Natural Alternatives International (NAII) – Tough market environment but strong asset backing

Natural Alternatives (NAII) is an American contract manufacturer of dietary supplements (about 90-95% of revenues), primarily capsules, tablets, and powder supplements for Multi-Level Marketing (MLM) clients. Approximately 5-10% of revenues (decreasing) come from its own patented brands (CarnoSyn and SR CarnoSyn) of beta-alanine, which have higher EBIT (before unallocated costs) than private-label. About 75% of sales are in the USA, with the rest in Europe, Canada, Australia, etc. Since 1999, manufacturing has been located in Vista, CA, USA, and Manno (subsidiary NAIE), in Switzerland (both facilities are leased). In 2021, a manufacturing and warehousing facility in Carlsbad, CA, USA, was acquired for about $20m.

MLM has volatile demand, which affects NAII, which typically has a gross margin of about 10-20% and sales concentrated with a few customers (usually MLM). Juice-plus, CIT Cosmeceuticals, Shaklee, and Mannatech (NYSE:MTEX) are or have been customers. Thin margins and high customer concentration mean that NAII is not for the "faint-hearted". The stock was listed in 1987 and traded for the first few years under $2, to trade at about $20 in 1999 and back under $2 in 2002. The event around 1999 was the start of manufacturing in Switzerland and Vista, (CA, USA) and the submission of the first patent for CarnoSyn® beta-alanine.

Decent Ability to Navigate Tough Times

We are currently in a period of low demand as MLM adjusts post-COVID (most negative growth QoQ and largest quarterly loss since 2012, see above). Two of the largest customers have paused orders. In 4Q23, the largest customer accounted for 55% of the turnover (3Q23 36%) and the gross margin was 1.5%. The cost base is relatively flexible with SG&A about $16m/year. On a TTM basis, EBITDA is $1.4m and NI -$4m. Besides falling demand, results are affected by an unfavorable sales mix, currency headwinds, and inflation pressure, especially during 4Q23.

The challenging market is reflected in the stock, which has gone from $18 to $6 (-67%) since fall 2021 and is now valued at P/TB 0.41. Net cash amounts to $1.2 per share. Historically, when NAII has been valued around P/TB 0.4 (unusual), the stock has in 78% of cases performed strongly over the following 12 months.

A simplified balance sheet (as of 2023-12) consists of PPE $53m, NWC $23m, net-other $2m, and net cash of $7m. This is entirely financed by TB of $85m. In "net-other," there is RoU/Leasing debt of about +$45m/-$48m, which increased by $26m after extending the lease in Vista, CA. As of 2023-12, the check of $12m was unused, $16.6m was in cash, and $9.4m in interest-bearing debt related to the purchase of the Carlsbad property (invested about $20m).

We find comfort in the stock (market cap $37m, share price $6) likely being valued below its liquidation value (TB/share is $14). Capital can be returned even without a liquidation. With a "sale-and-leaseback" of mainly Carlsbad for say $20m, the PF net cash (regardless of transaction costs, etc.) could become about $27m or $4.5/share. Additionally, there are likely significant values in the machinery. Of the inventory of $20m, $14m is raw materials, which should be sellable in a market if needed.

We also find comfort in this not being the first time NAII faces challenges. Revenue has indeed increased from $50m in 2002 to $130m (peak 2021, COVID, $179m), but the long-term trend includes several ups and downs. For example, in 2006, revenue was about $100m, in 2011 about $55m. Since 2002 (as far back as we have checked), NAII has only recorded net losses in 2007, 2008, 2009, and 2020.

With a 2024 as weak as 2023, TB/share would decrease from $14 to $13.3 - not pleasant but not draconian. If we assume a net loss of $10m (equivalent to the cumulative net loss for all loss years over the past 20 years), then TB would decrease to $12.4/share (P/TB then 0.48). We believe there are alternatives for restructuring; new customers or selling capacity (new facility).

