The Deep value Week is created in the spirit of Shelby Cullom Davis who wrote a market letter (on insurance) that “no one read”, and when questioned on the why of still writing it, answered that they wrote it for themselves, as a form of self-reflection on their activities – helping them refine their thoughts, test their theories and maintain discipline.

Companies mentioned:

· Alpha Pro Tech (APT)

· Alico (ALCO)

· Avalon Holdings (AWX)

· Hurco Companies (HURC)

· Jerash Holdings (JRSH)

· Key Tronic (KTCC)

· Reko International Group (REKO)

· Seneca Foods (SENEA)

· Strattec Security (STRT)

· Unifi (UFI)

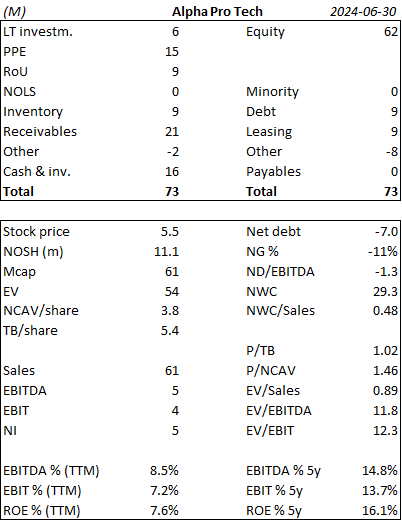

Alpha Pro Tech - Decrease in construction but increase in protective equipment sales

ATP │ New Report │ P/TB 1.01 │ Weak Outlook │ URL

Alpha Pro Tech reported an 11.2% decrease in sales for the third quarter of 2024, with revenue of $14.3m compared to $16.1m for the same period in 2023. The Building Materials segment showed a significant sales decline of 23.2% to $8.8m, primarily due to a downturn in the U.S. housing market and reduced demand from major customers. Conversely, the Disposable Protective Apparel segment saw an increase of 18.4% to $5.5m, with face masks and face shields showing strong growth. Net profit for Q3 2024 was $0.9m ($1.4m).

APT continues to see challenges in the construction sector, with weak housing start statistics and multi-family construction at its lowest level in ten years. However, they are cautiously optimistic for Q4, as storm-related demand is expected to increase. The company also emphasizes continued growth potential in the protective apparel segment, despite market saturation in COVID-related products such as face masks and face shields.

Alico – New investor presentation

ALCO │ New IR Material │ P/TB 0.75 │ URL

Alico Inc., a Florida-based agribusiness and land management company, owns and manages a total of 53,700 acres, primarily dedicated to citrus farming and land leasing for various purposes. A significant part of its operations is focused on citrus production, supported by a long-term supply agreement with Tropicana. Through a new agreement, prices are expected to be 33–50% higher than in previous seasons.

In 2023 and 2024, Alico has continued to reduce its debt, aiming to decrease long-term liabilities by 60% since 2014. Alico has also sold significant land holdings, including 798 acres for $7.2 million and 17,229 acres for $77.6 million.

To combat citrus greening, a disease that threatens citrus production, Alico has initiated a trunk injection treatment program. The company received government grants to partially fund the treatment. Additionally, Alico is exploring opportunities to develop its land assets through real estate projects, including potential developments near Fort Myers.

Avalon Holdings – 3Q24

AWX │ New Report │ P/TB 0.28 │ Strong Performance│ URL

In the third quarter of 2024, net revenue in the Waste Management segment was $11.5m ($11.7m), with operating expenses for the segment at $8.9m ($9.3m). This resulted in a gross profit of $2.5m ($2.4m) or 21.7% (20.5%). The improved margin is attributed to higher project profitability. Revenue in the golf and resort segment increased to $12.8m ($12.2m), driven by higher prices and activity at The Grand Resort. Operating costs decreased to $9.3m from $9.5m, with cost savings primarily from reduced personnel expenses. Pre-tax earnings for this segment rose to $2.0m compared to $1.2m in 2023, mainly due to higher revenues from room rentals, spa and salon services, as well as implemented cost savings. Net profit for shareholders doubled to $1.8m, or $0.47 per share, compared to $0.9m ($0.23 per share) the previous year. The quarter's net profit is the company’s highest since at least June 30, 2012.

