Flexible Solutions International – Sells Its Half of Florida-Based Company

Flexible Solutions International, Inc. (FSI) specializes in the development and manufacturing of biodegradable polymers for applications in oil extraction, water treatment, and the agricultural sector. The company generates approximately $38 million in revenue and has historically enjoyed very impressive margins as well as returns on invested capital.

The stock is currently near an all-time low in valuation (in terms of P/TB), and since 2012, FSI has only been valued below a P/TB of 0.90 (currently 0.78x) on 3% of trading days.

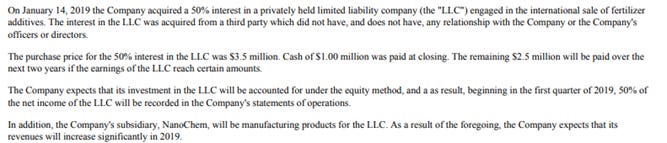

FSI has announced the sale of its stake in a Florida-based company active in the sale of fertilizer additives. The sale includes an immediate payment of $2 million, as well as an additional $0.8 million per year over five years, resulting in a total sum of $6 million. The original investment in 2019 was $3.5 million. Below is the company's press release from the 2019 investment.

As of Q1 2024, the holding was recorded at $3.9 million, resulting in a book gain of $2.1 million; however, $4 million of the $6 million will be received over the next five years. If we assume a 10% interest rate, the present value of the $4 million is just over $3 million, so it might be more accurate to say that the company realizes a book gain of $1.1 million on the sale. The sale is occurring at approximately a P/E of 10 and a P/S of 0.31.

CEO Dan O'Brien states that this transaction improves FSI's liquidity at a time when the company sees significant opportunities in its nutrition and food businesses. Additionally, FSI has retained a supply agreement with the Florida company, which is expected to lead to increased sales to the Florida company in the coming quarters.

As of Q1 2024, FSI had net debt of $6 million, corresponding to net gearing (tangible) of 19% and ND/EBITDA of 1.3. After the sale, the company will be virtually debt-free. Tangible equity as of Q1 2024 was $31.2 million and is estimated to rise to $32.2 million, an increase of approximately 3.2%. But during the quarter the company also paid out c. $1.2m in dividends, taking tangible equity down to $31.0m (pre 2Q24 earnings - which likely will be around $1m.

All in all not a deal that “changes everything” but takes the company to a very solid financial position whilst also simplifying the group structure somewhat.

(Disclaimer: at the time of publication, the writer owns shares in the mentioned company)