The Deep Value Week – 2025/06-07

A Couple of (Mainly Positive) Reports, Insider Buying's and Investments and Asset Sales

Companies mentioned:

· Alpha Pro Tech (APT) - Donna Millar Reports 11.7% Stake

· Alico (ALCO) - Reports Q1 2025 Results Amid Strategic Shift from Citrus to Land Management

· Art’s-Way (ARTW) - Reports Fiscal 2024: Modular Buildings Growth Offsets Agricultural Decline

· Friedman Industries (FRD) - Reports Q3 2024 Results: Sales Decline Amid Market Challenges, Stronger Order Backlog & Insider and Institutional Ownership Updates

· Jerash Holdings (JRSH) - Fiscal Q3 2025 Financial Results & Outlook

· Jewett-Cameron Trading (JCTC) - Expands MyEcoWorld® Pet Waste Bags into Grocery Retail, Comprehensive Financial Planning Reports 7.83% Stake & Oregon Community Foundation Reduces Stake &

· Key Tronic (KTCC) - Reports Q2 FY2025 Financial Results Amid Supply Chain Disruptions, Expands U.S. Manufacturing with New Arkansas Facility & Morgan Stanley Increases Stake

· Natural Alternatives International (NAII) - Caldwell Sutter and Renaissance Technologies Adjust Ownership

· Orbit Garant (OGD) - Reports Stronger Profitability in Q2 2025 Amid Increased Drilling Activity

· Seneca Foods (SENEA) - Reports Q3 2025 Results with Strong Sales Growth but Lower Margins

· Strattec Security (STRT) - Reports Q2 2025 Results with Strong Revenue Growth and Cash Flow Generation

· Unifi Inc. (UFI) - Q2 2025: Modest Revenue Growth Amid Continued Profitability Challenges & Kenneth Langone Increases Stake

