Companies mentioned:

· Alico, Inc. (ALCO) - Extends Stock Incentive Plan and Elects New Board & to Present Strategic Transformation Progress at 37th Annual ROTH Conference

· Bridgford Foods (BRID) – Shareholder Letter & Take Private Proposal from Mark Krieger

· Fonar (FONR) – New Analysis on Seeking Alpha

· Friedman Industries (FRD) - De Lisle Partners Reports 6% Stake

· Jerash Holdings (JRSH) - Files Post-Effective Amendment to S-8 for Stock Incentive Plan, $100m Mixed Securities Shelf & New Seeking Alpha Analysis

· Jewett-Cameron Trading (JCTC) – Held AGM

· Orbit Garant Drilling (OGD) - Pierre Alexandre to Sell 1 million Shares, Retaining Majority Stake

· Seneca Foods (SENEA) – Mentioned on X

· Strattec Security (STRT) - SVP & COO Rolando Guillot Sells Shares

· Village Super Market (VLGEA) - Reports Strong Q2 Growth with Increased Sales and Net Income

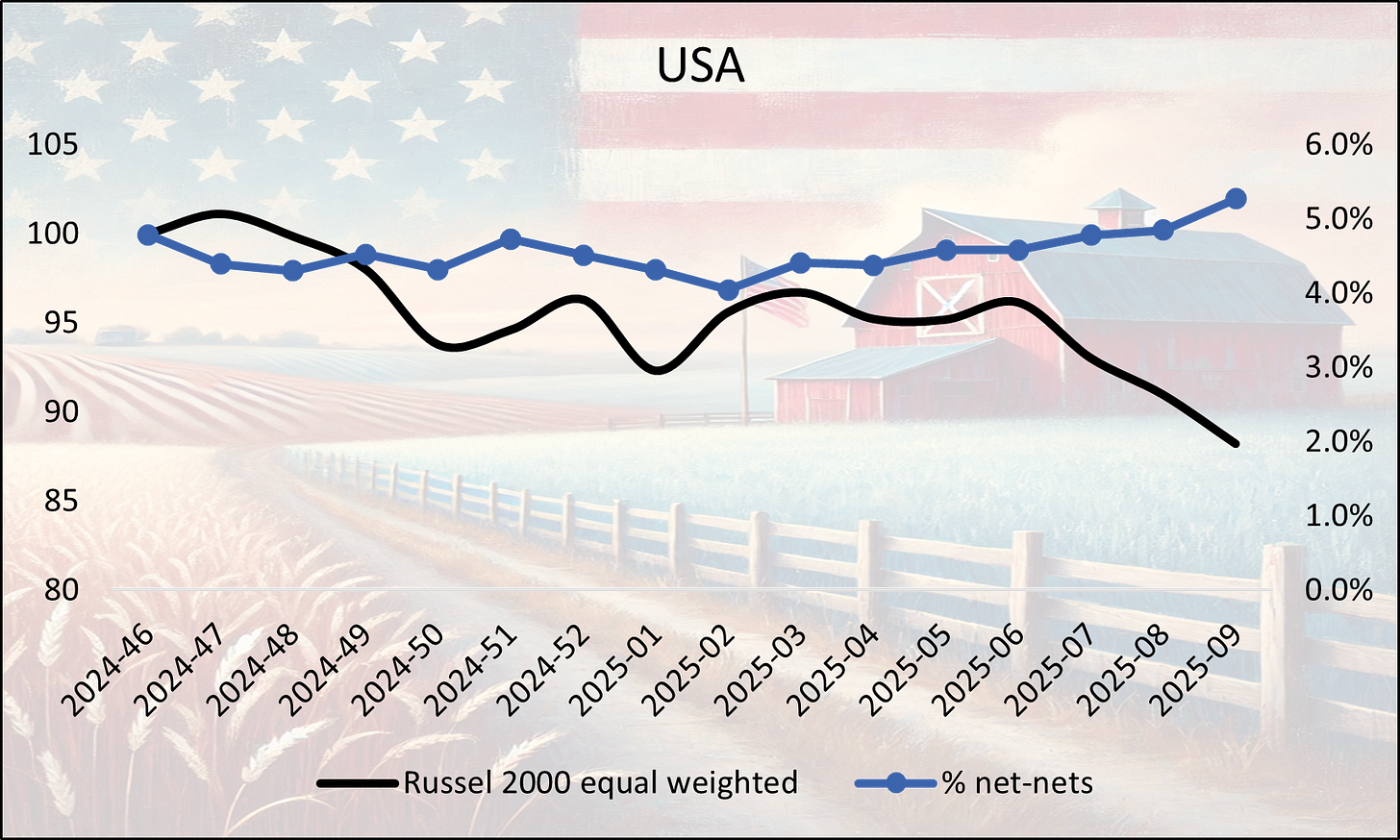

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

During the last week, Russel 2000 (e.w.) fell 3.0% and S&P / TSX Canadian Smallcap fell 4.1%. The number of raw net-nets as a percentage of total listed stocks is now at its highest point since we started measuring during week 46 2024.

