The Deep Value Week – 2024/47

Sleepy deep value week in America, surprising (positive) RE valuation at JCTC and some new analysis on companies followed.

The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Companies mentioned:

· Alico (ALCO)

· Asia Pacific Wire & Cable (APWC)

· Chicago Rivet & Machine (CVR)

· Friedman Industries (FRD)

· Jewett-Cameron Trading (JCTC)

· Nacco Industries (NC)

· Natural Alternatives (NAII)

· Seneca Foods (SENEA)

· Strattec Security (STRT)

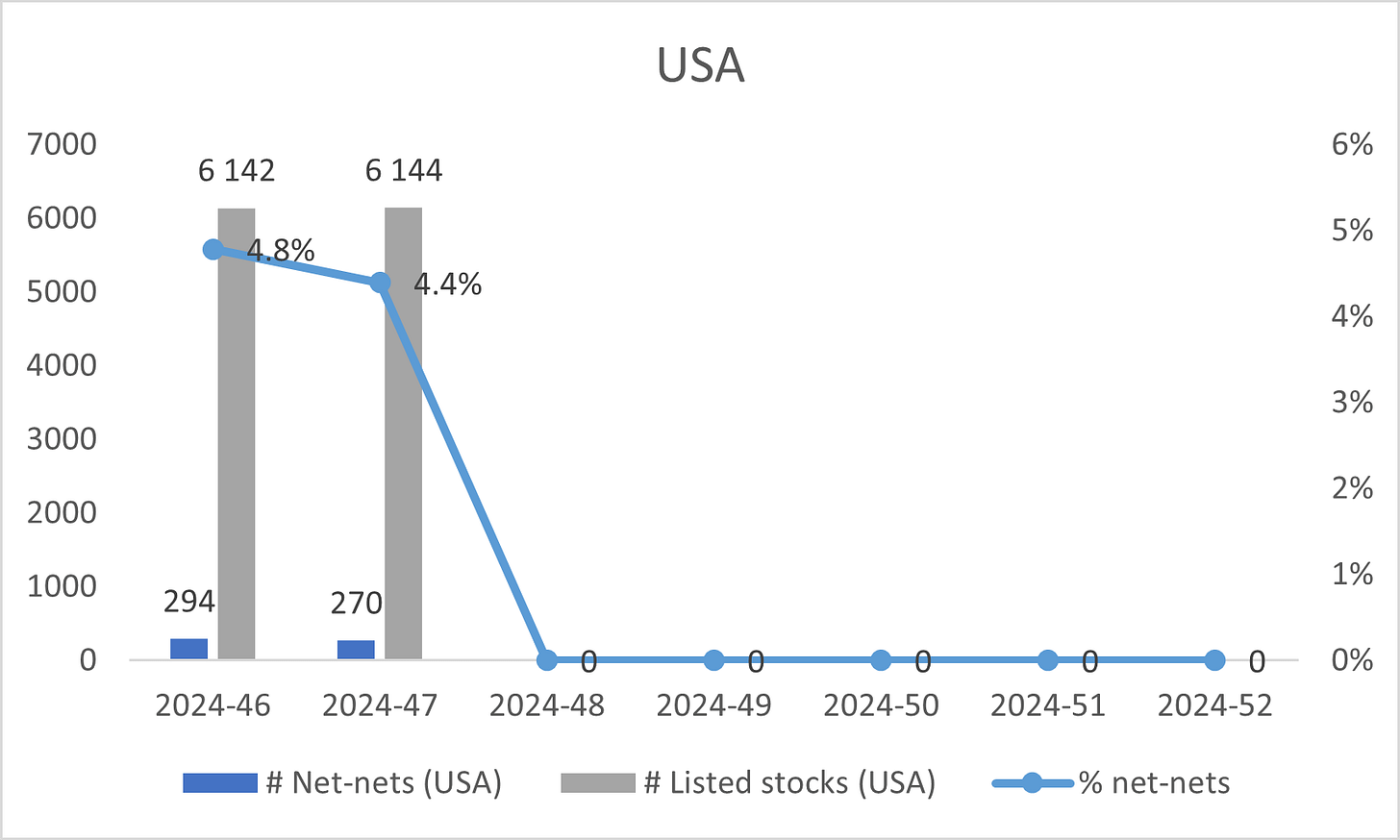

Benjamin Graham famously suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. The prevalence of net-nets serves as a barometer for market valuation. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive.