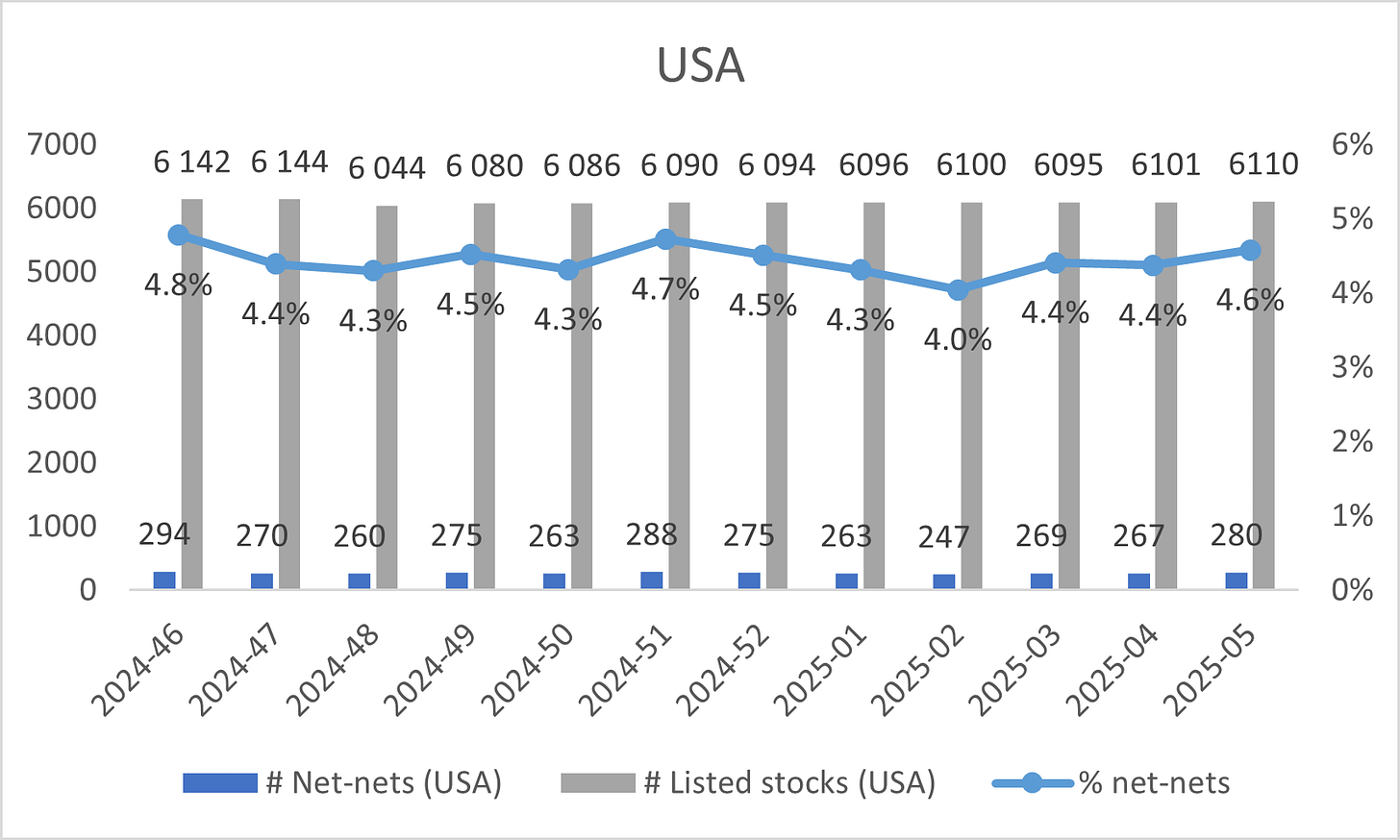

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alpha Pro Tech (APT) - Donna Millar Reports 11.7% Stake

P/TB 0.96 │ URL

Donna Millar has filed an amended Schedule 13D/A with the SEC, disclosing her beneficial ownership of 1,284,603 shares of Alpha Pro Tech Ltd., representing 11.7% of the company's outstanding common stock. Millar, a director and employee of the company, originally acquired 1,380,921 shares on December 13, 2018, as part of the estate settlement of her late husband, who was the former President and Chairman of Alpha Pro Tech.

Alico (ALCO) - Reports Q1 2025 Results Amid Strategic Shift from Citrus to Land Management

P/TB 0.93 │ URL

Alico, Inc. reported its first-quarter 2025 financial results, highlighting a 20.8% year-over-year increase in revenue to $16.9 million. However, the company posted a net loss of $9.2 million, compared to a net income of $42.9 million in Q1 2024, primarily due to the absence of major land sales that had significantly boosted the prior-year quarter. EBITDA also dropped to $(6.7) million from $63.8 million, reflecting the company's ongoing transition from citrus production to diversified land management.

Alico reaffirmed its decision to exit citrus operations following the 2025 harvest, citing the persistent impact of citrus greening disease and declining production levels. The company is now focusing on strategic land sales, with expectations to generate $20 million in proceeds in fiscal 2025. With $73.5 million in available credit facilities and no significant debt maturity until 2029, Alico believes it is well-positioned to fund operations through fiscal 2027. The company anticipates lower citrus harvest volumes in 2025, but expects continued growth in land management revenue, particularly from rock and sand royalties and sod sales.

The company continues to prioritize financial stability and cash preservation while exploring opportunities in commercial and residential land development. Looking ahead, management remains confident that Alico’s transformation into a diversified land company will enhance long-term shareholder value.

Art’s-Way (ARTW) - Reports Fiscal 2024 Results: Modular Buildings Growth Offsets Agricultural Decline

P/TB 0.77 │ URL

Art’s-Way Manufacturing Co., Inc. reported its fiscal year 2024 financial results, highlighting strong performance in its Modular Buildings segment, which saw a 25.9% revenue increase to $9.8 million, driven by higher demand in the research sector. However, agricultural product sales declined by 34.7% to $14.7 million, reflecting industry-wide challenges such as lower commodity prices and higher dealer inventories. As a result, total net sales dropped 19.1% year-over-year to $24.5 million, while operating income fell to $461,000 from $1.5 million in 2023.

