The Deep Value Week – 2025/05

Analyses, Shareholder Increases, a Special Dividend and an Open Letter

Companies mentioned:

· Alico (ALCO) – “Worth the Squeeze?”

· Bridgford Foods (BRID) - FY 2024 Performance and Outlook

· Charles & Colvard (CTHR) - Board Resignation and Bylaws Amendment

· Hurco Companies, Inc. (HURC) - Announces Proxy Statement for 2025 Annual Meeting

· Jewett-Cameron Trading Co. (JCTC) - Updates Investor Presentation & Receives Open Letter (again) from Parthenon LLC

· Coffee Holding Co. (JVA) - Announces Delay in Filing Annual Report, Reports Strong Fiscal 2024 Growth

· Key Tronic Corporation (KTCC) - Reports Preliminary Q2 FY2025 Results and Outlook & Mentioned on X

· Reko International Group (REKO) – Further Buybacks

· Seneca Foods Corporation (SENEA) - Royce & Associates Increases Stake to 5.71%

· SigmaTron International (SGMA) - Peter J. Abrahamson Increases Stake to 9.3%

· Tandy Leather Factory (TLF) - Completes Headquarters Sale, Signs New Lease, and Announces Special Dividend

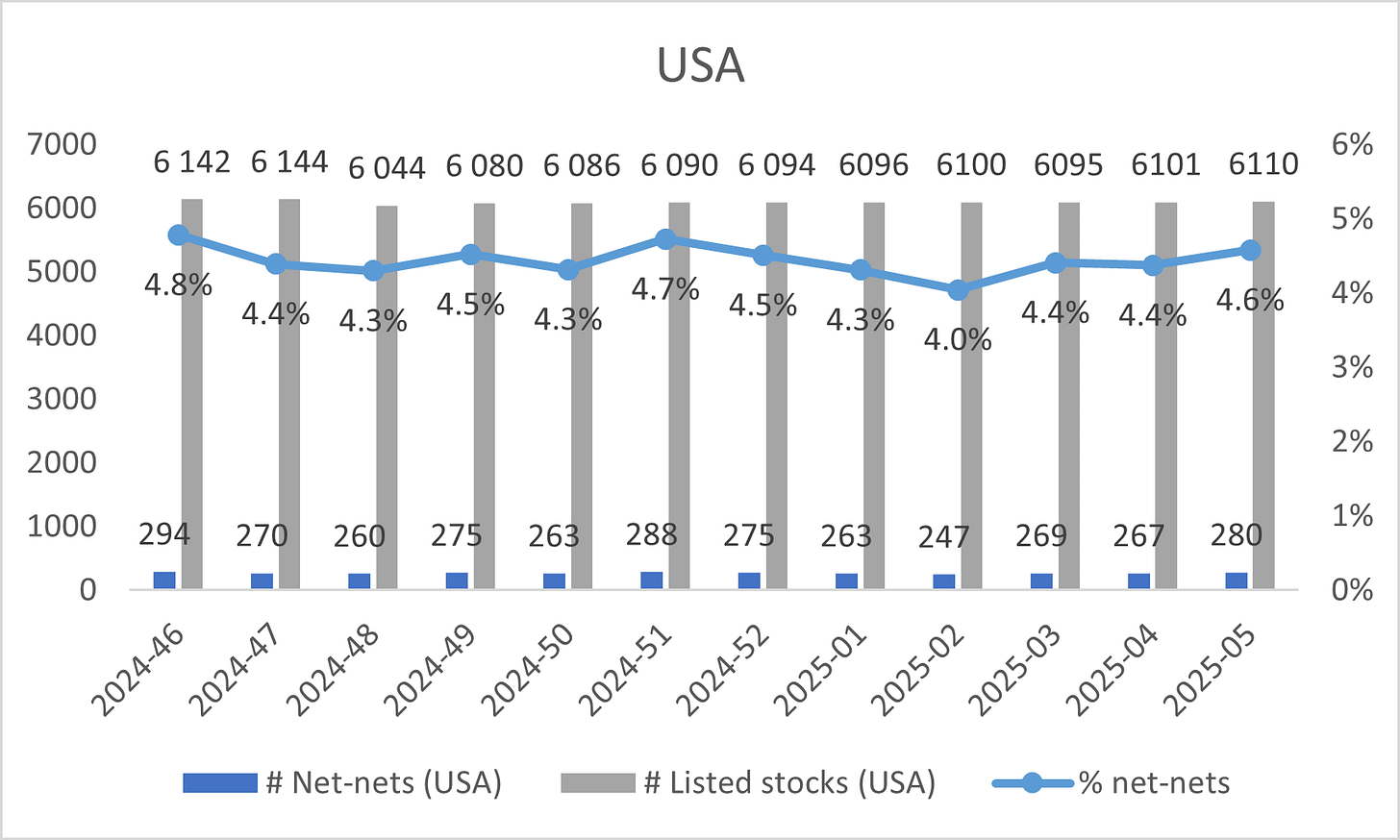

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alico – “Worth the Squeeze?”

P/TB 0.96 │ Agriculture │ URL

UnlearningCFA posted a write-up on Alico.

