Companies mentioned:

· Alpha Pro Tech (APT) – Mentioned on X

· Alico (ALCO) – AGM Notice

· Bridgford Foods (BRID) – New Analysis by Mark Krieger

· Flexible Solutions (FSI) - Signs $15-30M Annual Contract for Food Grade Manufacturing

· Friedman Industries (FRD) – Insider Purchase

· Hurco Companies (HURC) – 4Q24, New SA Analysis & Mentioned on X

· Key Tronic (KTCC) – Mentioned on X

· Jewett-Cameron Trading (JCTC) – 10Q

· Coffee Holding (JVA) – Filed a Lawsuit

· Orbit Garant Drilling (OGD) – Further Buybacks & New Analysis

· Reko International (REKO) – Further Buybacks

· Strattec Security (STRT) - Lists local plant for sale at $17M

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Alpha Pro Tech (APT) – Mentioned on X

P/TB 0.99 │ Building Products │ URL

Pierre Cappuccino shared his thoughts on the stock from a technical viewpoint.

Alico (ALCO) – AGM Notice

P/TB 1.01 │ Agriculture │ URL

Alico, Inc. has scheduled its Annual Shareholder Meeting for February 28, 2025, to be held virtually. The agenda includes the election of eight directors, approval of Grant Thornton LLP as auditors for 2025, and a proposal to extend and amend the company's stock-based incentive plan through December 2035.

The company is undergoing a strategic shift, planning to exit its citrus production business due to challenges like citrus greening and environmental factors. Alico aims to focus on diversified land use and real estate development, leveraging its assets for leasing and sales in commercial and residential markets.

The board highlights the importance of the stock-based incentive plan to attract and retain talent essential for the company's transformation and long-term growth. Failure to approve the plan could force Alico to increase cash compensation, potentially impacting financial flexibility and shareholder returns.

Bridgford Foods (BRID) – New Analysis by Mark Krieger

P/TB 0.75 │ Food Production │ URL

In the comment section of a Seeking Alpha Analysis, Krieger shared his thoughts on the company (on the 6th of January).

Flexible Solutions (FSI) - Signs $15-30M Annual Contract for Food Grade Manufacturing

P/TB 2.18 │ Chemicals │ URL

Flexible Solutions International, Inc. (NYSE-AMERICAN: FSI) has announced a new five-year contract with a U.S.-based company for the non-exclusive manufacturing of food-grade products. The agreement, effective January 7, 2025, includes automatic five-year renewals unless either party opts out with six months' notice. The contract is estimated to generate annual revenue between $15 million and $30 million, with production expected to start in approximately six months after necessary cleanroom expansion and equipment installation.

CEO Dan O’Brien highlighted the significance of this deal, which validates the company’s strategic entry into the food-grade manufacturing market. The contract provides a long-term revenue stream and establishes a solid foundation for further growth in this segment. O’Brien also commended the FSI team for their efforts in meeting high-quality standards and customer expectations.

This agreement strengthens FSI's position in the food and nutrition supplement manufacturing market while complementing its existing portfolio of environmentally safe and biodegradable technologies. The company expects the deal to contribute significantly to its financial performance in the coming years.

Friedman Industries (FRD) – Insider Purchase

P/TB 0.75 │ Steel │ URL

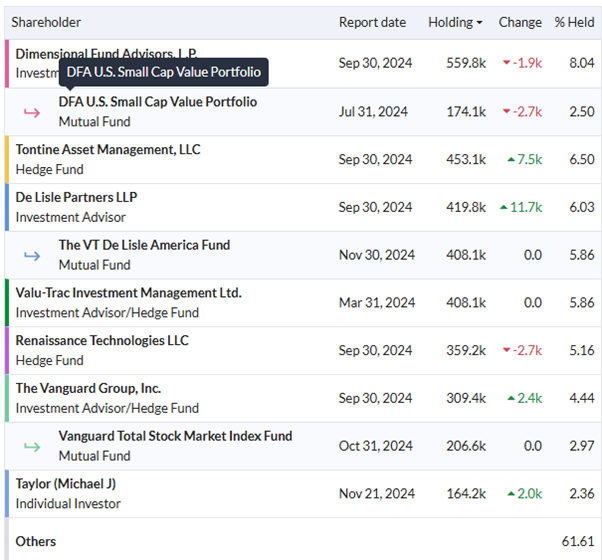

M. J. Taylor bought another 2.5k shares last week at $14.50. Taylor has a good history of buy transactions and has averaged a one-year return of 43% over the 24 transactions (which has one year data) he has done since 2019.