Despite the decline in agricultural equipment sales, the company successfully reduced costs, improved liquidity, and completed the sale of its discontinued Tools segment of $1.8 million. Art’s-Way reported a net loss from continuing operations of $94,000, compared to a net income of $763,000 in 2023, but still achieved a consolidated net income of $307,000, up from $267,000 in the prior year, due to gains from discontinued operations. The company also lowered its debt to historical lows.

Looking ahead to fiscal 2025, Art’s-Way expects continued strength in Modular Buildings and improving demand in the dairy and livestock sectors, which could boost agricultural product sales. The company anticipates reduced overhead costs, improved cash flow, and stronger profitability, driven by cost-saving measures and operational efficiencies. CEO Marc McConnell expressed optimism for 2025, citing a more balanced business model and favorable market trends in key segments.

Friedman Industries (FRD) - Reports Q3 2024 Results: Sales Decline Amid Market Challenges, Stronger Order Backlog & Insider and Institutional Ownership Updates

P/TB 0.93 │ URL

Friedman Industries, Inc. reported third-quarter fiscal 2024 results, reflecting challenging market conditions with continued pricing pressure and lower sales volumes. Revenue fell to $94.1 million, down from $116.0 million in Q3 2023, while net income turned to a loss of $1.2 million ($0.17 per share), compared to a $1.2 million profit last year. However, the company reduced debt by 9% and maintained strong working capital of $107 million, positioning it for future stability.

The flat-roll segment, which contributed the majority of sales, reported $86.1 million in revenue, down from $106.4 million due to lower steel prices and reduced sales volume. The tubular segment saw revenue decline to $7.9 million from $9.5 million, driven by a lower per-ton selling price despite steady sales volume. A 11% year-over-year increase in the company’s sales backlog signals strengthening demand heading into Q4.

Friedman expects Q4 sales volume to rise, supported by higher order activity and increasing hot-rolled coil prices. The company anticipates improved sales margins and stronger financial performance in the coming quarters, backed by a robust balance sheet and strategic positioning for long-term growth. CEO Michael Taylor emphasized confidence in the industry’s long-term outlook and Friedman’s ability to capitalize on new opportunities.

On February 11, 2025, Tim Scott Stevenson, a director of Friedman purchased 1,500 shares of the company’s common stock at $17.23 per share. Following this acquisition, Stevenson now owns 28,675 shares of the company.

Renaissance Technologies LLC, a well-known quantitative investment firm, filed an amended Schedule 13G/A on February 13, 2025, disclosing ownership of 336,782 shares of Friedman Industries stock, representing 4.83% of the company’s outstanding shares. This marks a slight reduction in its stake, bringing ownership below the 5% threshold that typically triggers mandatory reporting requirements for institutional investors.

These ownership movements come as Friedman navigates a volatile steel market, with expectations for stronger Q4 sales and improved margins.

Jerash Holdings (JRSH) - Fiscal Q3 2025 Financial Results & Outlook

Jerash Holdings reported a 28.6% year-over-year increase in Q3 FY 2025 revenue, reaching $35.4 million, driven by higher shipments to major U.S. customers. However, gross margin declined to 15.2% (from 16.2% last year) due to higher logistics costs, mainly caused by congestion at Israel’s Haifa port, which delayed $3.8 million worth of shipments and resulted in $100,000 in storage fees. Additionally, $2 million of finished goods were held back in warehouses. Despite these disruptions, port logistics have improved since late January 2025, allowing shipments to move more efficiently.