Below is this week’s net-net screen from Stockopedia. Note though that today’s net-nets are not the same as Graham’s net-nets. We view most of these as un-investable being Chinese RTO’s, loss-making biopharma’s etc. There are likely also quite a few false positives in the number below, being pink sheet with aged financials or de-listed companies still within Stockopedia’s database. The same goes for Canada, several being seldom traded cash boxes with market caps of a few hundred thousand dollars.

But even though we would not touch most of today’s crop with a ten-foot pole we think it could be interesting to follow this raw number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Each week, we plan to hold “Graham’s Geiger counter” over our markets.

Alico – Miko Kap David’s on two recent transactions in the area

ALCO │ Analyst │ P/TB 0.70 │ Food │ URL

Mikro Kap David shared the following and highly interesting discrepancy between recent land transactions and Alico’s holdings and what they are carried at. The question – as always within deep value – is just when and how the values will be realized.

Asia Pacific Wire & Cable - Leadership transition

APWC │ Management Change │ P/TB 0.27│ Wire & Cable │ URL

APWC is a Bermuda-based company that, through its subsidiaries, manufactures and distributes telecommunications and power cables, enameled wires, and electronic cables primarily in Thailand, China, Singapore, and Australia. The company announced the resignation of CFO Ivan Hsia, effective November 25, 2024. James Lu, currently the Deputy CFO, has been appointed as acting CFO with immediate effect. An executive search for a permanent CFO is underway. Hsia was with the company for 11 years.

Chicago Rivet & Machine – Cuts dividend to $0.03 ($0.10)

CVR │ Dividend Change │ P/TB 0.75 │ Fasteners │ URL

CVR is a manufacturer specializing in rivets, cold-formed fasteners, and automatic rivet setting machines, primarily serving the automotive industry. The company announced a quarterly cash dividend of $0.03 per share (0.65% yield on a yearly basis), marking a significant reduction from the previous $0.10 per share. The Board of Directors attributed the dividend reduction to macroeconomic headwinds, notably a sharp decline in demand from automotive customers. While this downturn is viewed as temporary, the impact is expected to extend into 2025. The company has responded with cost-cutting measures, including the consolidation of operations in Iowa and Pennsylvania, and strategic price adjustments with customers, yielding year-over-year improvements. CVR has paid a dividend for 90+ years so there is likely some sort of “do not want to break the stretch” bias behind the decision to keep a tiny dividend going forward.

Friedman Industries – Insider purchases

FRD │ Insider Buy │ P/TB 0.82 │ Steel and processing │ URL / URL

FRD operates in the steel industry, focusing on rolling and finishing mills. On November 19, 2024, Sharon L. Taylor, a director of FRD, acquired 700 shares of common stock at a price of $13.85 per share. Following this transaction, Taylor now holds a total of 6,741 shares directly. On November 20, 2024, Max Alan Reichenthal, another director, acquired 2,000 shares of common stock at a price of $13.72 per share. Following this transaction, Reichenthal now holds a total of 32,761 shares directly (0.50%). During 2024, there has been quite some insider purchases.

Jewett-Cameron Trading – 10Q & Lists property for $9m ($0.6m in books)

AWX │ Real Estate Sell │ P/TB 0.62 │ Diversified │ URL / URL / URL

JCTC distributes specialty metal and pet products and wholesales wood products. The company announced its fiscal 2024 financial results, reporting a full-year revenue decline of 13.3% to $47.1m from $54.3m in 2023. The decrease was driven by the exit from seed cleaning operations, reduced pet product sales, and lower-margin wood fence products, offset partly by growth in higher-margin metal fence products and industrial wood operations. Gross margins fell to 18.8% (22.6) for the year, impacted by higher inventory costs and shipping volatility, though the company anticipates improvement in fiscal 2025 from cost-cutting initiatives.