Hurco Companies (HURC) – 4Q24, New SA Analysis & Mentioned on X

P/TB 0.59 │ Machine Tools │ URL

During fiscal year 2024, Hurco reported revenues of $186.6m, an 18% decline from $227.8m in 2023. This was primarily due to reduced shipments across key markets, including the Americas, Germany, and China. The company also reported a net loss of $16.6m, a sharp contrast to the $4.4m net income achieved in 2023. The loss was compounded by an $8.6m non-cash tax valuation allowance. Economic uncertainty and the cyclical nature of the machine tool industry were significant contributors to the weaker financial performance.

Innovation remains a cornerstone of Hurco's strategy. In 2024, the company enhanced its proprietary WinMax® software and introduced new high-speed spindles for improved precision and productivity. Updates to multi-axis machine lines and the development of automation solutions underscore Hurco's commitment to addressing evolving customer needs, particularly in complex manufacturing environments. These advancements aim to strengthen the company’s competitive edge in a rapidly changing industry.

Hurco faces several challenges, including global economic headwinds, geopolitical tensions, and supply chain disruptions. With 61% of its revenues derived from international markets, the company is exposed to risks related to fluctuating currency rates and economic instability in Europe and Asia-Pacific. Moreover, Hurco’s reliance on manufacturing facilities in Taiwan and China makes it vulnerable to potential geopolitical conflicts in these regions, which could disrupt operations and impact financial results.

Despite these challenges, Hurco remains focused on long-term growth and market diversification. The company aims to strengthen its product portfolio by integrating advanced automation technologies and intelligent manufacturing solutions. Strategic acquisitions and enhanced customer relationships are central to its approach, as it seeks to navigate the cyclical nature of the machine tool industry while maintaining a strong position in global markets.

Stephen Simpson also published a write-up on Seeking Alpha and there was a discussion on X.

Natural Alternatives International (NAII) – Discussion on X

P/TB 0.33 │ Nutrition │ URL

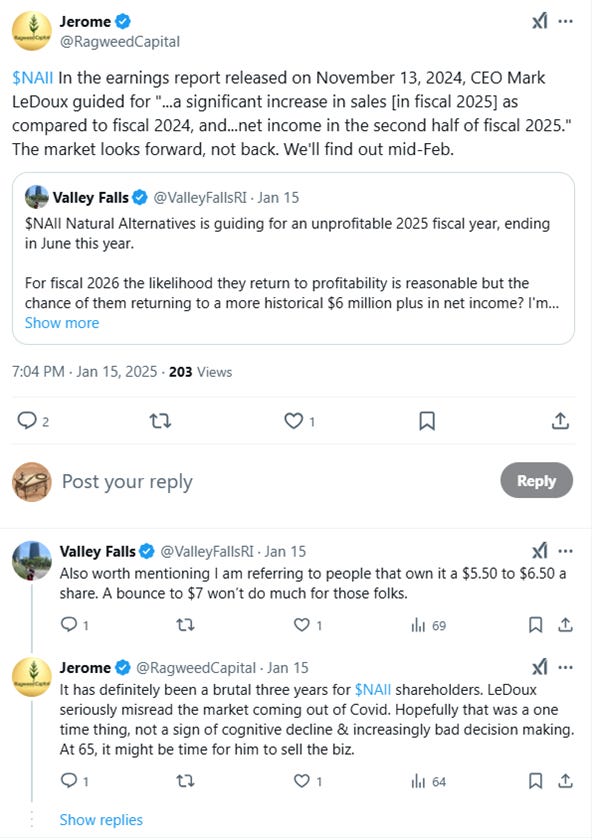

Valley Falls and Jerome had a thread on the company on X.

