The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Companies mentioned:

· Alico (ALCO)

· Asia Pacific & Cable (APWC)

· Flexible Solutions International (FSI)

· Fonar (FONR)

· Key Tronic Corp. (KTCC)

· Natural Alternatives (NAII)

· Orbit Garant Drilling (OGD)

· Reko International (REKO)

· Seneca Foods (SENEA)

· Strattec Security (STRT)

· Village Super Markets (VLGEA)

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive.

Below is this week’s net-net screen from Stockopedia. Note though that today’s net-nets are not the same as Graham’s net-nets. We view most of these as un-investable being Chinese RTO’s, loss-making biopharma’s etc. There are likely also quite a few false positives in the number below, being pink sheet with aged financials or de-listed companies still within Stockopedia’s database. The same goes for Canada, several being seldom traded cash boxes with market caps of a few hundred thousand dollars.

But even though we would not touch most of today’s crop with a ten-foot pole we think it could be interesting to follow this raw number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable.

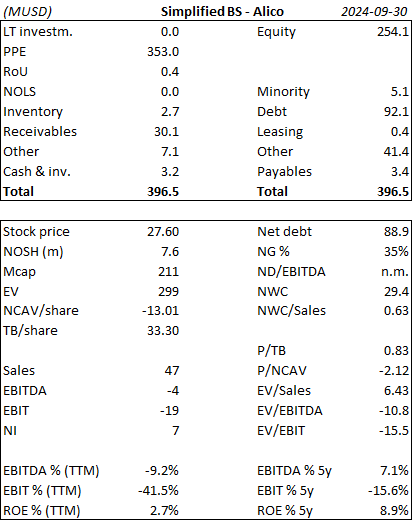

Alico – 4Q23/24

ALCO │ New Report │ P/TB 0.85 │ Food & Nutrition │ URL / URL

ALCO reported a fiscal year 2024 net income of $7.0 million ($1.8 million), largely driven by $81.4 million in gains from land sales, including a significant sale of 17,229 acres of Alico Ranch. However, inventory impairments of $19.5 million for the 2024-2025 citrus harvest offset these gains. Adjusted EBITDA for the fiscal year was negative at $(3.8) million, improving from $(16.1) million in 2023. Total revenue grew 17.1% year-on-year to $46.6 million, driven by an increase in citrus sales and higher prices per pound solids.

The citrus division faced a 14.7% production increase in 2024, slightly exceeding industry growth. However, Hurricane Milton caused fruit drop in northern groves, creating uncertainty for the upcoming 2024-2025 harvest.

Despite challenges such as Hurricane Milton and citrus greening, Alico's management expressed optimism about future profitability. Strategic moves, including securing higher-priced contracts, reducing debt, and focusing on land management initiatives, aim to strengthen the company's operational and financial performance in the coming years.

In land management, Alico advanced entitlement projects for its 4,500-acre Collier County property while evaluating other holdings for potential sales. These initiatives align with the company’s strategy to maximize the long-term value of its real estate portfolio. Management reiterated their commitment to providing shareholder returns through active land management and stable agricultural operations.

Looking ahead, Alico plans to capitalize on higher citrus pricing, continue improving operational efficiencies, and explore strategic real estate opportunities. Despite weather-related setbacks, the company remains optimistic about leveraging its assets to create sustained shareholder value.

Mikro Kap David also shared his take on the report on X.

Asia Pacific Wire & Cable - Revenue growth despite regional challenges

APWC │ New Report │ P/TB 0.19 │ Wire & Cables │ URL

APWC reported a 14.4% increase in revenues to $336.6 million for the first nine months of 2024, driven by growth in all regional markets. Thailand contributed a 14.7% rise in revenue, supported by strong demand for power cables and government contracts earlier in the year, though momentum slowed in Q3 due to economic headwinds. North Asia saw a 17.8% revenue increase from higher copper prices, new customers, and expanded product offerings such as rectangular wires and drone motor wires. The Rest of World (ROW) segment grew 13.1%, fueled by strong demand for power cables in Singapore.

EBIT surged to $4.5m from $0.1m in 2023, reflecting improved profitability in the Thailand public sector. Margins improved in Thailand from -3.78% to 2.85% but contracted in North Asia due to higher R&D expenses and reversals of pension provisions from the prior year. The ROW segment also saw a margin decline, impacted by provisions for onerous contracts in Singapore. Despite these gains, net income declined by 19.5% to $0.9 million, affected by higher administrative costs and regional operating challenges.

Flexible Solutions International Announces Change in Auditors & DEF 14A

FSI │ Change in Auditor │ P/TB 1.48 │ Specialty Chemicals │ URL / URL

FSI filed an 8-K report on December 3, 2024, detailing a change in its independent registered public accounting firm. Smythe LLP, the company’s previous auditors, resigned on November 14, 2024, following their decision to cease auditing public entities. There were no disagreements or reportable events with Smythe during their tenure. On November 23, 2024, FSI engaged Assure CPA, LLC, based in Spokane, WA, as their new auditors starting with the fiscal year ending December 31, 2024. Assure CPA had no prior consultation with FSI regarding accounting principles, audit opinions, or any reportable events before their appointment.

FSI has announced its annual shareholders' meeting scheduled for December 30, 2024, in Grand Cayman, Cayman Islands. The agenda includes the election of the board of directors for the upcoming year, advisory votes on executive compensation and its review frequency, and the ratification of Assure CPA, LLC as the company’s independent auditor for fiscal year 2024. December 2, 2024, has been set as the record date for voting eligibility, with 12.46 million outstanding shares eligible to vote. Key proposals include retaining the current six-member board, chaired by CEO Daniel B. O’Brien.