Bridgford Foods (BRID) - FY 2024 Performance and Outlook

P/TB 0.75 │ Food Products │ URL

Bridgford Foods Corporation reported a net sales decline of 11.1% for the fiscal year ending November 1, 2024, driven primarily by a 14.8% drop in Snack Food Products sales. This was attributed to lower consumer demand, inflationary pressures affecting discretionary spending, and a shift in product mix. The Frozen Food Products segment saw a 1.3% increase in net sales, benefiting from higher pricing and stronger institutional demand. Overall, lower unit sales volumes and increased promotional activity negatively impacted revenue.

Despite a 7.7% decrease in cost of products sold, gross margins contracted from 28.0% to 25.2%, reflecting increased commodity costs, particularly in the Snack Food Products segment. Meat commodity costs rose by approximately $4.9m, and inventory write-downs added further pressure. The company noted higher net realizable value reserves due to declining market prices for some products. The Frozen Food segment improved its gross margin to 27.4%, thanks to product mix optimization, but this was offset by the sharp margin drop in Snack Food Products.

Selling, General & Administrative (SG&A) expenses declined by 4.8%, largely due to lower sales commissions, reduced brand licensing fees, and cost-cutting initiatives in fleet management. However, higher healthcare costs and consulting fees partially offset these savings. The company recorded a net loss of $3.4m for the year, compared to a $3.5m profit in FY 2023, primarily due to declining sales in Snack Food Products and higher input costs.

Looking ahead, Bridgford Foods expects continued challenges in consumer demand, particularly for snack products, as inflation pressures persist. The company is shifting towards cost-efficient transportation methods and optimizing its product mix to favor higher-margin items. Management is also exploring price adjustments and operational efficiencies to mitigate commodity price volatility. With $7.5m available under its credit line and $61.5m in net working capital, the company has liquidity to navigate near-term pressures but must address declining demand trends to restore profitability.

Charles & Colvard (CTHR) - Board Resignation and Bylaws Amendment

P/TB 0.15 │ Mossainite │ URL

Charles & Colvard, Ltd. has announced the resignation of Board Director Benedetta Casamento, effective January 20, 2025. The company confirmed that her departure was not due to any disagreements related to operations, policies, or practices. Additionally, the Board of Directors has approved an amendment to the company’s Bylaws, reducing the minimum and maximum number of board members. Previously set between five and ten, the new range allows for four to nine directors.

Hurco Companies, Inc. (HURC) - Announces Proxy Statement for 2025 Annual Meeting

P/TB 0.70 │ Machine Tool │ URL

Hurco Companies, Inc. has released its 2025 Proxy Statement, detailing key proposals for the upcoming Annual Shareholder Meeting on March 13, 2025, at the company's headquarters in Indianapolis, Indiana.

The board has put forth four key proposals for shareholder approval: (1) the election of eight directors, including one new nominee, Benjamin Rashleger; (2) an advisory vote on executive compensation; (3) amendments to the 2016 Equity Incentive Plan; and (4) the appointment of Deloitte & Touche LLP as the company's independent auditor. The board unanimously recommends approval of all proposals.

Financially, Hurco reported first-half 2024 revenue of $65.2 million, a 4% decline year-over-year. Operating profit stood at $2.1 million, with a 3.2% margin, while net income was -$16.6 million, largely impacted by a $8.6 million tax adjustment. Despite these challenges, the company’s order book increased by 24% to $43.4 million as of December 31, 2024, reflecting improving demand in core markets.

CEO Gregory S. Volovic's total compensation increased by 11% to $659,812, while other executive salaries saw mixed adjustments. No bonuses were awarded for 2024, reflecting the company’s disciplined financial approach.

Looking ahead, Hurco expects growth in infrastructure, rail, and energy markets, despite continued challenges in certain sectors. The board remains confident in its strategic direction, emphasizing cost efficiencies, technology investments, and market expansion.

Jewett-Cameron Trading Co. (JCTC) - Updates Investor Presentation & Receives Open Letter (again) from Parthenon LLC

P/TB 0.67 │ Building Products │ URL / URL

Jewett-Cameron Trading Company Ltd. has released an updated investor presentation, now available on its corporate website.

Parthenon LLC, a significant shareholder in Jewett-Cameron Trading Company, has issued an open letter urging fellow shareholders to vote “WITHHOLD” on the re-election of all Board Directors at the upcoming 2025 Annual Meeting on February 21, 2025. The firm, which holds approximately 6.2% beneficial ownership in Jewett-Cameron, criticizes the Board for poor business performance, declining profitability, and a lack of strategic action to enhance shareholder value.

According to Parthenon LLC, Fiscal Year 2024 marked the first annual operating loss in at least 25 years, based on SEC filings. Despite management’s assurances that improvements will be evident in Q3 2025 results, Parthenon points out that no Board Director has purchased shares in the company, even as the stock declined 15% in 2024 and 40% over the past five years.

The letter highlights that insiders collectively own less than 1.3% of outstanding shares, with all holdings acquired through grants or options rather than direct purchases. Parthenon argues that this lack of personal investment signals a lack of confidence in the company’s future and questions why the Board has not considered strategic alternatives to maximize shareholder value.