Key operational achievements included expanding the distribution of the Lifetime Steel Post® product to over 100 stores, partnering with Continental Sales & Marketing for broader retail penetration, and diversifying supply chains to mitigate tariff impacts. Additionally, the company listed a non-core property for sale at $9m (which is carried in the books for $0.6m (!)).

For 4Q23/24 sales decreased by 9.6% to $13.2m ($14.6m). Gross profit was $1.9m ($3.1m), corresponding to a gross margin of 14.4% (23.5%). EBIT was -$0.3m ($0.4m), corresponding to an EBIT margin of -2.3% (2.7%). Despite a 4Q23/24 net loss of $0.2m, JCTC reported a full-year net income of $0.7m, however, supported by a one-time $2.45m settlement from a legal dispute. Operationally, JCTC reduced its inventory by 33% year-over-year, improving working capital, and implemented a multi-source supply chain strategy to mitigate tariff risks and increase operational resilience. DIO is continuing to decrease, which is positive given the long-time covid hangover the company has had.

Looking ahead, the company expects profitability improvements in fiscal 2025, driven by cost reduction initiatives, optimized product placement, and ongoing expansion in high-margin product categories.

Nacco Industries - Dividend

NC │ Dividend │ P/TB 0.60 │ Energy │ URL

NC engaged in natural resources, operating through segments such as Coal Mining, North American Mining, and Minerals Management. The company announced a regular quarterly cash dividend of $0.2275 per share (2.8% yield on a yearly basis), payable on December 16, 2024, to shareholders of record as of December 2, 2024. The company remains focused on its strategic growth within the natural resources sector, emphasizing its robust portfolio that spans aggregates, minerals, fuels, and environmental solutions. Through its NACCO Natural Resources businesses, the company continues to address the demand for reliable resources while exploring opportunities for innovation and expansion in its core markets.

Natural Alternatives International – In DeepValueStonks portfolio

NAII │ Analysis │ P/TB 0.33 │ Nutrition │ URL

NAII is a leading formulator and manufacturer of customized nutritional supplements. DeepValueStonks shared some of his thoughts on NAII this was week – well worth a read.

Seneca – “Cautious Buy Story” & write-up on Value Degen

SENEA │ Analysis │ P/TB 0.84 │ Food Processing │ URL / URL

SENEA is a food processor and distributor specializing in canned and frozen fruits and vegetables, as well as snacks. A new analysis on Seeking Alpha - Seneca Foods Corporation: Cautious Buy Story as well as on the Value Degen substack.

Strattec Security – Insider selling

STRT │ Insider Sell │ P/TB 0.85 │ Automotive Parts │ URL / URL / URL

STRT specializes in motor vehicle parts and accessories, operating within the consumer cyclicals sector. On November 20, 2024, David R. Zimmer, a director of STRT, filed a Form 144 indicating his intention to sell 1,050 shares of common stock at an aggregate market value of $42.5k.

The same day, Associated Capital Group, Inc., along with other entities under the GAMCO Investors umbrella, filed a Form 4 disclosing the sale of 200 shares of STRT at a price of $40.50 per share on November 19, 2024.

On November 21, 2024, Chey Becker-Varto, Senior Vice President and Chief Commercial Officer, filed Form 3 to disclose her initial statement of beneficial ownership upon assuming her role as an officer of the company. The filing, which pertains to the period ending November 11, 2024, indicates that no securities are currently beneficially owned by Becker-Varto.

Other

Brandon Beylo shared an interesting graph on X the other day. The US markets has been really strong lately and looking at a longer perspective we seem to now be in extreme territory.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.