Fonar – New Seeking Alpha analysis

FONR │ Analysis │ P/TB 0.65 │ Healthcare │ URL

Assets Remain Too Cheap To Pass Up by Individual Trader.

Key Tronic - Updates by-laws and reports annual shareholders’ meeting results & Refinancing

KTCC │ AGM & Refinancing │ P/TB 0.47 │ Contract Manufacturing │ URL / URL

KTCC filed an 8-K report detailing amendments to its By-Laws and summarizing outcomes from its Annual Shareholders’ Meeting held on November 25, 2024. The updated By-Laws aim to modernize governance, including changes to the advance notice requirements for shareholder proposals and director nominations, clarifying the Board’s authority to evaluate these proposals. Shareholders must now submit proposals for the 2025 meeting between July 28 and August 27, 2025.

Key votes from the Annual Meeting included the re-election of all nominated directors, approval of executive compensation, ratification of Moss Adams LLP as the independent auditor for FY 2025, and adoption of the 2024 Incentive Plan. Each proposal received a majority vote in favor.

KTCC has entered into two significant financing agreements to strengthen its financial position and replace prior credit facilities. On December 3, 2024, the company executed a new senior secured revolving credit facility agreement for $115m, maturing on December 3, 2029. As of December 4, 2024, approximately $75m of this facility was utilized. Interest rates for SOFR loans are set at Adjusted Term SOFR plus 2.50–3.00%, while Base Rate loans are set at Base Rate plus 1.50–2.00%, depending on the available borrowing base. In the event of default, the interest rate increases by 2.00%.

Simultaneously, KTCC entered into a $28m term loan agreement with the same maturity date. The loan will be repaid in quarterly installments of $0.75m, with the remainder due at maturity. The interest rate for the term loan is Adjusted Term SOFR plus 7.15%, with a floor of 3.50%. The company must maintain a 12-month trailing EBITDA that increases from $14.3m to $25.8m over the loan term. There is also an option to request incremental funding of up to $5m in two tranches, subject to lender approval.

The new credit facilities are being used to refinance previous loans, including a credit facility with Bank of America and an equipment term loan, as well as to cover costs related to the new agreements and other business purposes.

Natural Alternatives International – Thread on X

NAII │ Discussion │ P/TB 0.33 │ Nutrition │

Valley Falls shared some thoughts on NAII on X.

Orbit Garant Drilling – Management changes

OGD │ Management Change │ P/TB 0.51 │ Mine & Oilfield Services │ URL

OGD announced significant senior management changes following its Annual and Special Meeting of Shareholders held on December 5, 2024. Pierre Alexandre has stepped down as President and CEO but will remain on the BOD and assume his previous position as Executive Vice President. Daniel Maheu, previously the CFO, has been appointed as the new President and CEO and was also elected as a director during the meeting. In turn, Pier-Luc Laplante, formerly the Corporate Controller, has been promoted to CFO, succeeding Maheu.

The company also announced that André Pagé has been appointed Chair of the Board, succeeding Jean-Yves Laliberté, who served as Chair since 2020 and as a board member since 2008. Pagé, who joined the board in May 2024, brings over 30 years of experience in capital markets, including his tenure as Managing Director at Desjardins Capital Markets.

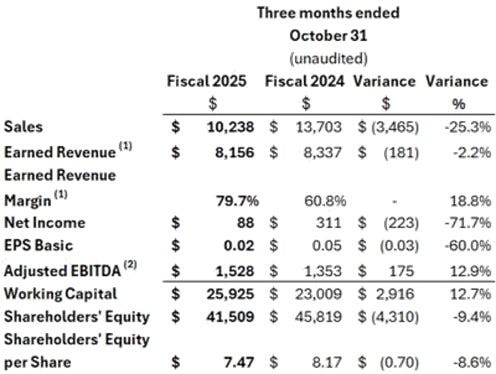

Reko International – 1Q24/25

REKO │ New Report │ P/TB 0.40 │ Injection Moulding │ URL

For the quarter, the company reported sales of c$10.2m (c$13.7m) and EBIT of c$374k (c$24k), corresponding to an EBIT margin of 3.7% (0.2%). Gross profit margin improved to 19.5% from 14.4% in the same period last year, driven by higher earned revenue margins and favorable project execution.

The company repurchased and canceled 3,000 shares during the quarter under its normal course issuer bid, reflecting shareholder value initiatives. This is a positive since the company has been pausing its buyback program for quite a few quarters now.

Seneca Foods – Discussions on X

SENEA │ Discussion │ P/TB 0.84 │ Food Production │ URL

Ansh Patel & RFortunae had a discussion on SENEA on X.

Strattec Security – Gamco sells more

STRT │ Insider Selling │ P/TB 0.84 │ Automotive Security │ URL

On December 3, 2024, GAMCO (or one of its subsidiaries) sold 500 shares at a price of $41.779 per share. But it is very recently that GAMCO has started selling some STRT shares, and this far in quite small volumes.

(13f.info)

Village Super Market – 1Q24/25

VLGEA │ New Report │ P/TB 1.10 │ Food Stores │ URL

VLGEA. reported a 4% sales increase for Q1 fiscal year 2025, reaching $557.7m. Same-store sales rose by 2.4%, driven by higher digital and pharmacy sales, as well as growth in remodeled locations. Net income increased 11% year-over-year to $12.m, reflecting operational improvements and strategic focus. Gross profit margins improved to 29.0% (from 28.5%) due to higher patronage dividends, rebates, and optimized departmental margins. Operating expenses as a percentage of sales increased slightly to 24.7%, attributed to wage growth and digital expansion costs, but partially offset by fixed cost efficiencies.

Village continues strategic investments, budgeting $75m for fiscal year 2025, with a focus on store replacements, technology, and efficiency upgrades.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.