Hurco Companies – Oppenheimer & Acuitas increases their holdings

HURC │ Shareholdings │ P/TB 0.72 │ Strong Performance│ URL

Oppenheimer & Close, LLC has filed a Form SC 13G notice to declare a marginal increase in HURCO to 5.5%. However, Acuitas Investments, LLC has made a more substantial increase, raising their stake from approximately 3.4% to 6.1%.

Here's how HURC compares to selected listed peers – although, as always, there is a certain apples-to-oranges dynamic.

Jerash Holdings – Quarterly dividend

JRSH │ Dividend Info │ P/TB 0.59 │ Strong Performance│ URL

Jerash Holdings (US), Inc. has announced that its board of directors has approved a quarterly dividend of $0.05 per share. The dividend will be paid on November 29, 2024, to shareholders of record as of November 22, 2024. On an annual basis, this amounts to a dividend of $0.20, corresponding to a yield of 6.6% at the current share price. JRSH has issued a dividend of 5 cents per quarter each quarter since Q4 2018. Jerash is a company focused on the manufacture and export of custom sports and outerwear for several global brands, including VF Corporation (The North Face, Timberland, Vans), New Balance, G-III (Calvin Klein, Tommy Hilfiger, DKNY, Guess), American Eagle, and Skechers. The company has six factory facilities and four warehouses, employing around 5,000 people.

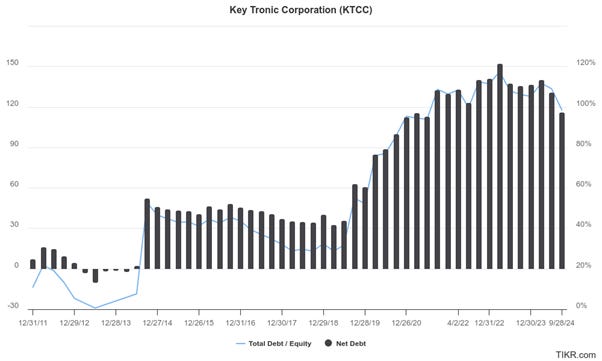

Key Tronic - Improved margins

KTCC │ New Report │ P/TB 0.52 │ Solid Performance│ URL │ Earnings Call Transcript

Key Tronic Corporation reports results for the first quarter of fiscal year 2025, with revenue of $131.6m ($150.1m). The decrease is largely attributed to customer-driven design and qualification delays for three programs, which the company states reduced revenue by approximately $9m. Two of these programs have now resumed in the second quarter.

Production efficiency improved, primarily due to workforce reductions, supply chain improvements, and a favorable currency shift in the Mexican peso. The gross margin increased to 10.1% (from 7.2%), and the operating margin rose to 3.4% (from 2.2%). Net income for the quarter was $1.1m ($0.3m). Expectations for the second quarter are revenue of $130-140m and profit of $0.5m-$1.5m. This represents the highest quarterly EBIT margin since 2012.

The company continues to expand its customer base and has recently won new programs in the manufacturing of production equipment, automotive lighting, and commercial pest control. Strategic investments are planned for the facility in Vietnam to increase capacity and capabilities, with expectations that this facility will play a significant role in future growth.

Management states that they believe the current debt level is too high and aim to reduce it somewhat, as well as pursue refinancing options to lower interest expenses.

Here's how KTCC compares to selected listed peers – although, as always, there is a certain apples-to-oranges dynamic.

RatzoRizzo also shared his take on the report on X.

Reko International Group – Annual report

REKO │ New Report │ P/TB 0.43 │ Weak Performance│ URL │

For the full year, REKO reported revenues of C$44.3m, down 5.3% from C$46.78m the previous year. Gross profit decreased from C$7.1m to C$4.9m. Administrative expenses remained at a similar level to the previous year, at C$5.8m. The company reported a net loss of C$3.9m, a significant decline compared to a net profit of C$1.3m the previous year. In the CEO's statement, Diane Reko reflected on a challenging year characterized by unpredictable market conditions that impacted sales. Despite this, the company made substantial progress in product innovation, productivity improvements, and expansion into new markets. This expansion aims to reduce reliance on existing markets and open new revenue opportunities in the long term. Product development, including a new automation project in collaboration with a partner, has made progress with a prototype under testing, expected to enhance productivity and safety.

