Companies mentioned:

· Alico (ALCO) – In Perritt Letter

· Flexible Solutions International (FSI) - Shareholder Meeting Outcomes and Key Approvals

· Fonar (FONR) – Discussion on X

· Jewett-Cameron Trading (JCTC) – Mentioned on X

· Key Tronic Corp (KTCC) – Mentioned on X

· Natural Alternatives International (NAII) – Mentioned on X

· Tandy Leather Factory (TLF) – New Analysis on Seeking Alpha

· Village Super Market (VLGEA) – New Analysis on Seeking Alpha

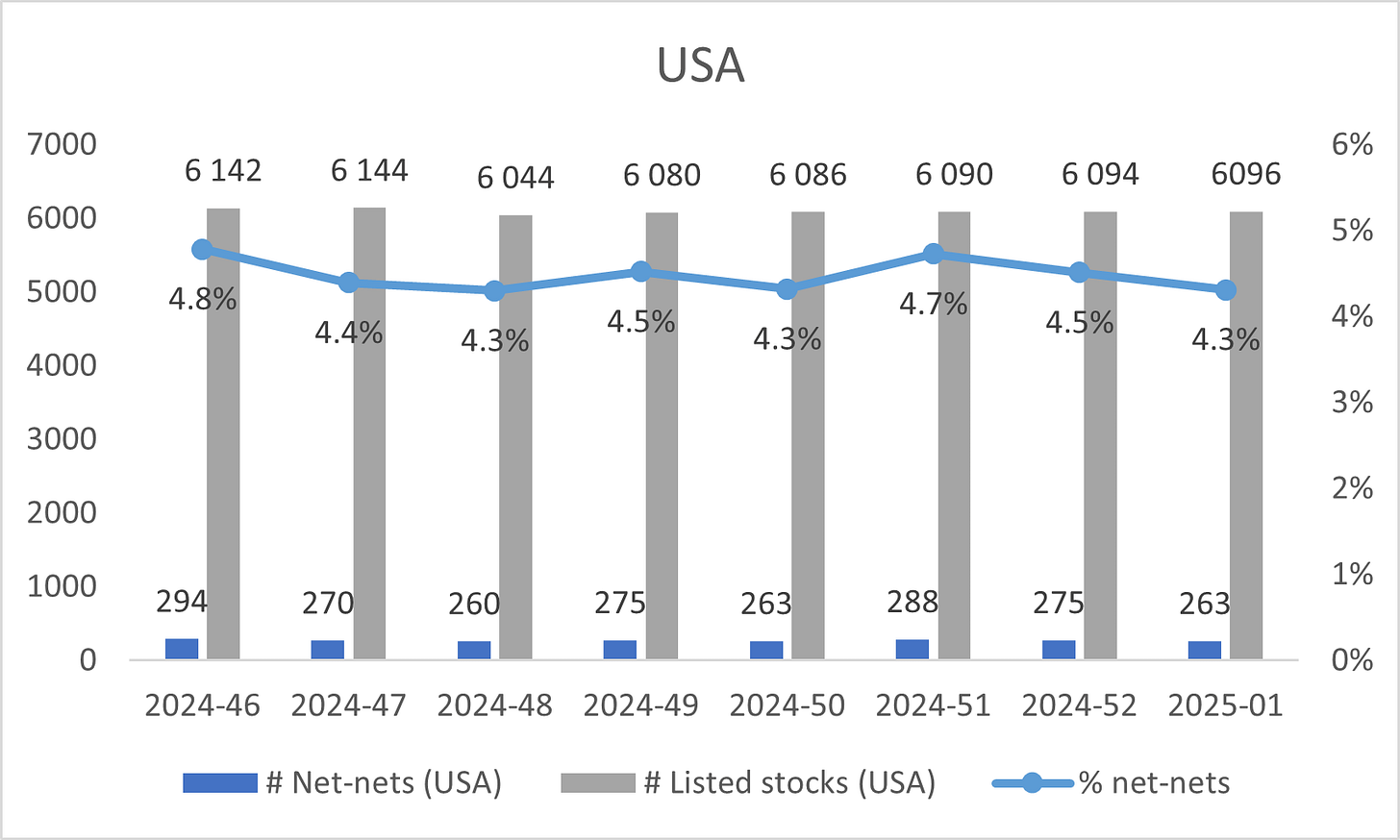

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

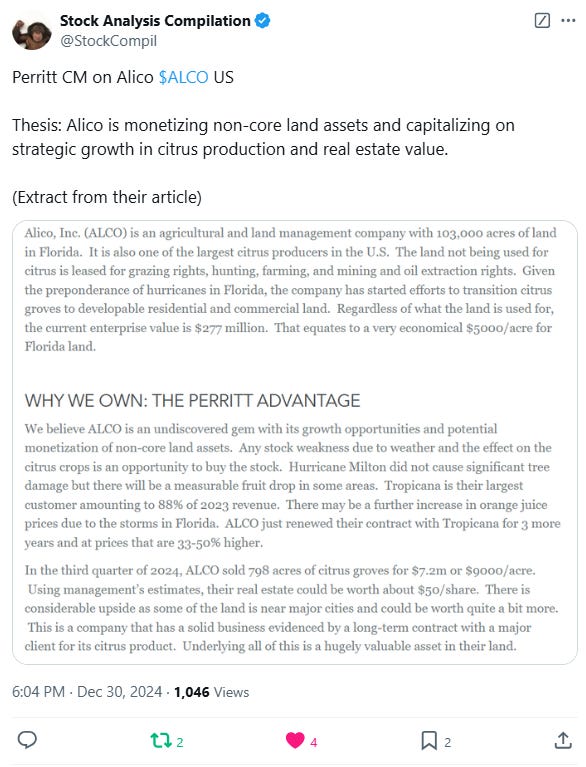

Alico (ALCO) – In Perritt Letter

Discussion │ P/TB 0.80 │ Agriculture │ URL

Flexible Solutions International (FSI) - Reports Shareholder Meeting Outcomes and Key Approvals

AGM Result │ P/TB 1.39 │ Specilaity Chemicals │ URL

Flexible Solutions International, Inc. held its annual shareholder meeting on December 30, 2024. All directors up for election—Daniel B. O’Brien, John H. Bientjes, Robert Helina, Thomas Fyles, Ben Seaman, and David Fynn—were unanimously reelected, receiving 4,480,150 votes each without opposition or abstention.

Shareholders approved three key proposals during the meeting. These included an advisory vote endorsing the compensation of executive officers, a non-binding advisory vote on maintaining an annual frequency for executive compensation reviews, and the ratification of Assure CPA, LLC as the company's independent auditor for the fiscal year ending December 31, 2024. All proposals received unanimous approval with no votes against or abstentions. The report was signed by President and CEO Daniel B. O’Brien on December 31, 2024, as part of the company's compliance with the Securities Exchange Act of 1934.