The company is expanding its production capacity to meet growing demand from existing and new customers looking for manufacturers in tariff-free regions like Jordan. Two existing facilities are being expanded to increase capacity by 15% by June 2025, and an additional 5-10% increase is planned by the end of the year in collaboration with the Jordanian government. Jerash’s factories are fully booked through August 2025, reflecting strong order flow and continued business momentum. However, higher interest expenses from supply chain financing programs weighed on profitability, leading to a net income of $6,000, compared to $232,000 last year.

Looking ahead, Q4 FY 2025 revenue is expected to grow by 50-53% year-over-year, while Q1 FY 2026 is projected to remain stable at $40.9 million, reflecting a strong start to the year. The company expects gross margin to reach 15-16% in Q4, though logistics and shipping costs remain key risks. Jerash maintains a solid cash position of $14.8 million and has declared a quarterly dividend of $0.05 per share, payable on February 25, 2025. While short-term profitability remains pressured, the company’s expansion efforts and strong order backlog position it for long-term growth.

Jewett-Cameron Trading (JCTC) - Expands MyEcoWorld® Pet Waste Bags into Grocery Retail, Comprehensive Financial Planning Reports 7.83% Stake & Oregon Community Foundation Reduces Stake &

Comprehensive Financial Planning, Inc. has reported a 7.83% stake in Jewett-Cameron Trading Company Ltd, according to its Schedule 13G/A filing on January 31, 2025. The investment advisory firm holds 275,400 shares of Jewett-Cameron’s common stock.

Oregon Community Foundation (OCF), a 10% owner of Jewett-Cameron Trading Company Ltd has reported a series of stock sales through Form 4 filings on February 12 and 13, 2025. The foundation sold a total of 13,134 shares over two days at an average price of $4.59 per share, reducing its total holdings to 995,400 shares. These transactions indicate a minor reduction in OCF’s investment position.

Jewett-Cameron Trading Company has announced the expansion of its MyEcoWorld® Pet Waste Bags into 59 Tops Friendly Markets across the Northeast by late February 2025. This marks a strategic milestone for the company, broadening its footprint beyond its traditional seasonal product lines and into the grocery sector. With consumers increasingly prioritizing environmentally responsible choices, MyEcoWorld® positions itself as a certified compostable alternative, aligning with the growing number of plastic bag bans across the U.S.

CEO Chad Summers emphasized that entering grocery retail opens new, recurring revenue streams, diversifying Jewett-Cameron’s customer base beyond its steel and fence products. This move not only enhances sales stability but also reinforces the company’s role in the global shift toward sustainable consumer products. The rollout at Tops Friendly Markets signals the brand’s accelerating growth and its continued push to deliver innovative, certified sustainable solutions in everyday consumer markets.

Key Tronic (KTCC) - Reports Q2 FY2025 Financial Results Amid Supply Chain Disruptions, Expands U.S. Manufacturing with New Arkansas Facility & Morgan Stanley Increases Stake

P/TB 0.30 │ URL / URL / URL / URL

Key Tronic Corporation has announced a significant expansion of its U.S. manufacturing operations by establishing a new flagship facility in Springdale, Arkansas. The company plans to invest over $28 million in the project, increasing production capacity by 40% and creating more than 400 new jobs over the next five years. The move strengthens Key Tronic’s position in the electronic manufacturing services (EMS) industry, reinforcing its commitment to domestic production and innovation.

The new 300,000-square-foot facility at 601 W Apple Blossom Avenue is part of a $100 million business park development by Crossland Realty Group. Construction, led by Crossland Construction, is expected to be completed in Q3 2025. Key Tronic’s decision to expand in Arkansas aligns with its long-term growth strategy and the region’s reputation as a hub for high-tech manufacturing.

Morgan Stanley has filed an amended Schedule 13G/A, disclosing an increased stake in Key Tronic Corporation. As of December 31, 2024, Morgan Stanley, along with its subsidiary Morgan Stanley Smith Barney LLC, reported beneficial ownership of 1,726,280 shares, representing 16.0% of Key Tronic’s outstanding common stock.