Alico, Inc. (ALCO) - Extends Stock Incentive Plan and Elects New Board & Present Strategic Transformation Progress at 37th Annual ROTH Conference

On February 28, 2025, Alico, Inc. held its Annual Meeting of Shareholders, where shareholders approved the extension of the company’s 2015 Stock Incentive Plan through 2035. All eight nominated board members, including George R. Brokaw and Henry R. Slack, were re-elected. Shareholders also voted to retain Grant Thornton LLP as the company’s independent auditor. A total of 5.67 million shares (74%) were represented in the voting process.

Alico, Inc. also announced that its President and CEO, John Kiernan, will hold one-on-one meetings with investors at the 37th Annual ROTH Conference in Dana Point, California, on March 17-18, 2025. Management will provide updates on the company’s strategic transformation, including its transition to a diversified land management company with an estimated portfolio value of $650-$750 million. The company expects to close $20 million in land transactions in fiscal 2025 and is exploring new agricultural revenue streams through leasing arrangements and seasonal crops. Alico Citrus, one of the largest citrus producers in the U.S., will cease operations after the current harvest due to environmental and financial challenges, with Alico shifting its focus to long-term land management and real estate development.

Bridgford Foods (BRID) – Shareholder Letter & Take Private Proposal from Mark Krieger

Bridgford Foods faced a difficult fiscal year 2024, reporting an 11.1% revenue decline to $223.6 million, with net income falling to $3.38 million from prior-year levels. Higher input costs, particularly for meat and wheat, impacted margins, while inflation contributed to lower consumer spending in grocery stores. Despite this, the Frozen Food division saw growth, while the Meat Snack division struggled with softer demand.

Looking ahead to fiscal 2025, management expects a rebound in Meat Snack sales and continued expansion in the Frozen Food segment. Cost-cutting measures and strategic initiatives, including new product launches such as beef jerky and multi-pack pepperoni, are in place to drive sales. The company’s working capital decreased by $4.38 million, and a transition from a defined benefit pension plan to a 401(k) contribution plan is expected to improve financial stability. Bridgford Foods remains optimistic about 2025, highlighting ongoing investments in brand awareness, partnerships with universities, and enhanced safety certifications across its processing facilities.

Shareholder Mark Krieger has submitted a proposal recommending that Bridgford Foods Corporation take the company private, citing cost savings from regulatory compliance, improved market competitiveness, and a fair premium for minority shareholders. Krieger argues that Bridgford’s market cap has stagnated for a decade, and that the company’s shares are trading at a significant discount to equity value despite strong financial liquidity. He also criticized the lack of stock repurchases despite an existing repurchase authorization.

The Board of Directors opposes the proposal, stating that the company is focused on reinvesting in growth rather than pursuing privatization. The Board argues that remaining public ensures transparency, liquidity, and access to capital, while delisting could harm the company’s financial flexibility and brand recognition. Instead, the company is exploring private-label product partnerships and cost optimization initiatives to improve profitability. While the Board acknowledges ongoing discussions about capital allocation, it maintains that staying public is in the best interests of shareholders at this time and recommends voting against the proposal.

Fonar (FONR) – New Analysis on Seeking Alpha

P/TB 0.59 │ URL

Kevin Mackie wrote a new piece called “Channel Trading Fonar Corporation” stating it as a compelling buy at $15.

Friedman Industries (FRD) - De Lisle Partners Reports 6% Stake

De Lisle Partners LLP, a UK-based institutional investment manager, has filed an amended Schedule 13G (passive investment) with the SEC, disclosing a 6.0% ownership stake in Friedman Industries Inc. as of December 31, 2024. De Lisle Partners LLP, founded in 2005 by Richard de Lisle in Poole, England, is a privately owned investment management firm specializing in U.S. equity markets, managing the VT De Lisle America Fund and the Emmanuel College Endowment Fund. With a strategic focus on value investing, the firm targets undervalued small and mid-cap U.S. companies with strong fundamentals and low debt, operating in promising industries such as consumer cyclicals and industrials, while leveraging long-term themes like infrastructure spending and onshoring trends. The VT De Lisle America Fund has had a CAGR of 14.3% since 2010.

