SigmaTron International – Delayed Annual Report Due to Ongoing Negotiations with Lenders

SigmaTron International, Inc. (SGMA) is a provider of electronics manufacturing services (EMS). The company specializes in providing services such as printed circuit board assembly, electromechanical sub-assemblies, and fully assembled electronic products (box-build). In addition to production, SGMA offers a range of services including material procurement, testing, design, warehousing, and distribution, as well as support for product approval and regulatory compliance. The company operates globally with activities in the USA, Mexico, China, Vietnam, and Taiwan.

On July 30, SGMA announced that their annual report for the fiscal year ending April 30, 2024, will be delayed due to ongoing negotiations with lenders regarding new amendments to their credit agreement, which require significant updates to their annual report and revised financial statements. The report is expected to be published before mid-August.

Since this announcement, the stock price has fallen by 42%. On July 30, 344k shares were traded and on July 31, 179k shares. This is for a stock with an average turnover of 43k. These two days of trading both qualify among the four days with the highest trading volume in the past year.

SGMA has long had a strained financial position and has in the past breached covenants. As of the latest report, net debt was $84.5m and TTM EBIT was $15.3m. Net gearing was 124% and ND/EBITDA was 4x. According to the latest report, the main financing consisted of a combination of a revolving loan and a term loan with a total available credit of up to $70 million from JPMorgan Chase Bank and a $40m term loan from TCW Asset Management – both with a maturity date in July 2027.

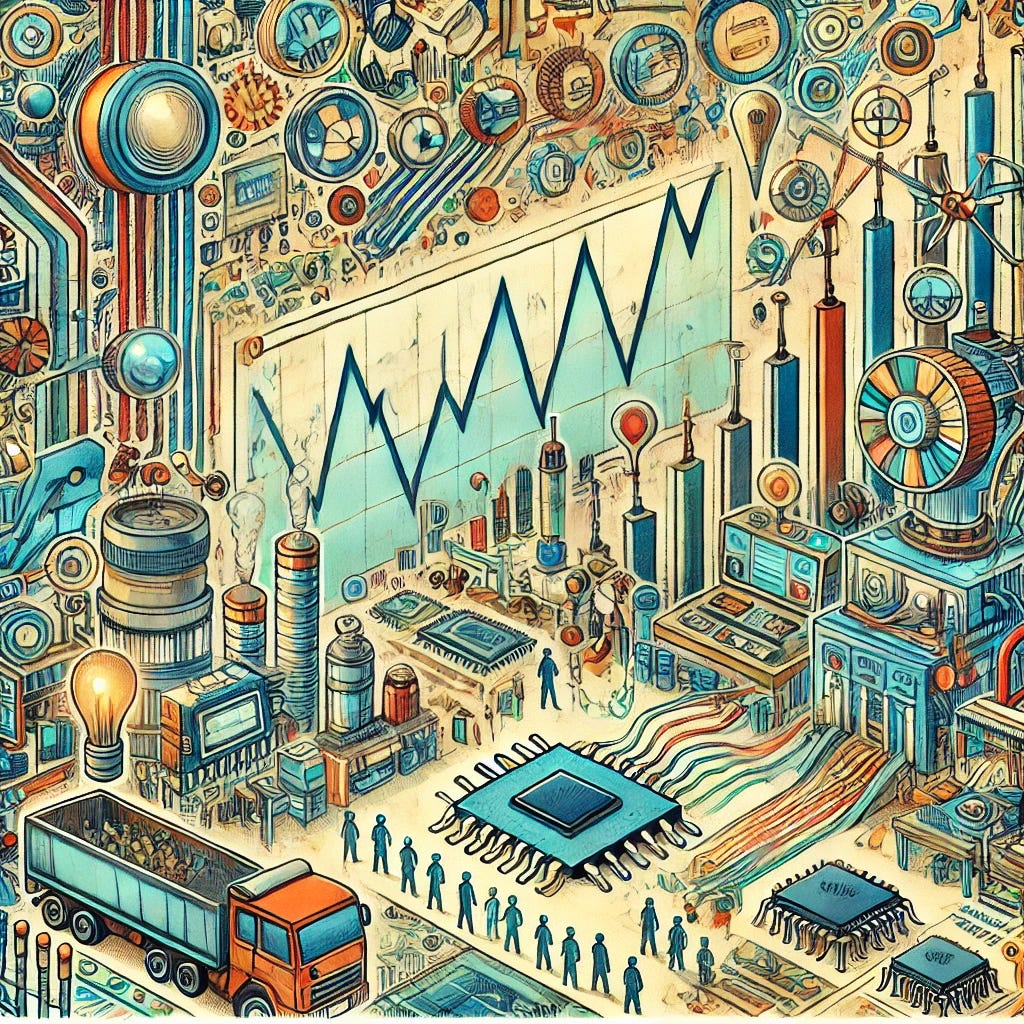

For the full year 2023/24, revenue is expected to decrease by approximately $35 million to $380m ($415m) and a result from continuing operations of approximately -$2.5m ($14m). This means that the figures for 4Q were revenue of $87.3m and a loss of $3.4m. In terms of margins, the operation is relatively stable so it is likely that there has been some type of write-down during the quarter – perhaps inventory or PPE. On a balance sheet of $244m, a write-down of say $4m may typically not be noteworthy, but given the high leverage, it has an impact on a company like SGMA. Below is the operating income per quarter since 2016. The worst quarter was 4Q19/20 with a loss of -$0.8m.

(Disclaimer: at the time of publication, the writer owns shares in the mentioned company)