Key Tronic also announced second-quarter fiscal 2025 results, reporting revenue of $113.9 million, down from $147.8 million in the same period of the previous fiscal year. The company attributed the decline to unexpected component shortages, lower-than-expected production during the holiday season, and reduced demand from certain customers, impacting revenue by approximately $15 million. Gross margins fell to 6.8%, and the company posted a net loss of $4.9 million ($0.46 per share), compared to a net income of $1.1 million ($0.10 per share) in Q2 FY2024. Despite the challenging quarter, Key Tronic highlighted new program wins and expansion initiatives as part of its long-term growth strategy. The company plans to increase production capacity by 40% with a new flagship facility in Arkansas, and expand operations in Vietnam, aimed at mitigating tariff risks and supporting customers shifting manufacturing away from China and Mexico. Additionally, Key Tronic secured a major energy resiliency technology program, which, once fully ramped, is expected to generate over $60 million in annual revenue.

Key Tronic did not provide revenue or earnings guidance for Q3 FY2025, citing economic and geopolitical uncertainties, including newly announced tariffs. However, CEO Brett Larsen emphasized that cost-cutting measures, inventory alignment, and streamlining operations are expected to improve profitability in the coming quarters. The company remains focused on expanding domestic and international production capacity while maintaining strong relationships with OEM customers across key industries.

Natural Alternatives International (NAII) - Caldwell Sutter and Renaissance Technologies Adjust Ownership

Natural Alternatives International Inc. saw changes in its ownership structure as Caldwell Sutter Capital, Inc. and Renaissance Technologies LLC reported updated holdings in recent Schedule 13G/A filings with the SEC. Caldwell Sutter Capital disclosed a 7.4% stake, holding 460,638 shares through advisory client accounts. Additionally, Joseph F. Helmer, President of Caldwell Sutter, reported beneficial ownership of 480,449 shares, representing 7.8% of the company's outstanding stock. Renaissance Technologies LLC, a quantitative investment firm, reported a reduction in its stake in Natural Alternatives International, now holding 309,256 shares, equivalent to 4.99% of the company.

Orbit Garant (OGD) - Reports Stronger Profitability in Q2 2025 Amid Increased Drilling Activity

P/TB 0.70 │ URL

Orbit Garant Drilling Inc. delivered improved financial results for Q2 2025, posting net earnings of $1.5 million ($0.04 per share) compared to a net loss of $1.7 million in the same period last year. Revenue remained stable at $43.5 million, reflecting stronger Canadian drilling activity, offset by the impact of ceasing operations in West Africa. Gross profit surged to $7.2 million, nearly double last year’s $3.0 million, with adjusted EBITDA rising sharply to $5.6 million from $1.0 million in Q2 2024.

The company attributed its profitability boost to improved operational efficiency and strong demand from gold mining customers, with gold prices recently surpassing US$2,900 per ounce. Canada saw 4% revenue growth to $30.8 million, while international operations declined slightly to $12.7 million due to regional restructuring. Orbit Garant’s adjusted gross margin increased to 21.5%, reflecting better cost management and higher drilling utilization.

Orbit Garant also reduced its long-term debt to $18.6 million and strengthened its balance sheet with a US$2.0 million loan for three new computerized drill rigs in Chile. The company repurchased 44,288 shares as part of its normal course issuer bid (NCIB). With $49.2 million in working capital and continued demand from mining clients, Orbit Garant remains well-positioned for sustained growth in fiscal 2025 and beyond.

Seneca Foods (SENEA) - Reports Q3 2025 Results with Strong Sales Growth but Lower Margins

P/TB 0.92 │ URL

Seneca Foods Corporation reported net sales of $502.9m for Q3 2025, a 13.1% increase from $444.5m in the same period last year. The growth was primarily driven by higher sales volumes, although pricing pressures limited gains. Year-to-date sales reached $1,233.0m, up from $1,150.6m in the previous year. Despite strong revenue growth, gross margin declined to 9.8% from 12.2% in Q3 2024, mainly due to supply chain disruptions and poor weather conditions affecting crop yields. Adjusted net earnings for the quarter were $22.9m, down from $26.7m last year, while net income fell to $14.7m from $17.7m in Q3 2024. EBITDA also declined to $39.6m from $45.1m in the prior-year quarter.

