The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Companies mentioned:

· Alico (ALCO)

· Avalon Holdings (AWX)

· AXT Inc (AXT)

· Chicago Rivet & Machine (CVR)

· Charles & Colvard (CTHR)

· Deswell Industries (DSWL)

· FSI International (FSI)

· Fonar (FONR)

· Hurco Companies (HURC)

· Jerash Holdings (JRSH)

· Coffee Holding (JVA)

· Key Tronic (KTCC)

· Emerson Radio (MSN)

· Natural Alternatives (NAII)

· Seneca Foods (SENEA)

· Sigmatron International (SGMA)

· Sunlink Health Systems (SSY)

· Strattec Security (STRT)

· Tandy Leather Factory (TLF)

New for this week is an experiment to follow the number of net-nets available, inspired by Benjamin Graham. Benjamin Graham famously suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. The prevalence of net-nets serves as a barometer for market valuation. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive.

Below is this week’s net-net screen from Stockopedia. Note though that today’s net-nets are not the same as Graham’s net-nets. We view most of these as un-investable being Chinese RTO’s, loss-making biopharma’s etc. There are likely also quite a few false positives in the number below, being pink sheet with aged financials or de-listed companies still within Stockopedia’s database. The same goes for Canada, several being seldom traded cash boxes with market caps of a few hundred thousand dollars.

But even though we would not touch most of today’s crop with a ten-foot pole we think it could be interesting to follow this raw number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make then investable.

Alico – Miko Kap David’s take on their latest presentation

ALCO │ Analyst │ P/TB 0.70 │ Food │ URL

Mikro Kap David shared his thoughts on Alico’s latest presentation at the Sidoti Micro Cap Conference.

Avalon Holdings – Nanocap100index quizzes on AWX

AWX │ Discussions │ P/TB 0.35 │ Waste Management & Leisure │

The seldom mentioned AWX were the subject of a quiz by nanocap100index. AWX provides waste management services and operates golf courses and related facilities. The company recently released a surprisingly strong quarterly report. We have previously written about the psychiatrist Nalluri’s 25 years of shareholding increases.

AXT Inc – 3Q24 & Form 4

AXTI │ New Report │ P/TB 0.42 │ Material Science│ URL

AXTI is a materials science company that develops and manufactures high-performance compound and single-element semiconductor wafer substrates, including indium phosphide (InP), gallium arsenide (GaAs), and germanium (Ge). AXTI reported a revenue increase to $23.6m for Q3 2024, up from $17.4m in the same period last year. Gross profit amounted to $5.7m, a strong improvement compared to $1.9m in the prior year. However, the company reported a net loss of $2.9m, an improvement from the $6.4m loss recorded in the same period last year. The company’s operating expenses rose slightly to $9.1m, compared to $8.6m for Q3 2023, primarily due to increased spending on research and development.

On November 11, 2024, AXT Inc. announced two transactions involving changes in common stock ownership. The company's CFO, Gary L. Fischer, was granted 38,800 shares as part of an incentive program, increasing his total holdings to 426,074 shares (0.9%). Additionally, Morris S. Young, the company’s CEO and Chairman of the Board, was granted 111,795 shares, raising his total ownership to 2,162,636 shares (4.8%). Both transactions were made as compensation for prior services and are subject to restrictions under the company’s 2015 stock agreement.

Chicago Rivet & Machine – 3Q24

CVR │ New Report │ P/TB 0.73 │ Fasteners │ URL

CVR is a manufacturer specializing in custom cold-formed parts and riveting machinery, serving industries such as automotive, appliance, and electronics. CVR’s Q3 2024 earnings report shows a decline in net sales to $7.0m, down from $7.9m in the same period in 2023, a decrease of 12.3%. The drop was primarily driven by lower sales in the automotive fasteners segment, which fell by 31% year-over-year, although sales to non-automotive customers increased by 31%. Operating results deteriorated, with the company reporting a net loss of $1.4m for the quarter, compared to a $964k loss in Q3 2023.