Seneca Foods – 2Q24/24

SENEA │ New Report │ P/TB 0.74 │ Weak Performance│ URL │ Earnings Call Transcript

Seneca Foods reported an increase in net sales for the second quarter of fiscal year 2025, reaching $425.5m compared to $407.5m for the same period last year, driven by higher sales volumes and price increases. For the first six months, net sales totaled $730.2m, an increase of $24.1m from the previous year. However, the gross margin declined significantly, from 14.3% to 10.1% for the quarter and from 16.1% to 11.7% for the half-year, attributed to unfavorable weather conditions and reduced inventory buildup. Adjusted pre-tax income for the half-year decreased from $70.5m to $45.6m, and net income fell to $25.9m from $47.9m the previous year. Adjusted EBITDA (FIFO) was also lower, at $89.7m compared to $109.4m last year.

Harris Perlman shared the following thoughts on X.

Strattec Security Corporation – New report & new analysis

STRT │ New Report │ P/TB 0.81 │ Mixed Performance│ URL │ Earnings Call Transcript │New analysis

Strattec Security Corporation reports for the first quarter of fiscal year 2025, with net sales increasing by 2.7% to $139.1m from $135.4m in the previous year. Adjusted for one-off effects, the increase was 9.1%. The gross margin slightly declined to 13.6% from 13.8%, but the adjusted gross margin improved due to a favorable sales mix, currency effects, and cost reductions. Net income decreased slightly to $3.7m from $4.2m. However, adjusted net income increased, reflecting improved profitability without last year's one-off effects. Operating cash flow was $11.3m, a significant improvement compared to last year's operating cash flow loss of $3.9m. Capital expenditures decreased to $2.1m from $2.9m, and cash increased to $34.4m from $25.4m at the end of the previous quarter. The company reduced its pre-production costs (customer tooling) by $6.9m and aims to reach a target balance of $10m. Strattec is working to enhance profitability and sustainability by reassessing its product portfolio and optimizing its cost structure.

Unifi – New analysis

UFI │ New Analysis │ P/TB 0.42 │ URL │ New Seeking Alpha

An analyst has chosen to maintain a "Hold" recommendation for Unifi, Inc.

Nacco’s customer Lithium Americas gains after U.S. finalized $2.26 billion loan

NC │ Secondary Relevance │ P/TB 0.59 │ Solid Performance│ URL

Nacco's NAMining segment provides contract mining and other value-added services for industrial mineral producers. As of December 31, 2023, NAMining operates in Florida, Texas, Arkansas, Virginia, and Nebraska. Additionally, Sawtooth Mining, LLC ("Sawtooth") offers mine design, consulting services, and will be the exclusive contract miner for the Thacker Pass lithium project in northern Nevada. The goal is for NAMining to become a substantial EBIT contributor over time, especially after Thacker Pass (operated by Lithium Americas, NYSE: LAC) starts up in late 2026.

U.S.-listed shares of Lithium Americas (LAC) rose 6.3% to $4.40 after hours. The U.S. Department of Energy finalized a $2.26 billion loan for the Canadian company to develop the Thacker Pass lithium mine in Nevada. The loan, provisionally approved in March, is a key part of U.S. President Joe Biden’s efforts to reduce reliance on lithium supplies from China. The Thacker Pass project is expected to begin operations later this decade and be a key supplier to General Motors (NYSE: GM), which increased its investment in the mine to nearly $1 billion earlier this month. As of the last close, the stock is down 35.3% YTD.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.

Harris Perlman has done good work on Seneca. TBV needs to be adjusted for the value of their farmland. It should be noted they also manufacture their own cans.

I want to take a closer look at Hurco and Key Tronic.

Avalon had a nice day today.

Excellent write up. Keep up the good work.