CEO Paul Palmby highlighted the company’s strong sales momentum and working capital improvements, along with debt reduction in the quarter. However, he acknowledged the margin pressures caused by a weaker pack season due to heavy rainfall in key agricultural regions.

Strattec Security (STRT) - Q2 2025 Results with Strong Revenue Growth and Cash Flow Generation

P/TB 1.03 │ URL

Strattec Security Corporation reported Q2 2025 revenue of $129.9m, a 9.6% increase from $118.5m in Q2 2024. The growth was driven by new program launches, improved product mix, and increased production volumes among key customers. Net income rose to $1.3m (EPS of $0.32) compared to $1.0m (EPS of $0.26) in the prior year. Adjusted EPS was $0.65, up 81% from $0.36 last year, reflecting operational improvements and cost optimization initiatives. Adjusted EBITDA reached $8.0m, representing 6.1% of sales, up from $5.0m (4.3%) in Q2 2024.

The company generated $9.4m in cash from operations, bringing year-to-date operating cash flow to $20.8m. Strattec also strengthened its balance sheet, ending the quarter with $42.6m in cash, an increase of $8.2m from the previous quarter. CEO Jennifer Slater emphasized ongoing business transformation efforts, including cost-saving measures in U.S. manufacturing and a strategic focus on high-value content platforms to drive future profitability.

Unifi Inc. (UFI) - Q2 2025: Modest Revenue Growth Amid Continued Profitability Challenges & Kenneth Langone Increases Stake

Unifi Inc. reported a slight increase in revenue for Q2 2025, reaching $138.9m (+1.4%) compared to the same quarter last year. However, profitability remains under pressure, with a gross margin of just 0.4% (vs. 1.2% in Q2 2024) and a net loss of $11.4m, although this is an improvement from the $19.8m loss a year earlier. Adjusted EBITDA came in at - $5.8m, reflecting ongoing operational inefficiencies and cost pressures. Sales of Unifi’s REPREVE Fiber products accounted for 31% of total revenue, down from 33% last year, indicating a slight decline in demand for the company’s sustainable textile offerings.

To address cost inefficiencies, Unifi announced the closure of its Madison, North Carolina facility, with production being consolidated into other locations in North and Central America. This restructuring is expected to eliminate up to 250 positions and generate $5.0m–$7.5m in one-time restructuring costs, including equipment relocation, severance, and asset impairment charges. The company aims to sell the Madison facility, using the proceeds to reduce debt and improve financial stability. This move is intended to enhance operational efficiency and increase utilization rates at its remaining production sites.

Unifi expects revenue for fiscal 2025 to remain in line with 2024 but anticipates profitability improvements in the second half of the year as restructuring efforts take effect. The company projects capital expenditures of $14.0m–$16.0m, including costs related to production transitions. CEO Eddie Ingle emphasized Unifi’s commitment to strengthening its business model and focusing on long-term profitability, stating that despite short-term financial headwinds, the company remains well-positioned for future growth in sustainable textiles.

Kenneth G. Langone, a director and 10% owner of Unifi Inc., expanded his holdings in the company with the purchase of 34,097 shares in two separate transactions on February 10 and 11, 2025. The shares were acquired at an average price of $5.55 and $5.43 per share, respectively, bringing Langone’s direct ownership to 2,370,000 shares. Additionally, he holds 30,000 shares through his wife and 130,000 shares via Invemed Associates LLC, where he serves as Chairman and CEO. Langone, best known as a co-founder of Home Depot, has been a long-time investor in Unifi and actively involved in its corporate governance.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.