The Deep Value Week – 2025/10

A few new Reports, Social Media Comments and Insider Transactions

Companies mentioned:

· Bridgford Foods (BRID) - Reports Q1 Loss Amid Sales Decline and Margin Pressure

· Flexible Solutions International (FSI) – on MSI Microcaps

· Hurco Internatonal (HURC) - Reports Wider Q1 Loss Amid Weak Orders and Tax-Driven Hit

· Jewett-Cameron (JCTC) - Director Chris Karlin Resigns from Board and Committees

· Key Tronic (KTCC) - CEO Brett Larsen Acquires Shares via 401(k) Plan

· NACCO (NC) - Turns Profitable in 2024, Boosted by Coal and Mining Recovery

· National Alternatives International (NAII) – Nai & CarnoSyn® Report Strong Results for New Paresthesia-Free Beta-Alanine Product

· Reko International (REKO) - Reports Strong Gross Margins Despite Lower Sales; FX Losses and Sector Risks Persist

· Alico (ALCO) & Tandy Leather Factory (TLF) – New Write-up by Enterprising Investor

· Unifi (UFI) - CFO Disposes Shares to Cover Tax Obligations on Equity Grant

· Village Super Market (VLGEA) - Delivers 17% Profit Growth in Q2 FY2025 on Strong Sales and Cost Control

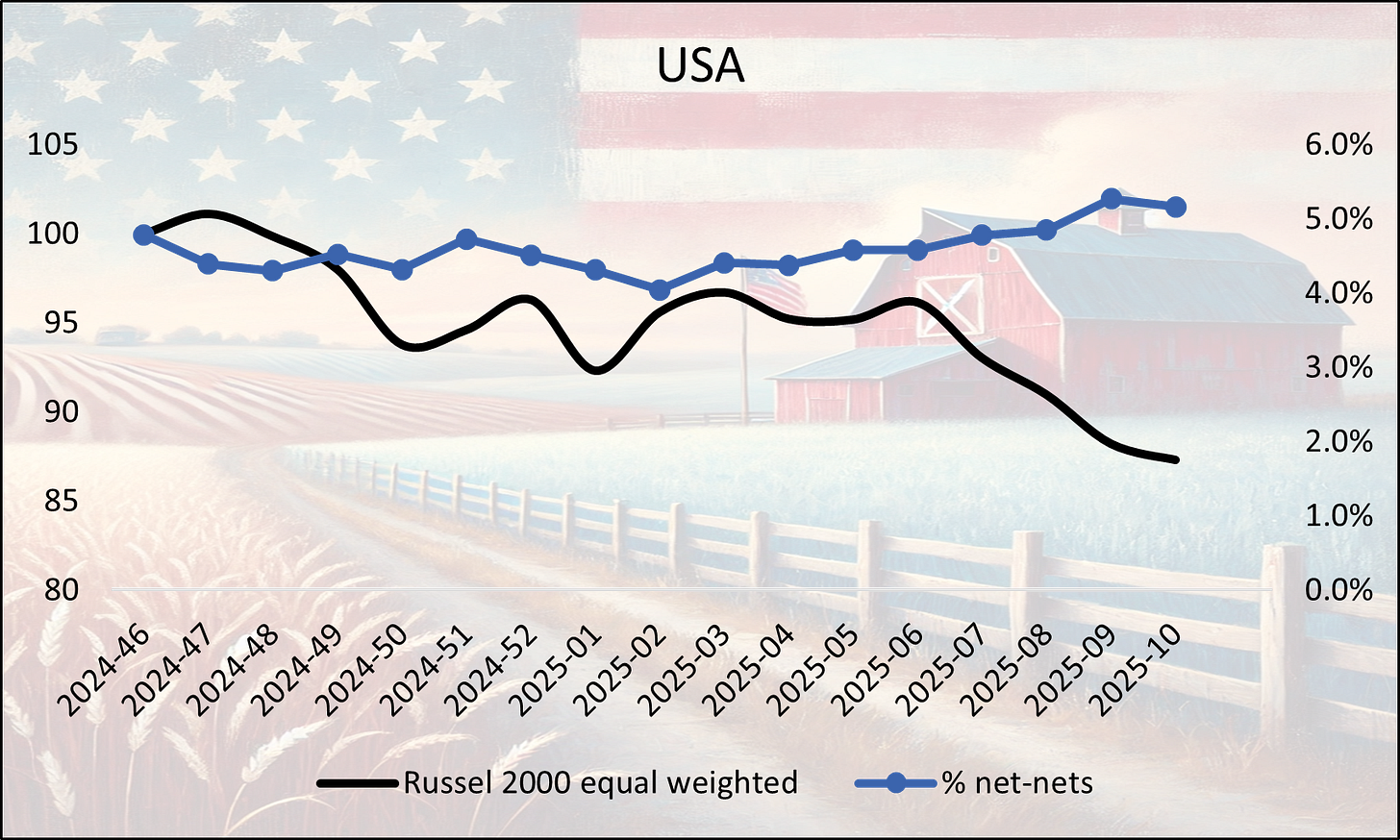

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Bridgford Foods (BRID) - Reports Q1 Loss Amid Sales Decline and Margin Pressure

