The Deep Value Week – 2024/48

A few DV names mentioned on X as "low downside ideas for 2025", a plant closure and some insider transactions.

The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Companies mentioned:

· Alico (ALCO)

· Bridgeford Foods (BRID)

· Charles & Colvard (CTHR)

· Friedman Industries (FRD)

· Jewett-Cameron Trading (JCTC)

· Natural Alternatives (NAII)

· Nortech Systems (NSYS)

· Seneca Foods (SENEA)

· Strattec Security (STRT)

Benjamin Graham famously suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. The prevalence of net-nets serves as a barometer for market valuation. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive.

Below is this week’s net-net screen from Stockopedia. Note though that today’s net-nets are not the same as Graham’s net-nets. We view most of these as un-investable being Chinese RTO’s, loss-making biopharma’s etc. There are likely also quite a few false positives in the number below, being pink sheet with aged financials or de-listed companies still within Stockopedia’s database. The same goes for Canada, several being seldom traded cash boxes with market caps of a few hundred thousand dollars.

But even though we would not touch most of today’s crop with a ten-foot pole we think it could be interesting to follow this raw number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Each week, we plan to hold “Graham’s Geiger counter” over our markets.

Alico – “Favorite low downside risk idea heading into 2025”

ALCO │ Discussion │ P/TB 0.77 │ Food & Nutrition │ URL

Alico was mentioned in an X thread by Colin King and Tintin Capital.

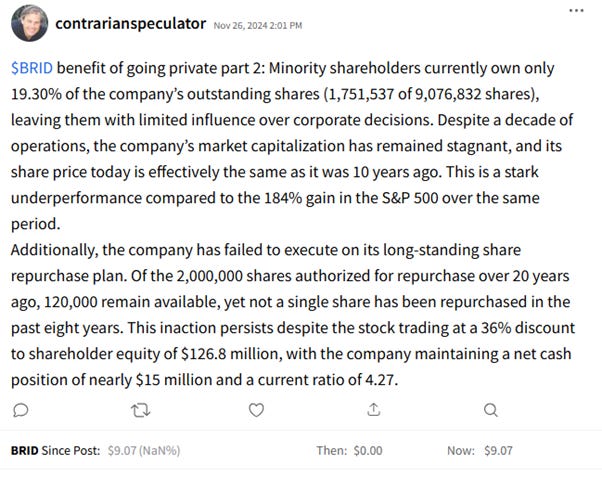

Bridgford Foods – Contrarianspeculator on benefits of going private

BRID │ Discussion │ P/TB 0.65 │ Food & Nutrition │ URL

Contrarianspeculator on Stocktwits had a good thread on the benefits of going private. See below. This rationale could be applied to quite a few of the deep value names we are following.

Charles & Colvard - Faces Nasdaq non-compliance due to delayed financial filings

CTHR │ Breach │ P/TB 0.12 │ Consumer Goods │ URL

CTHR announced it has - again - received a notice from Nasdaq for non-compliance with listing rule 5250(c)(1), following delays in filing its Form 10-Q for the quarter ending September 30, 2024, and Form 10-K for the fiscal year ending June 30, 2024. The notification gives CTHR until December 17, 2024, to either file the missing forms or submit a compliance plan. If the plan is accepted, the company may have until April 14, 2025, to resolve the issue.

Friedman Industries – Insider purchases

FRD │ Insider Buy │ P/TB 0.82 │ Steel Processing │ URL / URL

Director Max Alan Reichenthal purchased 2k shares of FRD stock at a price of $13.72 per share on November 20, 2024. This brings his total ownership to 32.8k shares (0.5%). Mike J. Taylor, President, CEO, and Director, also reported the purchase of 2k shares of the company’s stock on November 21, 2024, at a price of $13.50 per share. This transaction increases Taylor's ownership to 164.2k shares (2.4%). This year, insiders have been quite active picking up shares in the market.

Also, this week a new analysis of the company was posted on Seeking Alpha - Friedman's Q2 2024 Is An Unusual Peek Into Its True Profitability, And It's Not Great.

Jewett-Cameron Trading - “Favorite low downside risk idea heading into 2025”

JCTC │ Discussion │ P/TB 0.61 │ Building Products │ URL

Impatient Value Guy chose JCTC as his favorite low downside risk case.

Natural Alternatives International – A back-of-the-envelope on X

NAII │ Discussion │ P/TB 0.36 │ Nutrition │ URL

Lani shared some short thoughts on NAII on X.

Nortech Systems - Extends milaca lease to 2030, secures expansion and renewal options

NSYS │ Refinancing │ P/TB 0.91 │ Contract Manufacturing │ URL

NSYS has extended its lease for the Milaca, Minnesota facility to June 30, 2030. The amended lease includes an option for a five-year renewal and sets a rental rate of $5 per square foot, equating to an annual rent of $100k, paid in equal monthly installments.

The lease amendment also provides NSYS with an expansion option, enabling the company to increase the facility’s space by 5,000 square feet, up to a total of 25,000 square feet. The landlord will handle construction costs, which will be reflected in adjusted rent payments. Financial incentives, such as tax benefits, may further support this expansion.

Seneca Foods - Lakeside foods to acquire smith frozen foods and closes plant

SENEA │ Acquisition │ P/TB 0.83 │ Food │ URL

Harris Perlman posted this interesting bit on SENEA this week. Lakeside Foods, based in Manitowoc, WI, announced its plan to acquire the business assets of Smith Frozen Foods, a company headquartered in Oregon. The acquisition, expected to close next week, includes Smith’s production facilities in Weston, OR, and Garrett Packing/Brittany Farms in Milton-Freewater, OR. These facilities will continue producing frozen vegetables, bolstering Lakeside Foods’ presence in the frozen vegetable market.

The deal positions Lakeside Foods to expand its product base and strengthen its service to retail, foodservice, and industrial customers, particularly on the West Coast. Smith Frozen Foods' facilities bring additional storage capacity and unique production capabilities that align with Lakeside’s growth strategy. Smith Frozen Foods President Gary Crowder will oversee the transition, and a significant number of Smith employees are expected to remain with Lakeside Foods post-acquisition.

As part of its strategic plan, Lakeside Foods will discontinue operations at its Manitowoc, WI, Jay Street production facility while retaining its corporate headquarters and other local operations. The company is supporting affected employees by providing opportunities at other locations, ensuring minimal disruption as it focuses on long-term growth.

Strattec Security – Insider selling

STRT │ Insider Sell │ P/TB 0.84 │ Automotive Parts │ URL / URL

David R. Zimmer, a director of STRT, filed a Form 144 on November 25, 2024, indicating his intent to sell 5k shares of the company's common stock. The proposed sale, valued at $210k, was scheduled for November 25, 2024, on the NASDAQ exchange. Zimmer made prior sales of 1k shares on November 21, 2024, for $43.1k.

GAMCO Investors, Inc. and related entities, led by Mario J. Gabelli, filed an amended Schedule 13D on November 29, 2024, reflecting their updated beneficial ownership. The group collectively holds 762,396 shares, representing 18.59% (down from 18.73%).

Other

Like last week, an interesting graph on the valuation discrepancies between the US markets and the European markets.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.