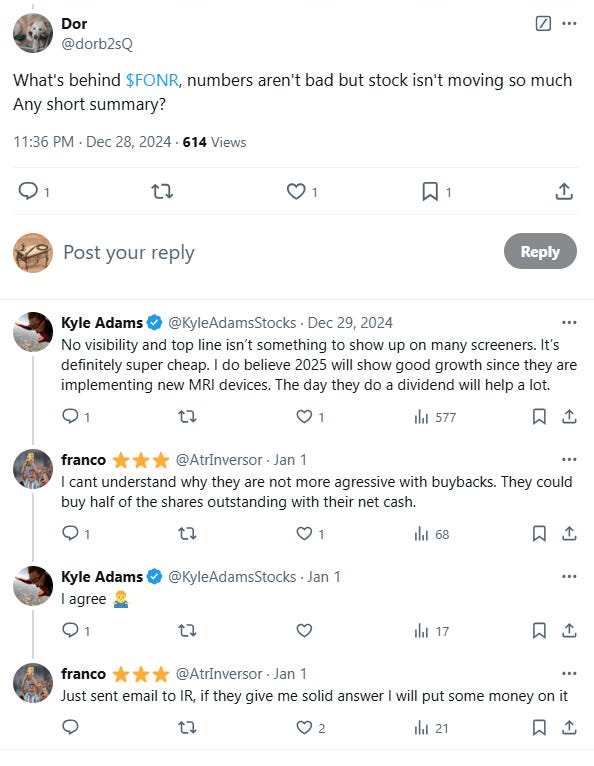

Fonar (FONR) – Discussion on X

Discussion │ P/TB 0.62 │ Healthcare │ URL

Dor shared some thoughts on the company on X.

Jewett-Cameron Trading (JCTC) – Mentioned on X

Discussion │ P/TB 0.66 │ Building Products │ URL

Odd Lot Arbitrageur shared some thoughts on the company on X.

Key Tronic Corp (KTCC) – Mentioned on X

Discussion │ P/TB 0.36 │ Contract Manufacturing │ URL

Jerome shared some interesting thoughts on the recent trading activity on X.

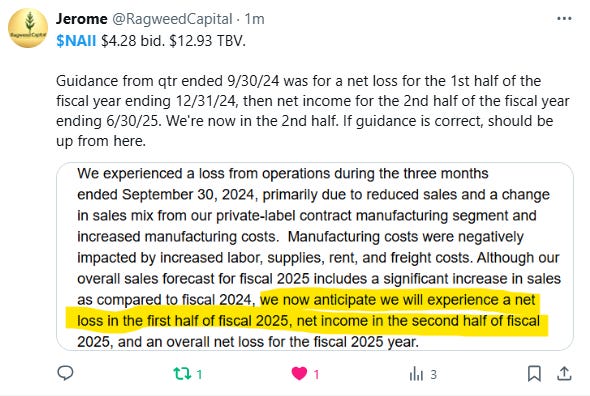

Natural Alternatives International (NAII) – Mentioned on X

Discussion │ P/TB 0.33 │ Nutrition │ URL

Jerome also shared his thoughts on NAII on X. Also, Phenom Capital wrote about the company briefly on Substack.

Seneca Foods (SENEA) - Enters New $450 Million Credit Facility to Support Growth & Mentioned on X

Refinancing │ P/TB 0.91 │ Food Production │ URL / URL

Seneca Foods Corporation, along with its subsidiaries, has entered a new Loan and Security Agreement on December 23, 2024, replacing its prior credit arrangement from 2021. The agreement establishes a senior revolving credit facility of up to $450 million, adjusted seasonally to $400 million. The facility will support various corporate needs, including acquisitions, capital expenditures, and working capital. The agreement introduces enhanced financial flexibility and is secured by the company's non-realty assets, with a maturity date of December 24, 2029.

The new credit agreement imposes customary covenants, including restrictions on additional indebtedness, liens, and dividend payments, and requires compliance with a fixed charge coverage ratio under specific circumstances. The prior credit agreement, terminated in conjunction with the new deal, incurred no early prepayment or termination penalties.

The 2024 Credit Facility, administered by Wells Fargo Bank as agent, replaces the previous agreement led by Bank of America. The company aims to leverage this facility for strategic acquisitions and operational needs, ensuring long-term financial stability.

Tandy Leather Factory (TLF) – New Analysis on Seeking Alpha

Analysis │ P/TB 0.70 │ Leather Retail │ URL

Published by Art of Stock Investing.

Village Super Market (VLGEA) – New Analysis on Seeking Alpha

Analysis │ P/TB 1.09 │ Food Retailer │ URL

Published by Thomas Niel.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.