Overall Attractive Risk:Reward as Part of a Diversified Portfolio

If we buy into the premise that MLM will experience a resurgence, there is significant potential upside. The highest revenue has been $178m, and EBIT around 11% (2012, 2016, 2017). In "modern times," EBIT has peaked at about 8% as several of the patents have lost their potency. Normalized EBIT of 6-9% could return, which means EBIT of about $10m to TTM sales, and at 6x EBIT, a share price of about $11 (80% upside). At a share price of $6 (near "all-time low"), merely a change in sentiment (hope for better times) could lead to a noticeable multiple expansion. Historically, NAII has been valued at P/TB 1x, which would imply a price of €14 (125% upside).

There could be further upside with a turnaround in the market. As mentioned, NAII acquired a manufacturing and warehousing facility (for "high volume powder") in Carlsbad, CA, in 2021, and with this, capacity increased by 44%, and the global capacity available for new business is now 75%. Despite increased capacity, fixed costs have remained relatively unchanged. Carlsbad was operational in April 2023, was temporarily closed last summer due to weak demand, and is operational again in 4Q23. If NAII manages to bring in volumes, there is a nice operational leverage in the current structure.

Owner-Operator

The largest shareholder, holding about 16% of the capital, is the founder (established in 1980) and chairman Mark A LeDoux (69 years old), followed by Dimensional Fund (7%), Caldwell Sutter Capital (7%), and Renaissance Technologies (6%). NAII could be a candidate for an MBO/LBO. LeDoux appears to have almost ideological motives (video) to change the industry/regulations, which may be easier in a private setting. In a 2009 interview, admittedly 14 years ago, LeDoux lamented the high listing costs.

NAII has grown without costly dilution or value-destroying acquisitions, but it should be mentioned that the timing of offensive capex has historically been weak. Between 2018-2021, the net cash was $20-30m, which is now approximately $7m after, among other things, a $20m investment in Carlsbad and the repurchase of 1.3m shares between 2019-2023 (for about $16m, at an average of $12/share). Now is a better time for buybacks, rather than peak times, and hopefully, operational development can support such actions (according to loan agreements, cannot repurchase shares or distribute money if TTM results are negative).

Facilities

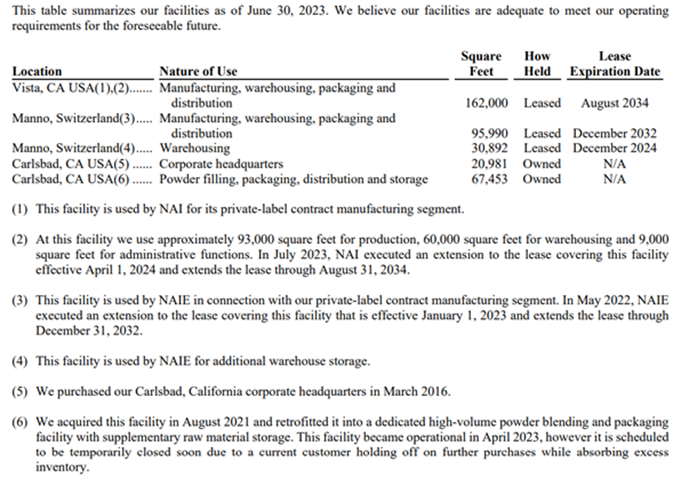

In 2015, NAII received an offer for its then headquarters in San Marcos, CA (2.7 thousand sqm, 29.5k sq.ft) for seemingly $3m. In conjunction with this, a new HQ was acquired in Carlsbad, CA (about 2 thousand sqm). In June 2016, the acquisition value of the land was $1.2m and for buildings and improvements $3.3m. Today, the acquisition value of the land is $8.9m and buildings and improvements $25m. PPE amounts to $53m. According to a company presentation from November 2023, NAII occupies the following facilities:

- Manno, Switzerland. 12,000 sqm (127,000 SF manufacturing).

- Vista, CA, USA. 15,000 sqm (162,000 SF manufacturing)

- Carlsbad, CA, USA. 2,000 sqm (21,000 SF office space)

- Carlsbad, CA, USA. 6,200 sqm (67,000 SF office space)

The annual report as of June 2023 indicates that NAII only owns the new properties in Carlsbad.

(Disclaimer: at the time of publication, the writer owns shares in the mentioned company)