For the first nine months of 2024, net sales totaled $22.9m, a 7.5% decrease from $24.7m in 2023. The net loss for this period was $2.0m, an improvement from a $2.9m loss in the same period the previous year. This improvement was partly due to implemented price increases and operational efficiencies that contributed to better gross margins in both the fastener and assembly equipment segments.

From a historical perspective, the company is really having a tough time at the moment. CVR has experienced declining gross margins in recent years due to several factors. Rising raw material costs and inflation have increased production expenses, squeezing margins. Delays in adjusting pricing, common in the competitive automotive industry, have further impacted profitability. Additionally, lower demand in non-automotive segments and workforce challenges have led to inefficiencies and higher costs. These combined pressures have contributed to the deterioration of the company's gross margins.

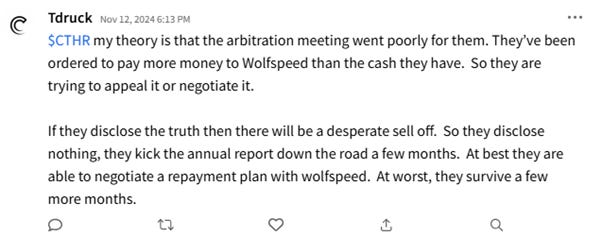

Charles & Colvard – Renewed Credit Facility & Delayed Quarterly Report

CTHR │ New Report │ P/TB 0.13 │ Jewelry │ URL

CTHR is a fine jewelry company specializing in lab-created moissanite and lab-grown diamonds, offering products through online channels and traditional retail outlets. The company has renewed its $5.0m credit facility with JPMorgan Chase Bank, extending its maturity date to January 31, 2025. The facility, with an outstanding balance of $2.3m, is secured by a $5.05m account and may be used for general working capital, acquisitions, and other permitted investments. The facility carries a variable interest rate based on the SOFR rate, with an additional 1.25% margin and a 0.10% adjustment for unsecured versus secured rates. In the event of default, the interest rate may increase by 3% as a penalty.

The company also announced a delay in filing its 10-Q for the period ending September 30, 2024. The delay is due to the company requiring additional time to complete its financial reporting processes, particularly related to an ongoing arbitration with Wolfspeed, Inc. The dispute involves an alleged breach of contract, with Wolfspeed seeking damages, including interest, costs, and legal fees. The outcome of the arbitration, which took place in late September, remains pending.

The company plans to include a "going concern" warning in its upcoming reports, indicating substantial doubt about its ability to continue as a going concern. This is based on current financial pressures and the need for significant cost reductions. The company expects net sales for the quarter ending September 30, 2024, to decline compared to the same quarter last year. Additionally, a net loss is anticipated for the period, though exact figures are not yet available. The company aims to file its quarterly report as soon as possible, though it is unlikely to meet the permitted five-day extension deadline.

Deswell Industries – 1H24/25

DSWL │ New Report │ P/TB 0.44 │ Injection Moulding │ URL

DSWL is a global manufacturer specializing in injection-molded plastic parts, electronic products and subassemblies, and metallic molds and accessory parts for original equipment manufacturers and contract manufacturers. The company reported revenue of $35.2m for the first half of fiscal year 2025, a decrease of 6.8% compared to the same period last year. The plastics segment declined by 8.1% to $5.8m, while the electronics segment decreased by 6.5% to $29.4m. The gross margin remained stable at 19.5%, with minor changes in the plastics and electronics segments due to cost control measures and benefits from a weaker Renminbi. Operating profit fell to $1.8m from $2.3m in the previous year. Net income, however, rose significantly to $6.2m compared to $3.6m the prior year, primarily driven by an increase in non-operating income to $4.6m (gain from investments).

The board declared a dividend of $0.10 per share (3.9% yield), payable on December 23, 2024. CEO Edward So highlighted the company's success in managing costs and developing new products for the commercial audio markets, with deliveries planned for airport customers in 2025, strengthening the company's long-term growth prospects.