Jerash Holdings (JRSH) - Files Post-Effective Amendment to S-8 for Stock Incentive Plan, $100m Mixed Securities Shelf & New Seeking Alpha Analysis

Jerash Holdings (US), Inc. (Nasdaq: JRSH) filed a post-effective amendment to its Form S-8 on February 24, 2025, updating the registration for its Amended and Restated 2018 Stock Incentive Plan. The filing allows insiders and affiliates to reoffer and resell up to 1,081,400 shares of common stock, with CEO Choi Lin Hung holding the largest allocation at 445,000 shares. No additional registration fees were required, and sales may occur on the open market or through private transactions.

Jerash Holdings (US), Inc. has filed a Form S-3 registration statement with the SEC, enabling it to offer and sell up to $100 million in securities, including common stock, debt securities, warrants, rights, and units. The company, a manufacturer of customized sportswear and outerwear, operates in Jordan and serves major global brands such as The North Face, Timberland, and New Balance. Jerash’s common stock is listed on Nasdaq under the ticker “JRSH,” with a market value of approximately $27.5 million as of February 24, 2025. The proceeds from any securities sales will be used as specified in future prospectus supplements.

Also, Leland Roach wrote a new analysis on Seeking Alpha.

Jewett-Cameron Trading (JCTC) – Held AGM

P/TB 0.66 │ URL

Jewett-Cameron Trading Company Ltd. held its AGM on February 21, 2025, where shareholders voted on several key matters. The number of directors was set, and all nominated directors were elected, including Charles E. Hopewell, Chris Karlin, Sarah Johnson, Geoffrey Guilfoy, Michelle Walker, Chad Summers, Mike Henningsen, Subriana Pierce, and Ian Wendler. The appointment of auditors was approved with strong support. Shareholders also approved executive compensation in an advisory vote and sanctioned the company's Restricted Share Plan. Additionally, votes confirmed approval of acts and deeds by directors and officers, as well as other business matters.

Orbit Garant Drilling (OGD) - Pierre Alexandre to Sell 1 Million Shares, Retaining Majority Stake

P/TB 0.64 │ URL

Pierre Alexandre, Executive Vice President and Director of Orbit Garant Drilling Inc., has announced his intention to sell up to 1,000,000 common shares (2.7% of the company’s outstanding shares) for personal financial planning purposes. Despite the sale, he will remain the largest shareholder, holding approximately 21% of the company’s shares. The shares are expected to be sold via the Toronto Stock Exchange or privately.

During the summer of 2021, Alexandre sold 630k shares for c. c$650k at a P/TB multiple around 0.55x. The one-year forward return from those sales was c. -35%. Today OGD is trading at c. 0.66x TB.

Seneca Foods (SENEA) – Mentioned on X

P/TB 0.95 │ URL

David Orr shared his thoughts on Seneca Foods on X.

Strattec Security Corp’s (STRT) - SVP & COO Rolando Guillot Sells Shares

STRATTEC Security Corp (NASDAQ: STRT) reported that its Senior Vice President and Chief Operating Officer, Rolando Guillot, sold a total of 3,500 shares of common stock in two transactions on February 26, 2025. The sales were executed at prices of $50 and $51 per share, respectively. Following these transactions, Guillot retains ownership of 36,790 shares of the company’s stock.

As far as we can see, this was Guillot’s first sale transaction. Looking at historical insider transactions, Strattec officers and directors have historically been quite good at selling when the one-year forward return has been in negative territories.

The company was also mentioned on X by Guy Baron.

Tandy Leather Factory (TLF) - Reports Decline in 2024 Earnings, Anticipates Challenging 2025

Tandy Leather Factory reported revenues of $74.4m for 2024, a 2.4% decline compared to 2023. Operating income for the year stood at $0.6m, while net income dropped significantly to $0.8m from $3.8m in the prior year. Gross margins fell to 56.2% from 59.2%, impacted by higher labor and material costs. Operating expenses increased slightly to $41.2m, representing 55.4% of sales. Despite weaker financial performance, the company ended the year with $13.3m in cash and cash equivalents, up from $12.2m in 2023.

The fourth quarter of 2024 showed continued softness, with revenues of $20.5m, down from $20.8m in Q4 2023. Gross profit declined to $10.8m from $11.5m in the prior-year quarter. Net income per share was $0.04, significantly lower than the $0.23 reported for the same period in 2023. The company also reduced its inventory to $35.6m from $38.0m a year earlier. Tandy completed the sale of its corporate headquarters and paid a $1.50 per share dividend.