P/TB 0.73 │ URL

In Q1 2025, Bridgford Foods reported a net loss of $1.1m, down from a $1.2m profit in the same period last year, driven by a 4.2% drop in net sales to $52.5m and a decline in gross margin from 29.2% to 24.5%. Snack Food Products saw a 6% revenue decline due to lower volumes and increased returns, despite modest price increases. Frozen Food Products remained flat with a slight 0.9% sales increase. Operating cash flow turned negative at -$4.6m, primarily due to inventory buildup and higher prepaid expenses. Cash reserves fell to $4.7m from $10.2m. Bridgford violated a fixed charge coverage ratio covenant but received a waiver. Customer concentration remains high, with Walmart and Dollar General accounting for over 40% of accounts receivable. Inflation, freight and labor costs, and consumer shifts to private label brands continue to pressure profitability, raising potential business risks if trends persist.

Flexible Solutions International (FSI) – on MSI Microcaps

P/TB 2.17 │ URL

Conference outline below:

Hurco Internatonal (HURC) - Reports Wider Q1 Loss Amid Weak Orders and Tax-Driven Hit

P/TB 0.58 │ URL

For Q1 FY2025, Hurco Companies reported a net loss of $4.3m (vs. $1.6m loss YoY), driven by a $2.4m non-cash tax valuation allowance and weaker margins. Sales rose 3% YoY to $46.4m, mainly in the Americas and Asia-Pacific, while European sales declined. Orders dropped 20% YoY to $40.1m, notably in the Americas (-30%) and Europe (-18%). Gross margin fell to 18% (vs. 22%) due to lower volumes of higher-margin machines. Despite negative earnings, Hurco generated $10.3m in positive operating cash flow, aided by inventory reduction. Cash increased to $41.8m. No debt was outstanding, and working capital remained solid at $172.6m. However, the order book weakness and full valuation allowance on U.S., Italy, and China deferred tax assets raise potential business risks.

Jewett-Cameron (JCTC) - Director Chris Karlin Resigns from Board and Committees

P/TB 0.64 │ URL

Jewett-Cameron Trading Company Ltd. announced that Director Chris Karlin will resign from the Board of Directors and from both the Audit and Compensation Committees, effective March 31, 2025. Mr. Karlin, who has served since December 2018, is stepping down to focus on commitments with local organizations. The company expressed its gratitude for his service.

Key Tronic (KTCC) - CEO Brett Larsen Acquires Shares via 401(k) Plan

P/TB 0.26 │ URL

Key Tronic Corporation CEO Brett R. Larsen reported the acquisition of 14,000 common shares through the company’s 401(k) plan, with purchases made on February 28 and March 3, 2025, at prices of $3.31 and $2.95 per share, respectively. Following these transactions, Larsen holds a total of 38,179.63 shares indirectly through the 401(k) plan and an additional 13,677 shares directly. The transactions were disclosed in a Form 4 filing. No financial risks or company performance commentary was included.

This was Larsens third buy transactions as long as we can see, and his prior timing has been very good. On the 3rd of March 2020 he bought c. 11k shares and had a one-year return of 75%. A few weeks later he bought an additional c. 8k shares and got a one-year return of 177%. Of course there is no covid crash now, but the KTCC stock has came down quite heavily – will be interesting to see if he manages to pick a good entry point this time as well.

NACCO (NC) - Turns Profitable in 2024, Boosted by Coal and Mining Recovery

P/TB 0.62 │ URL

NACCO Industries reported a strong turnaround in 2024, posting net income of $33.7m ($4.55/share) versus a net loss of $39.6m in 2023. Adjusted EBITDA more than doubled to $59.4m, driven primarily by improved results in the Coal Mining segment and the absence of prior-year impairment charges. Q4 2024 net income was $7.6m compared to a loss of $44.0m the year before. Revenue rose 10.7% YoY to $237.7m, with meaningful contributions from Coal, North American Mining, and Minerals Management.