FSI International – 3Q24 & Conference call

FSI │ New Report │ P/TB 1.49 │ Speciality Chemicals │ URL / URL

FSI specializes in the development, manufacturing, and marketing of specialty chemicals aimed at reducing water evaporation. For the last quarter, sales increased by 7% to $9.3mn compared to $8.7m in Q3 2023. Net income for the quarter was $612,000, an improvement from a loss of $718,000 in the same period last year. The NanoChem division, which accounts for 70% of revenue, has continued to grow with products like TPA (biodegradable polymers) for agriculture and water treatment. The company also has a pipeline of new food-related products with potential seven-figure revenues, expected to contribute to growth in 2025. Additionally, pharmaceutical production is being explored as a new segment, focusing on GLP-1 drugs, with efforts underway to secure pre-orders and partnerships.

The sale of a jointly owned company in Florida for $6m resulted in a one-time loss of $385,000 for the quarter, but this is expected to generate future gains during the coming repayment period. A new facility in Mendota, Illinois, has been commissioned for internal operations and external leasing, with the potential to create additional revenue.

The company is working to recover over $1m in tariff rebates. Stable demand for core products and expected sales growth in food and agriculture in 2025 provide growth opportunities. However, the company faces challenges in raising prices due to customer cost pressures and low raw material prices in the agricultural sector. All in all, O’Brien sounded quite positive in the conference call.

Fonar – 3Q24

FONR │ New Report │ P/TB 0.62 │ MRI Scanners │ URL

FONR is a pioneer in magnetic resonance imaging (MRI) technology, specializing in the design, manufacture, and servicing of MRI scanners, including the unique Upright® Multi-Position™ MRI, which allows for scanning patients in various positions such as sitting, standing, bending, and lying down. For the first quarter of fiscal year 2025 revenue decreased by 3% to $25.0m compared to the same period last year. Operating income fell by 30% to $4.6m, while net income decreased by 25% to $4.0m. The company reports continued expansion of its high-field MRI scanner equipment, particularly in Florida and New York, which is expected to increase referrals and enhance diagnostic capabilities.

FONR also has a share repurchase program, with over 283,770 shares repurchased for a total of $4.7m. However, over time NOSH has been increasing, and the company has multiple classes of shares.

Common Stock is the most widely held class, with 6,327,570 shares outstanding. These shares carry one vote per share and are publicly traded on NASDAQ.

The Class A Non-Voting Preferred Stock consists of 313,438 shares and does not grant voting rights. However, these shares get some part of the net income. The company also has Class B Common Stock and Class C Common Stock, both designed to provide enhanced voting power. Class B shares grant 10 votes per share, with only 146 shares outstanding, while Class C shares grant 25 votes per share, with 382,513 shares outstanding.

FONR might quantitatively be a deep value-case, but as seen above it is no easy nut to crack. FONR is deep value on hard mode and likely can / should be put in the “too hard pile”. On the other hand, when a case is hard to crack there is of course also room for opportunities for the one who does the work. But our experience is that deep value cases with unorthodox equity structures have quite an unattractive base rate.

Hurco Companies – Brandes Investment Partners increases its stake

HURC │ Ownership change │ P/TB 0.70 │ Machine Tool │ URL

HURC is an industrial company that designs, manufactures, and sells computer-controlled machine tools, including vertical and horizontal machining centers and lathes, for the metalworking industry. Brandes Investment Partners and its affiliated entities report a joint holding of 365,639 shares in Hurco Companies Inc., representing 5.67% of the company’s outstanding shares. The holding is reported as part of Brandes’ ordinary investment activities with no intent to influence the company’s management or control.

Brandes Investment Partners is an independent investment advisory firm founded in 1974 by Charles Brandes in San Diego, USA. The firm specializes in value investing, inspired by Benjamin Graham’s principles, and applies this strategy consistently across varying market conditions. In 2024, Brandes managed approximately $22.2 billion in assets and had 9,220 clients. Some of the shares seems to be held in the “Brandes Small Cap Value Fund”.