Parthenon LLC’s CEO, Thomas A. Corea, concludes the letter by calling on shareholders to send a strong message of dissatisfaction by voting “WITHHOLD” on all director re-elections. He emphasizes that shareholders, as the true owners of the company, must demand accountability and a change in direction.

Coffee Holding Co. (JVA) - Announces Delay in Filing Annual Report, Reports Strong Fiscal 2024 Growth

P/TB 0.93 │ Coffee │ URL

Coffee Holding Co., Inc. has announced a delay in filing its Annual Report for the fiscal year ending October 31, 2024. The company cited the need for additional time to finalize its financial statements but expects to submit the report within the SEC's 15-day grace period. The delay does not indicate any irregularities but rather reflects the company's commitment to ensuring accurate and complete financial disclosures.

Despite the delayed filing, Coffee Holding Co. reported strong financial growth for fiscal 2024. Net sales increased by 15% compared to the previous year, while gross margins improved from 16% in 2023 to 20% in 2024. The company also returned to profitability, posting a net income of $2.25 million ($0.39 per share), a significant turnaround from a net loss of $835,576 (-$0.15 per share) in fiscal 2023.

Key Tronic Corporation (KTCC) - Reports Preliminary Q2 FY2025 Results and Outlook & Mentioned on X

P/TB 0.31 │ Contract Manufacturing │ URL

Key Tronic Corporation, a leading provider of electronic manufacturing services (EMS), has announced preliminary financial results for the second quarter of fiscal year 2025, ending December 28, 2024. The company anticipates revenue of approximately $114 million and a net loss of $0.40 to $0.48 per share, which is below previous guidance. The lower-than-expected results are attributed to unexpected component shortages, seasonal production slowdowns, and decreased demand from certain customers, resulting in a $15 million revenue shortfall for the quarter. Additionally, the company expects to record approximately $1.0 million in loan fee write-offs related to a recent debt refinancing.

Despite these short-term challenges, Key Tronic remains optimistic about the upcoming quarter. The company expects revenue and earnings to improve in Q3 FY2025 as previously implemented strategic initiatives take effect. Key Tronic is actively streamlining its international and domestic operations, including headcount reductions to enhance efficiency. Moreover, the company has secured new business in aerospace systems and energy resiliency technology, which is expected to support long-term growth. For Q3 FY2025, Key Tronic projects revenue in the range of $115 million to $130 million and earnings between $0.00 and $0.15 per diluted share. The company plans to release its full Q2 FY2025 results and host an earnings conference call on February 4, 2025.

Reko International Group (REKO) – Further Buybacks

P/TB 0.51 │ Injection Moulding │ URL

Reko bought back another 766 shares during the last week.

Seneca Foods Corporation (SENEA) - Royce & Associates Increases Stake to 5.71%

P/TB 0.83 │ Food │ URL

Royce & Associates LP has filed a Schedule 13G, disclosing a 5.71% beneficial ownership in Seneca Foods Corporation as of December 31, 2024. The filing indicates that Royce & Associates holds 300,363 shares of Seneca’s Class A common stock.

SigmaTron International (SGMA) - Peter J. Abrahamson Increases Stake to 9.3%

P/TB 0.19 │ Contract Manufacturing │ URL

Investor Peter J. Abrahamson has filed an amended Schedule 13G/A, disclosing an increased ownership stake in SigmaTron International, Inc. As of December 31, 2024, Abrahamson holds 570,403 shares of the company’s common stock, representing 9.3% of the outstanding shares.

Tandy Leather Factory (TLF) - Completes Headquarters Sale, Signs New Lease, and Announces Special Dividend

P/TB 0.70 │ Leather Retail │ URL

Tandy Leather Factory, Inc. has successfully completed the sale of its corporate headquarters, distribution center, and flagship retail store to Colonna Brothers, Inc. The company has signed lease agreements to continue occupying the existing facilities until September 2025 while actively searching for a new location for its Fort Worth flagship store.

Additionally, Tandy Leather entered into a 10-year lease for a new headquarters and distribution facility at Chisolm 20 Commerce Park in Benbrook, Texas, just a few miles from its current location. The lease covers approximately 134,000 square feet, with rent commencing in October 2025 at approximately $111,000 per month.

In a move to return capital to shareholders, the company's Board of Directors declared a special cash dividend of $1.50 per share, payable on February 18, 2025, to stockholders of record as of February 3, 2025. Chairman Jeff Gramm highlighted that the company’s new space is better suited for operations and that the monetization of an under-utilized asset allows for returning value to shareholders. He also indicated that the Board may consider an additional special dividend after the relocation process is completed.

CEO Johan Hedberg expressed confidence in overcoming the challenges of relocating the company’s headquarters and flagship store while managing increased expenses from the new leased facilities. His goal is to drive profitable growth while maintaining strong customer engagement and product offerings.

Tandy Leather also announced the resignation of Board Director Eric Speron, effective January 31, 2025. Speron praised the company’s patience and strategic execution in maximizing the value of its headquarters sale and expressed confidence in the management team’s continued success.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.