Cash stood at $72.8m and total debt at $99.5m by year-end. The company repurchased $9.9m of stock and paid $6.6m in dividends in 2024. While modest operating profit growth is expected in 2025, a large non-cash pension settlement charge is anticipated to reduce reported earnings.

NACCO flagged continued customer demand in coal and growth prospects in its lithium (Thacker Pass) and mitigation businesses. However, potential risks include commodity price volatility, regulatory shifts (especially around coal), and execution on newer investments like ReGen Resources.

National Alternatives International (NAII) – Nai & CarnoSyn® Report Strong Results for New Paresthesia-Free Beta-Alanine Product

P/TB 0.30 │ URL

Natural Alternatives International and CarnoSyn® published clinical results showing that TriBsyn™, a new encapsulated beta-alanine supplement using Hydro Oleo technology, delivers 4.5x greater bioavailability than standard beta-alanine and eliminates the common side effect of paresthesia. In a randomized crossover study, TriBsyn™ (400 mg) outperformed both low and high doses of conventional beta-alanine in plasma absorption and was well tolerated, with no adverse sensory effects reported. The results support TriBsyn™'s potential in muscle and cognitive health, particularly for older adults and active aging populations.

Reko International (REKO) - Reports Strong Gross Margins Despite Lower Sales; FX Losses and Sector Risks Persist

P/TB 0.40 │ URL

For the quarter ending January 31, 2025, Reko International posted sales of C$10.8m, down 9.7% YoY, mainly due to fewer early-stage projects in the automotive sector. Despite the drop in sales, gross profit improved by 19% to C$1.7m, driven by better project mix and timing of material costs, lifting earned revenue margin to 72.2% from 65.8% a year earlier. Adjusted EBITDA rose to C$1.2m (vs. C$1.0m), supported by strong operating leverage, but offset by C$588k in mark-to-market FX losses. Net income was C$313k (C$0.05/share), aided by C$456k in SRED-related deferred tax benefits.

Cash on hand increased to C$18.2m, supported by positive operating cash flow of C$8.0m, mainly from favorable working capital movements. Reko reported no draws on its C$9.7m available credit facility and maintained compliance with all financial covenants. Risks include exposure to FX volatility (notably USD/CAD), pricing pressure from OEMs, and shifts in automotive model launches or EV demand. The company also flagged ongoing global uncertainty (Ukraine, Gaza), talent recruitment challenges, and potential cybersecurity threats. Reko continues investing in AI and emerging tech but acknowledges risks if adoption lags peers.

Alico (ALCO) & Tandy Leather Factory (TLF) – New Write-up by Enterprising Investor

Well worth the read. Can be found here.

Unifi (UFI) - CFO Disposes Shares to Cover Tax Obligations on Equity Grant

P/TB 0.42 │ URL

Andrew J. Eaker, EVP, CFO & Treasurer of Unifi Inc., filed a Form 4 disclosing the disposal of 1,956 shares of common stock on March 3, 2025, at a price of $5.52 per share. The transaction represents shares withheld to cover tax obligations related to a prior restricted stock unit vesting. Following this transaction, Eaker holds 69,811 shares directly. No open market sale or purchase occurred, and no derivative securities were involved in this filing.

Village Super Market (VLGEA) - Delivers 17% Profit Growth in Q2 FY2025 on Strong Sales and Cost Control

P/TB 1.09 │ URL

Village Super Market reported Q2 FY2025 net income of $16.9m, up 17% YoY, with sales rising 4.2% to $599.7m. Same-store sales rose 2.3%, supported by 9% digital growth, inflation in meat and dairy, and strength in remodeled stores. Gross margin slightly declined to 28.35% due to higher promotional spending and mix shifts, partly offset by lower warehouse fees and improved departmental margins. Operating and administrative expenses fell to 23.22% of sales thanks to lower insurance, legal, and supply costs, enhancing operating leverage.

Year-to-date net income reached $29.7m (+14% YoY), with sales up 4.1% to $1.157bn and same-store sales rising 2.4%. Gross margin expanded to 28.68%, while operating expenses declined to 23.91% of sales. Interest expense fell due to lower debt, though interest income declined due to lower returns on Wakefern-related assets. The company maintains strong operational momentum, aided by digital investments and disciplined cost control, but flags risks tied to supply chains, inflation, and macroeconomic conditions in its forward-looking statements.

There were also some discussions on X:

The writer may own shares of the companies mentioned. This communication is for informational purposes only.

If you like Hurco take a look at Amada in Japan (6113). They make money, have a lot of cash and very little debt and also pay a dividend.

A lot of what happens with either company or the sector will depend on the state of manufacturing and if the government will allow accelerated depreciation on the purchase of new equipment.