Jerash Holdings – 3Q24 & Earnings call

JRSH │ New Report │ P/TB 0.65 │ Apparel │ URL

JRSH manufactures and exports custom, ready-made sportswear and outerwear from Jordan. The company reported strong growth in Q2 FY2025, with revenue increasing by 20.6% to $40.2m from $33.4m the previous year. Gross profit rose by 31.4% to $7.1m, and the gross margin improved to 17.5% from 16.1%, driven by higher-margin product orders from U.S. customers. Operating expenses rose to $5.9m due to higher logistics and inventory costs, resulting in an operating income of $1.1m, up from $0.9m last year.

For the first half of FY2025, revenue grew to $81.2m from $68.1m, but the net result showed a loss of $0.7m compared to a profit of $0.9m in the same period last year. JRSH remains optimistic about continued growth, expecting both revenue and margin improvements.

During the Q&A session an analyst asked about the company’s maximum revenue potential based on current capacity. Management stated they are operating at full capacity and that revenue depends on the product mix. Growth is expected without seasonal fluctuations in H2 FY2025, with annual revenue projected to increase by 30–35%, reaching $155–160m.

Management is considering building a new factory on existing land, starting with a warehouse to reduce costs. Capacity will be increased gradually, with decisions depending on customer demand and long-term growth plans. Management noted that a warehouse could be built within 12 months, while a full-scale production facility might take up to two years. They are also working to increase capacity within existing facilities, which has already grown by 7–8%. An analysts asked whether U.S. tariffs on Chinese products benefit JRSH. Management stated that the trend of shifting production from China to Jordan has been ongoing for several years, and stricter tariffs could accelerate this, benefiting the company.

Coffee Holding – Acquires the assets of Empire Coffee

JVA │ Acquisition │ P/TB 0.75 │ Coffee │ URL

JVA is a wholesale coffee roaster and dealer, offering green, private label, and branded coffee products to retailers, foodservice, and distributors. The company announced the acquisition of Empire Coffee Company’s assets for $800,000. The purchase includes Empire’s inventory, equipment, accounts receivable, customer list, and intellectual property, with payment completed on November 7, 2024. To manage the acquired operations, Coffee Holding established a new wholly-owned subsidiary, Second Empire, which will oversee the business. The company also signed a new lease agreement for Empire’s facilities.

According to Coffee Holding CEO Andrew Gordon, the acquisition was advantageous, with the price representing approximately $0.60 per dollar of value. Empire had struggled to recover from the pandemic’s effects and shifting consumer behaviors. Coffee Holding views the acquisition as an opportunity to improve Empire’s performance and restore its revenue levels to pre-pandemic figures.

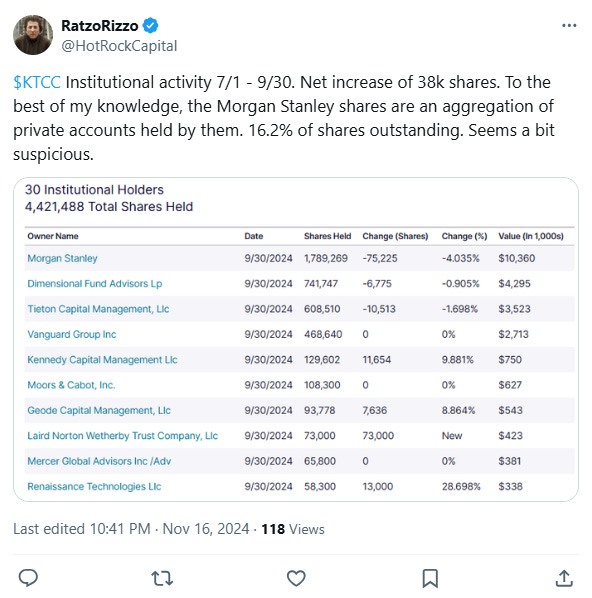

Key Tronic – RatzoRizzo on last quarters institutional activity

KTCC │ Analyst │ P/TB 0.50 │ Contract Manfacturing │

Emerson Radio – 3Q24

MSN │ New Report │ P/TB 0.46 │ Electronics │ URL

Emerson Radio Corp reported net sales of $2.7m for the quarter, an increase of 12.3% compared to the same period last year. The growth was primarily driven by new models of household products, particularly microwaves and refrigerators. However, the company reported a net loss of $881,000, a decline from a net profit of $2.6m in the same period last year. The loss reflects increased costs and the absence of one-time income from a prior legal case that had positively impacted last year’s results.

