Tandy Leather Factory - Cheap with a Catalyst

The most recent development is a potential successful sale of the company's headquarters, distribution center, and flagship store in Fort Worth, TX (approximately 21,000 sqm). In December 2023, a broker was hired to find buyers.

The PPE is currently $11m. This includes land and buildings with an acquisition cost of $9.3m (the book value is not specified). Before 2007, there was no line item for land and buildings. It was in 2007 that TLF acquired the mentioned property for over $4.5m, followed by $2.5m spent on renovations. Some additional improvement investments have been made since then. In 2023, land and buildings had an acquisition cost of around $10.7m. In 1Q24, $1.2m was invested to replace the roof on the HQ.

The land, which is not depreciated, remains at $1.5m in acquisition and book value. Buildings are depreciated over 40 years (2.5%), meaning the book value of the initial portion should have decreased from approximately $5.5m to $3.4m. We estimate that the book value is around $8-9m, including investments made in 1Q24.

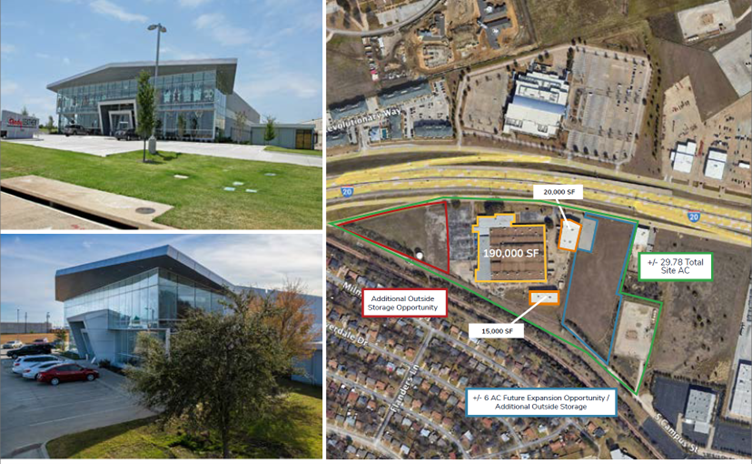

Since the property was acquired in 2007, the Fort Worth area has experienced significant economic growth, likely increasing demand for industrial and logistics properties. The property TLF is now seeking to sell is approximately 21,000 sqm, with the flagship store covering 2,000 sqm. The properties are situated on roughly 12 hectares of land. Desktop research shows that “similar” properties in the corresponding area sell for around $1,100–1,700/sqm.

One exercise could be to start from an EV of $26m and then assume different sales prices (excluding tax):

• $900/sqm results in approximately $18.8m, reducing EV to $7.2m.

• $1,000/sqm gives a value of $20.9m, reducing EV to $5.1m.

• $1,200/sqm gives $25m, reducing EV to $1m.

• If the sale exceeds $1,240/sqm (the average of similar properties in the area currently on the market), the pro forma EV becomes negative.

A similar “step” can be made for the expected increase in TB/share (book value increase estimated at around $8m).

The situation presents an interesting outcome distribution for 2024. If the sale does not occur, the “as-is” case remains sound. In 2023, TLF generated sales of approximately $76m and an operating profit of $4.4m (5.8% margin, a bit below the 20-year average of 9%). If the property is sold—especially at a favorable price—the market will “need” to reconsider what is a reasonable EV/EBIT for a profitable market leader.

(Disclaimer: at the time of publication, the writer owns shares in the mentioned company)