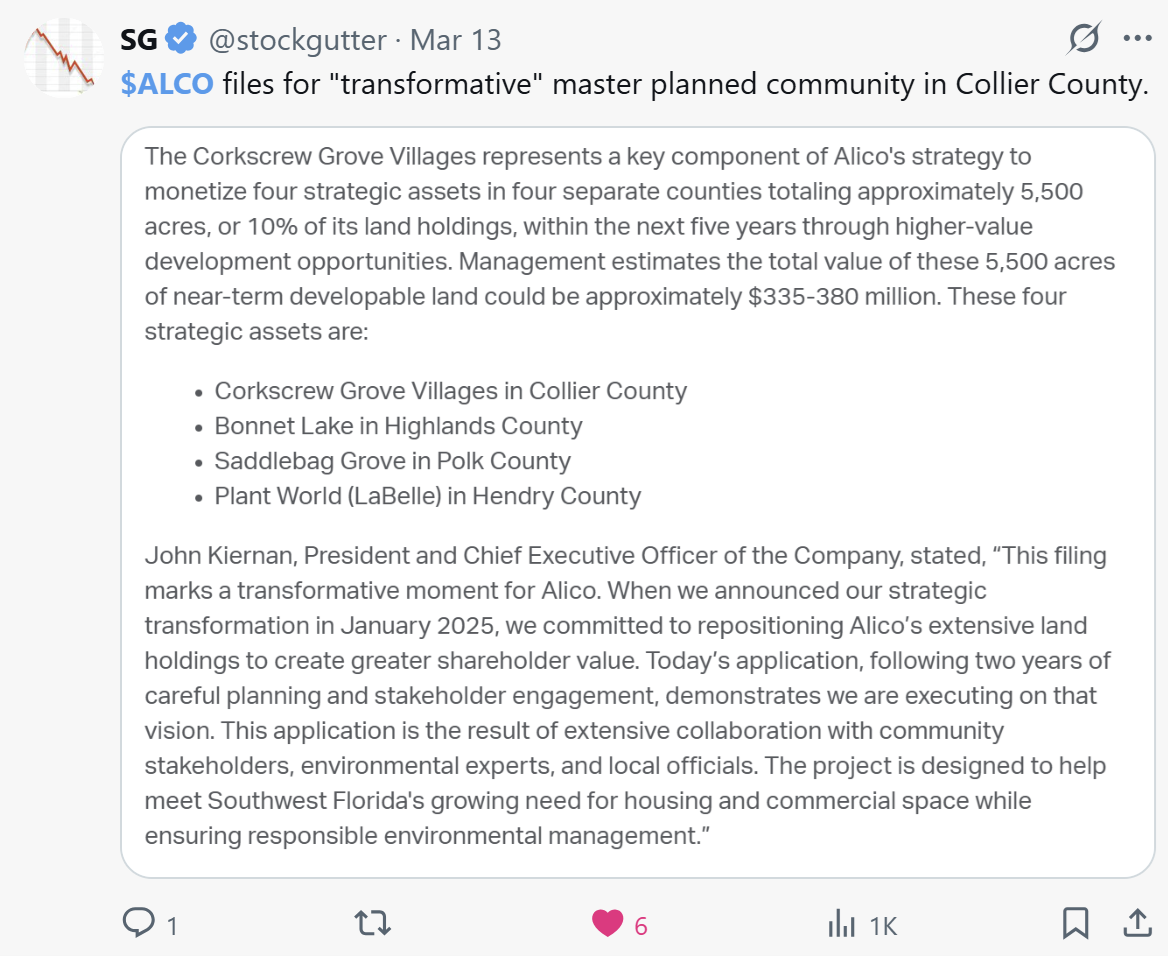

Alico (ALCO) - Declares Q2 FY2025 Dividend, Files Development Application for 3,000-Acre Community in Strategic Land Shift & X Discussion

P/TB 0.92 │ URL

On March 14, 2025, Alico, Inc. announced that its Board of Directors has declared a cash dividend of $0.05 per share for the second quarter of fiscal year 2025. The dividend will be paid on April 11, 2025, to shareholders of record as of March 28, 2025.

On March 13, 2025, Alico, Inc. announced the submission of a development application for “Corkscrew Grove East Village,” the first phase of a planned 3,000-acre mixed-use community in Collier County, Florida. This marks a major step in Alico’s strategic transformation to unlock value from land holdings. In addition to the villages, 6,000 acres will be permanently conserved. The Corkscrew Grove Villages project is part of the broader RLSA (Rural Land Stewardship Area) framework and one of four key assets—along with properties in Highlands, Polk, and Hendry Counties—covering 5,500 acres with an estimated value of $335–380m. Construction may begin by 2028–2029, pending permits. Alico is also seeking state approval for a Corkscrew Grove Stewardship District to ensure efficient governance and long-term planning.

Lee Roach and SG also shared their thoughts on X.

Flexible Solutions International (FSI) – New Analysis & Youtube Presentation

P/TB 2.18 │ URL

Atrium Research published a onepager.

Fonar (FONR) – New Analysis

P/TB 0.57 │ URL

The substack Stock Pursuit wrote a piece on the company.

Key Tronic (KTCC) & Sigmatron International (SGMA) – Mentioned on X

P/TB 0.24 / 0.13 │ URL

Jerome on X.

Orbit Garant Drilling (OGD) - Significant Insider Selling by 10% Owner Pierre Alexandre

P/TB 0.67 │ URL

Between March 12 and March 14, 2025, 6705570 Canada Inc.—a company controlled by Orbit Garant Drilling Inc.’s CEO, director, and 10% shareholder Pierre Alexandre—executed multiple open market sales totaling over 301,000 common shares. The transactions were executed at prices ranging from CAD 1.10 to CAD 1.16 per share, amounting to a cumulative value exceeding CAD 340,000. Following these disposals, the remaining ownership stands at approximately 8.53 million shares.

SigmaTron (SGMA) - Reports Q3 Profit Driven by One-Time Gain Amid Ongoing Revenue Decline

P/TB 0.13 │ URL

SigmaTron International, Inc. reported fiscal Q3 2025 results showing a 26% year-over-year revenue decline to $71.1 million (vs. $95.9m), but net income increased to $3.9 million (vs. $0.6m) due to a $7.2 million gain from a sale/leaseback of its Illinois facility. EPS was $0.63 (vs. $0.10). However, for the nine-month period ending January 31, revenue fell 21% to $230.6m, and the company posted a net loss of $8.9m (vs. $0.9m profit), driven by $3.3m in debt-related expenses and a $5.0m non-cash deferred tax charge in Q2. Management believes the worst of the revenue downturn is over and anticipates Q4 revenues will exceed Q3 based on backlog. Risks include exposure to tariff policy shifts, customer concentration, supply chain pressures, and ongoing macroeconomic uncertainty.

FutureFuel Corp. (FF) - Delays Release Of 2024 Financial Results Pending Audit Completion

P/TB 0.86 │ URL

On March 13, 2025, FutureFuel Corp. (NYSE: FF) filed a Form 8-K to announce a delay in releasing its financial and operational results for Q4 and the full year ended December 31, 2024. The company cited the need to complete certain procedures with its independent registered public accounting firm before finalizing the results. A new announcement date will be communicated once the necessary procedures are complete. FutureFuel, which operates in the chemicals and biofuels segment, gave no indication of financial irregularities but noted the standard caution regarding forward-looking statements.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.