The cost of goods sold rose by 20.9% to $2.5m, driven by higher inventory values and changes in the product mix. Selling and administrative expenses increased by 30.6% to $1.4m, primarily due to higher payroll costs, increased audit fees, and expanded marketing efforts. This resulted in an operating loss of $1.1m, compared to a loss of $666,000 in the prior year.

The company’s cash and cash equivalents dropped sharply to $0.5m from $19.9m at the beginning of the year, mainly due to investments of $16.3m in short-term assets. The net loss and changes in working capital, such as increased accounts receivable and reduced accounts payable, also contributed to the cash decline. Despite this, the company believes its existing cash reserves and investments are sufficient to support operations over the next 12 months.

Emerson faces significant business risks, including reliance on major customers like Walmart and Amazon, which together accounted for 73% of net sales during the quarter. Additionally, the company is impacted by potential tariffs and rising production costs due to geopolitical tensions between the U.S. and China, where most of its production takes place. To address these risks, Emerson plans to diversify its product portfolio and strengthen its presence in e-commerce and licensing.

We previously wrote a post about the company – Emerson Radio – a peculiar cashbox.

Natural Alternatives International – 1Q24

NAII │ New Report │ P/TB 0.34 │ Nutrition │ URL

NAII specializes in the formulation, manufacturing, and marketing of customized nutritional supplements, offering services such as scientific research, clinical studies, proprietary ingredients, and product testing. The company reported a loss for Q1 FY2025, with a net loss of $2.0m, on net sales of $33.2m. This compares to a loss of $0.7m, and revenue of $33.2m in the same period last year. The decrease in sales was primarily driven by a 4.8% decline in private-label manufacturing sales due to lower orders from a major customer. However, revenue from CarnoSyn® beta-alanine licensing and raw material sales increased by 41.6% to $2.5m, driven by fewer volume discounts and higher orders from existing customers.

Despite a forecast for increased sales in FY2025, the company expects a net loss for the first half of the year, a net profit for the second half, but an overall net loss for the full year. CEO Mark A. Le Doux expressed optimism about future revenue opportunities, particularly in light of political initiatives supporting healthy lifestyles and nutritional supplements.

RatzoRizzo also had a look on the last quarters institutional activity for this stock:

Seneca Foods – Paul Isaac on the shareholder list

SENEA │ Ownership │ P/TB 0.79 │ Food │ URL

SENEA specializes in the processing and distribution of packaged fruits and vegetables, offering products under its own brands like Seneca, Libby's, and Aunt Nellie's, as well as private labels. According to Bobby Boucher on X there is a famous value investor on the shareholder list of SENEA. From Isaac we have taken one of our favourite quotes on value investing: “It is harder to get hurt if you fall out of the basement window”.

Sigmatron International – CFO leaves

SGMA │ Management Change │ P/TB 0.26 │ Contract Manufacturing │ URL / URL

SGMA provides electronic manufacturing services, including the production of printed circuit board assemblies and complete electronic products, serving industries such as industrial electronics, consumer electronics, and medical/life sciences. The company announced that CFO James J. Reiman resigned from his position on November 8, 2024, citing personal reasons. Frank Cesario has been appointed as the new CFO, Vice President of Finance, Treasurer, and Secretary, effective November 11, 2024. Cesario brings extensive experience from senior financial roles, having previously served as both CFO and CEO of Yunhong Green CTI Ltd, and held leadership positions at Nanophase Technologies Corporation and ISCO International. Cesario’s compensation package includes an annual salary of $300,000, participation in the company’s annual bonus program, and stock options for 30,000 shares, vesting over four years.