Looking ahead, CEO Johan Hedberg noted that while the company aims to improve sales in both stores and e-commerce, the transition to leasing its headquarters and flagship store in Fort Worth is expected to increase costs and impact profitability in 2025. Tandy anticipates some disruption in sales but is focused on stabilizing operations to position the company for a potential recovery in 2026.

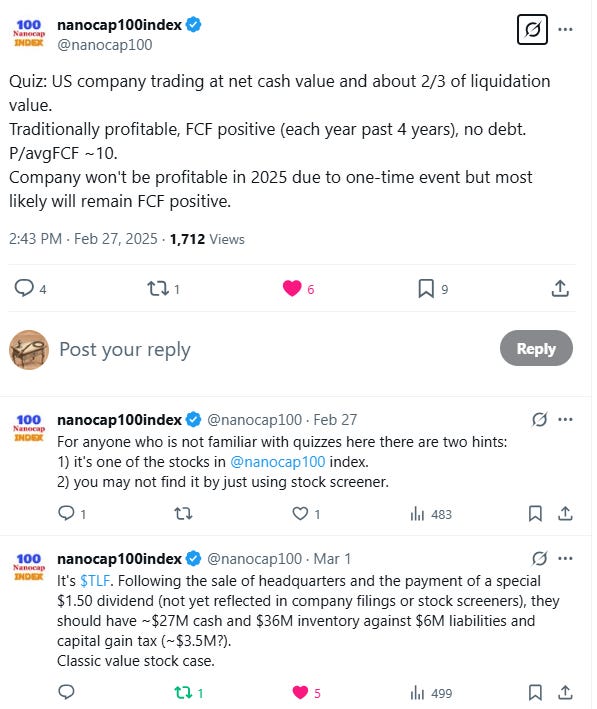

On X, Nanocap100index also mentioned the company:

Unifi (UFI) - Advances Sustainability Goals with Growth in Textile Recycling

P/TB 0.42 │ URL

Unifi, Inc., the maker of REPREVE®, has released its 2024 Sustainability Snapshot, highlighting key progress in textile-to-textile recycling and sustainability initiatives. The company has recycled the equivalent of 950 million T-shirts’ worth of textile waste and diverted 42 billion plastic bottles from landfills, aiming for 1.5 billion T-shirts and 50 billion bottles by 2030 and 2025, respectively. UNIFI also reported an 8% reduction in Scope 1 and 2 GHG emissions, targeting a 30% reduction by 2030. REPREVE now contributes 32% of revenue, with a goal of exceeding 50% by 2030. New product launches, such as REPREVE Takeback™ and ThermaLoop™, have been recognized for their circular innovations, with ThermaLoop winning multiple sustainability awards. Third-party life cycle assessments confirmed that these innovations significantly reduce GHG emissions, energy use, and fossil fuel consumption compared to virgin polyester. The Snapshot reinforces UNIFI’s commitment to sustainable manufacturing and circularity within the textile industry.

Village Super Market (VLGEA) - Reports Strong Q2 Growth with Increased Sales and Net Income

P/TB 1.05 │ URL

Village Super Market posted a solid second quarter for fiscal 2025, with net income rising 17% to $16.9m compared to the prior year. Total sales increased 4.2% to $599.7m, driven by a 2.3% rise in same-store sales and strong digital sales growth of 9%. The company benefited from higher pharmacy sales, inflation in meat and dairy, and the positive impact of store remodels. However, gross margin declined slightly to 28.35% due to increased promotional spending and an unfavorable product mix. Operating expenses as a percentage of sales improved to 23.22%, reflecting lower insurance, legal, and facility costs.

For the first half of fiscal 2025, sales reached $1.157bn, up 4.1% from the same period in 2024, with same-store sales rising 2.4%. Net income for the year-to-date period climbed 14% to $29.7m, supported by margin improvements from increased departmental profitability, lower warehouse assessment charges, and higher patronage dividends. Operating expenses as a percentage of sales decreased slightly to 23.91%, despite increased costs related to digital sales expansion. The company also saw a decline in interest expense due to lower outstanding debt, while the effective tax rate remained stable at 31.1%.

Looking ahead, Village Super Market continues to focus on growing its digital sales and optimizing its store network. The company operates 34 supermarkets under the ShopRite and Fairway banners, along with three Gourmet Garage specialty markets in New York City. Management remains optimistic about leveraging recent investments in store renovations and digital expansion to drive future growth while maintaining cost efficiency.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.