Key Tronic (KTCC) – Mentioned on X

P/TB 0.36 │ Contract Manufacturing │ URL

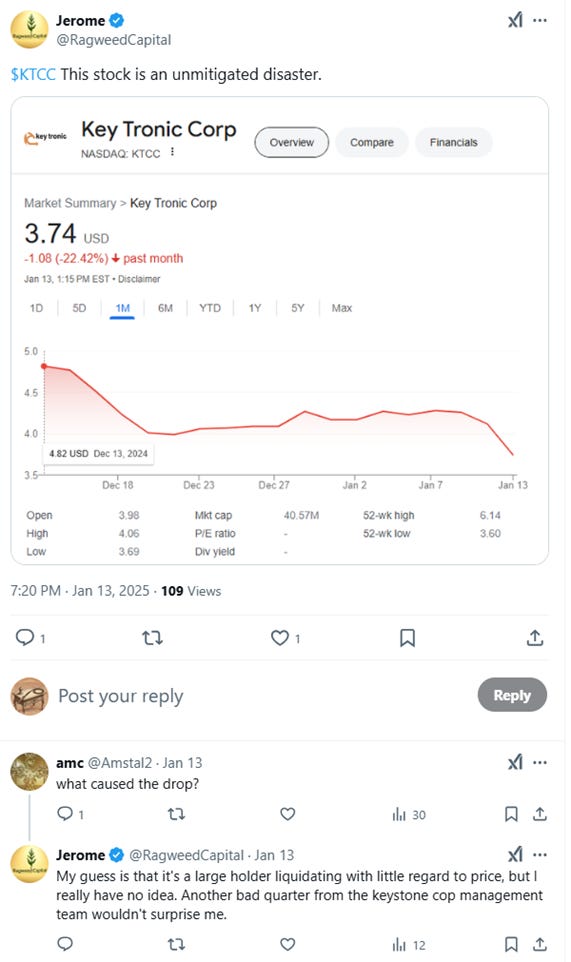

Jerome also shared his thoughts on KTCC.

Jewett-Cameron Trading (JCTC) – 10Q

P/TB 0.67 │ Fencing │ URL

Jewett-Cameron Trading Co. Ltd. reported a net loss of $658,717 for the quarter ended November 30, 2024, compared to net income of $1,291,541 in the same period of 2023. Sales declined by 5% year-over-year to $9.27 million, impacted by inflation, lowered consumer confidence, and higher shipping costs. The Pet, Fencing, and Other segment saw a mixed performance, with fencing product sales increasing by 19%, driven by new in-store display units, while pet product sales dropped by 31%. Gross margins fell to 18.3% due to higher logistics costs and investment in display units.

The company has focused on expanding its product offerings and diversifying its supply chain. Notable initiatives include the launch of Adjust-A-Gate® Unlimited and MyEcoWorld® compostable and recycled products. Strategic partnerships, such as one with Continental Sales & Marketing, aim to enhance distribution and inventory management. Greenwood, the industrial wood products segment, experienced a 26% decline in sales but is realigning resources to target new customer bases beyond transit markets.

Jewett-Cameron ended the quarter with $3.04 million in cash and a strong current ratio of 8.79. Inventory turnover improved compared to the prior year, although pet product demand remained weak. The company has listed its seed facility property for sale, which could generate $9 million, pending re-zoning opportunities. Liquidity remains robust, supported by a $6 million undrawn credit line, as the company prepares for its peak selling season in spring.

Coffee Holding (JVA) – Filed a Lawsuit

P/TB 0.88 │ Coffee │ URL

Coffee Holding Co., a New York-based green coffee trading and roasting company, has filed a lawsuit against Ryaan Logistics Group, a logistics broker based in Prosper, Texas, for breach of contract and negligence. The lawsuit, filed in the United States District Court in Eastern New York on January 10, 2025, alleges that a coffee shipment valued at over $84,000 went missing during transit. The shipment was intended to be transported from Coffee Holding Co.'s facility in La Junta, Colorado, to a United Natural Foods (UNFI) warehouse in Centralia, Washington, in February 2024. Ryaan Logistics was hired to coordinate the shipment with AFC Trucking, a Florida-based trucking company.

According to the complaint, the scheduled AFC Trucking driver missed the pickup due to truck issues, but the shipment was erroneously picked up by a driver from Maya Transportation, whose identity was misrepresented as being part of AFC Trucking. Further investigation revealed that AFC Trucking's web system had been hacked, enabling the fraudulent pickup. The shipment was tracked to warehouses in Santa Ana and Montebello, California, but the trail eventually went cold. Ryaan filed an incident report with the La Junta police but was unable to recover the shipment.

Coffee Holding Co. is accusing Ryaan Logistics of failing to prevent or mitigate the loss of the shipment, citing breach of contract and negligence. The company is seeking damages of at least $84,491.94 plus legal fees. Ryaan Logistics has not commented publicly on the allegations or the lawsuit.

Orbit Garant Drilling (OGD) – Further Buybacks & New Analysis

P/TB 0.49 │ Oilfield Services │ URL

Orbit Garant Drilling bought back another 44.3k shares last week at c$0.82 a share. Also, Rahil Gillani posted a new analysis on the company.

Reko International (REKO) – Further Buybacks

P/TB 0.51 │ Industrial │ URL

During the past week, Reko bought back another 1,300 shares.

Strattec Security (STRT) - Lists local plant for sale at $17M

P/TB 0.80 │ Automotive Security │ URL

Milwaukee business journal mentioned this sale. Unfortunately behind paywall.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.