Sunlink Health Systems – 3Q24

SSY │ New Report │ P/TB 0.38 │ Healthcare Facilities │ URL

SSY invests in healthcare facilities and related businesses in the Southeast, including a community hospital, skilled nursing facilities, a healthcare technology company, and a specialty pharmacy. The company´s quarterly report for the period ending September 30, 2024, shows declining revenue and an increased loss. Net revenue decreased by 7.4% to $7.9m compared to the same period last year. Meanwhile, rising expenses for wages, cost of goods sold, and depreciation led to an operating loss of $1.2m, a significant increase from last year’s loss of $0.45m.

During the quarter, the company generated some income by selling a minority interest in a subsidiary and a parcel of land in Georgia. These transactions resulted in a combined gain of $0.7m, which partially offset the overall deficit. Following an evaluation, the company determined that its deferred tax assets are unlikely to be utilized and recorded a valuation allowance of $8.2m to cover these uncertain assets. The company also reported losses from discontinued operations. The sale of Trace Regional Hospital and associated properties resulted in a loss of $0.1m during the quarter.

Strattec Security – New CFO

STRT │ Management │ P/TB 0.82 │ Security Systems │ URL

STRT is specializing in the design, development, and manufacture of automotive access control products, including mechanical and electronically enhanced locks and keys, latches, power access systems, and related security solutions for global automotive manufacturers. The company announced on November 11, 2024, the appointment of Matthew Pauli as its new CFO, effective November 13, 2024. He succeeds Dennis Bowe, who will remain with the company in an advisory role to facilitate the transition. Pauli brings over 20 years of financial leadership experience and most recently served at CentroMotion, where he focused on improving forecasting processes and managing capital.

Tandy Leather Factory – 3Q24

TLF │ New Report │ P/TB 0.61 │ Leather Retail │ URL

TLF is a specialty retailer and wholesale distributor of leather and leatherworking products, operating over 100 stores worldwide. The company reported a 1.1% decrease in net sales for Q3 2024 compared to the same period last year, amounting to $17.4m. The decline was partly due to temporary store closures and weak consumer demand driven by economic uncertainty. Gross profit for the quarter dropped by 8.4% to $10m, with a gross margin of 57.8% (62.4%). The margin contraction was attributed to higher inventory costs and increased promotional activities aimed at addressing low consumer demand.

Operating expenses rose slightly, increasing by 2.3% to $10.3m, primarily due to higher wage costs for store personnel and hourly employees. The company reported an operating loss of $0.3m for the quarter (+$0.9m), a notable deterioration compared to the same period in 2023.

For the first nine months of 2024, net sales declined by 2.7%, with net income totaling $0.5m, significantly lower than the same period last year. The company plans to continue focusing on cost control and selective investments to improve profitability in a challenging market environment.

The company has ramped up promotional activities and emphasized cost control to maintain profitability. It plans to continue these strategies moving forward to navigate the challenging market conditions.

Other:

Harris Perlman ran a screen for US/Canada profitable net-nets and the list shows that this is not the best hunting season for American cigar butts. This combined with the early parts of this letter clearly shows how much digging and sorting a net-net investor needs to do in order to build a decent deep value portfolio.

And finally, even though it is unlikely no one of our readers missed it, Mikro Kap David released a very interesting interview with Lawrence J. Goldstein of Santa Monica Partners last week.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.

Paul Isaac does own shares but his position,has remained stable for a number of years. He owns a small position in both the A and B shares.

I find the Brandes holding of Hurco interesting. In fact I don’t hear his name come up that often as it has in the past. He wrote a book on value investing years ago and used to do a lot of interviews back in the day. Personally, I would think Amada, a Japanese company may be more compelling than Hurco. But then again, I am not up to speed on Hurco.

Also on Chicago Rivet and Emerson these have been on Net/Net screens for decades. At one time Emerson at least paid a nice dividend. If they are burning cash now, I would take a pass. Chicago Rivet is probably having a hard time finding young people to employ. Also by looking at their Site, their rivet machines look antiquated, but maybe a manufacturing boom helps them as well as Hurco and Amada.

Great job as usual Buggy Whip.